Macroeconomic objectives II Economics Growth and Equity in the Distribution of Income Notes

ECONOMIC GROWTH

- Economic growth – increase in real GDP, expressed in % change (per capita) over a period of time.

- Growth rates can impact a country’s performance.

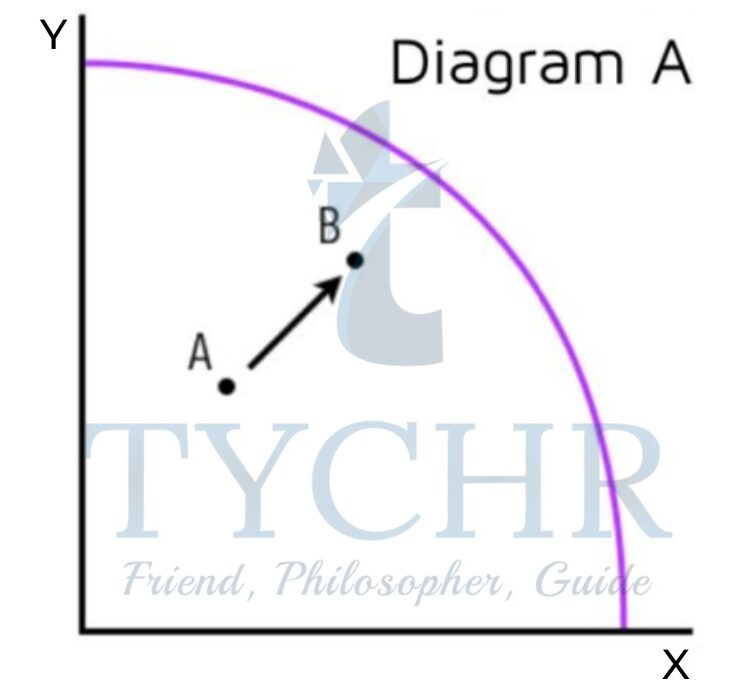

- Reductions in unemployment and increases in productive efficiency can cause growth of actual output (diagram A).

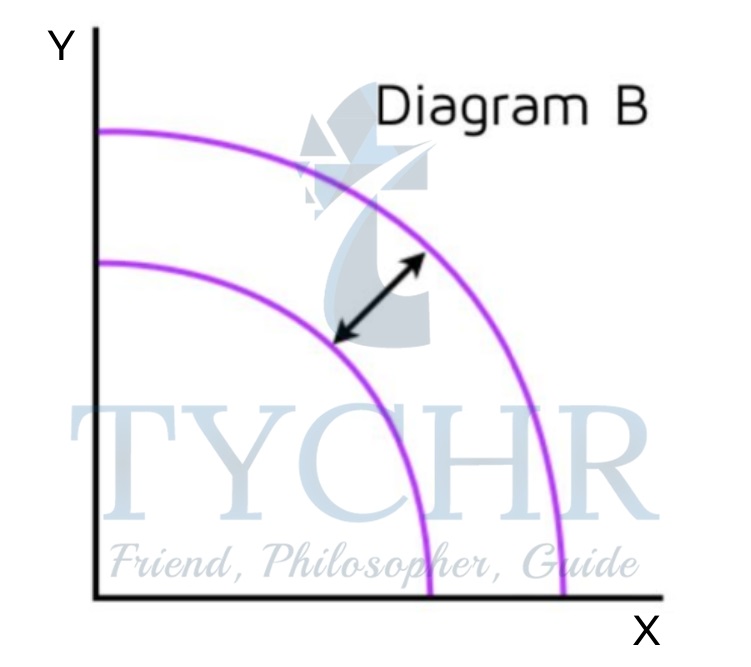

- A shift of the PPC means that an economy can produce more of the two goods (diagram B), but does not mean that output increases – only the possibilities.

- The factors that cause these PPC shifts are:

- quantity increase of resources

- quality increase of resources

- PPCs can also shift inwards.

- Capital – resources that can produce future benefits

- Physical capital – capital from investments, spending for machines

- Human capital – skills, ability, knowledge, and health of workers

- Natural capital – “land” or “natural resources”; everything under the land, everything on land, and the ecosystem of the country.

- Land – given by nature and doesn’t change

- Natural capital – can be destroyed or improved

- Investment can apply to the three factors of production, and can be done by the private sector or the public sector. Investment is needed to build capital.

- Increase in quantity of physical capital – increase in number of machines, tools, etc. in an economy.

- Increase in quality of physical capital – technological advances.

- A technological advance incorporated into capital goods is embodied into new capital.

- Increase in the quantity of labor is not always growth. The quality of labor is more important because it increases the productivity of the workers.

- Two types of natural capital exist: products and natural resources

- Commodities that can be sold can help the economy grow, but they are not necessary. Even though they only produce a small number of goods that can be sold, some nations, like Taiwan, experience rapid economic expansion.

- Ecological goods and common access resources are important to long-term growth. Environmental destruction will cause future generations to have an unsustainable economy.

- Productivity – quantity of output produced for each hour of work of the working population (real GDP/total hours worked). Improvement in productivity increases produced output

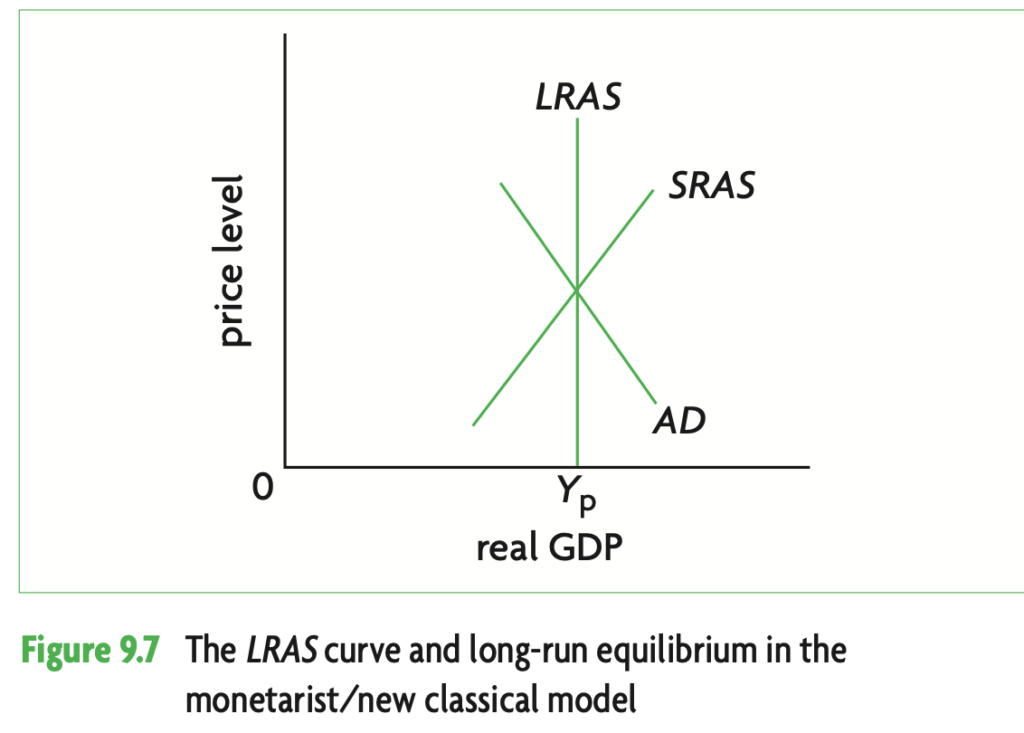

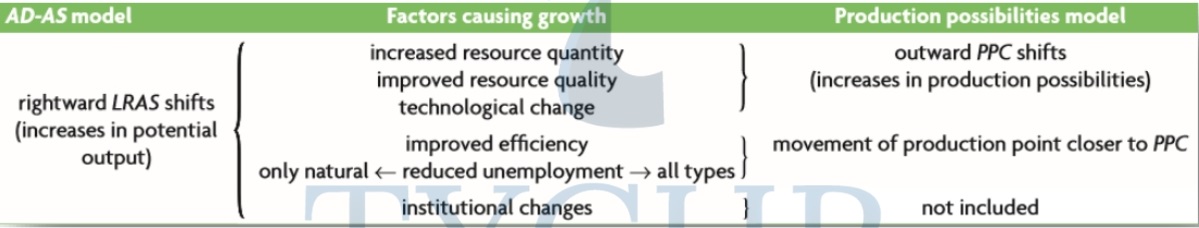

=> growth. - In the AD-AS model, rightward LRAS shifts cause economic growth.

- In the PPC, outward shifts cause growth relating to increasing possibilities, and the movement of production points is the result of increasing efficiency.

- Consumption vs. Investment: In order to have long term economic growth, it is necessary to sacrifice some consumption in the present in order to make investments that result in the formation of new capital for use in the future.

- Economic Growth and the LRAS Curve:

EQUITY IN THE DISTRIBUTION OF INCOME

- Equity – condition of being fair or just

- Equality – equal with respect to something

- Some think that it is fair to have income equality, but others think that it is more equitable for those who work more to get more income.

- There is unequal distribution of ownership of production factors, and prices vary greatly. Because of their unique abilities, some workers earn more than others.Results in the distribution of income being unequal because some people have more factors of production than others.

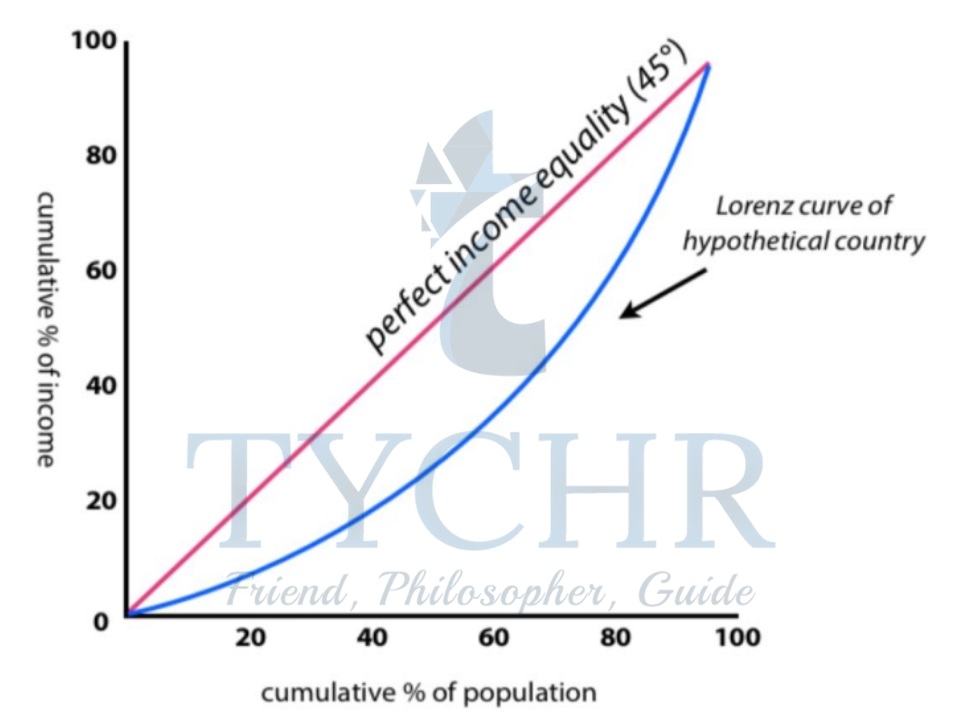

THE LORENZ CURVE

- A quintile is a 20% portion of a country’s population. Income is distributed by quintiles, and if income were equally distributed, every quintile will receive 20% of the income.

- To be more realistic, the poorest quintile receives less than 20% of income, and the richest 20% receives more than 20% of income.

- Can also be split into deciles (10%), or quartiles (25%).

- The degree of income equality in an economy is depicted by a Lorenz curve.

- The percentages are cumulative: 40 shows the lower 40%.

- The closer the Lorenz curve is to the line of income equality, the more evenly distributed the income is.

- The Gini coefficient is (area between diagonal and Lorenz curve)/ (entire area under 45° line).

- It has a value between 0 and 1. Zero means perfect income inequality. The closer the coefficient is to 1, the greater the inequality.

POVERTY

- Poverty is the inability to satisfy minimal consumption needs.

- Absolute poverty is measured with a poverty line (minimum income level needed for a family to sustain sufficiently).

- World Bank defined lines: less than $1.25/day (extreme poverty), less than $2/day (moderate poverty).

- calculating the proportion of people whose income is below the poverty line.

- Many developing countries also have national poverty lines, and those with a higher income will have higher national poverty lines, so a higher percentage of people there will be considered poor.

- Relative poverty compares incomes of individuals with the median incomes. Related to equality of income.

- Even though people can buy basic necessities, they can’t afford goods/services that are typical in a society. Usually the percentage is 50% of median income.

- Many factors can cause poverty:

- Low incomes – poverty is defined by income falling below a certain level.

- Unemployment – even though unemployment benefits are given, they are still lower than work received income.

- Low levels of human capital – there’s usually a positive relationship between skill and income levels.

- Low levels of capital/land ownership – some have no resources to rely on, such as a

home or stocks that would give them an income advantage. - Discrimination – social groups can be discriminated against and receive less pay.

- Geography – people living in isolated places have limited choices.

- Age – older people may have pensions, but they are usually low.

- Limited social services – those with low income rely on social services, but if they are reduced, the people may have to purchase these services.

- Poverty – poverty can cause even more poverty.

- Poverty comes with several consequences

- Low living standards – low income causes low living standards

- Lack of access to health care & education – this lowers productivity and income even more

- Higher mortality rate – limited health care and poor nutrition can cause many deaths

- Social problems – crime rates, drugs, homelessness

- Inability to realize full potential – people can’t realize their full potential and talent is then wasted. May result in lower economic growth.

- There are several ways that can promote equity:

- Transfer payments – payments made by gov’t to individuals just to redistribute income. Vulnerable groups receive the transfer payments and include pensions, benefits, grants, etc. Made possible by the government’s tax collection.

- Provision of merit goods – Merit goods would be under-consumed if the market controlled income distribution. Education and health care are considered fundamental rights. Subsidized to make sure they are affordable. Tax revenue used to ensure provision of goods.

- Government intervention – minimum wage legislation, food price ceilings, and farmer price floors.

- Taxation – allows redistribution to take place by lowering income inequality.

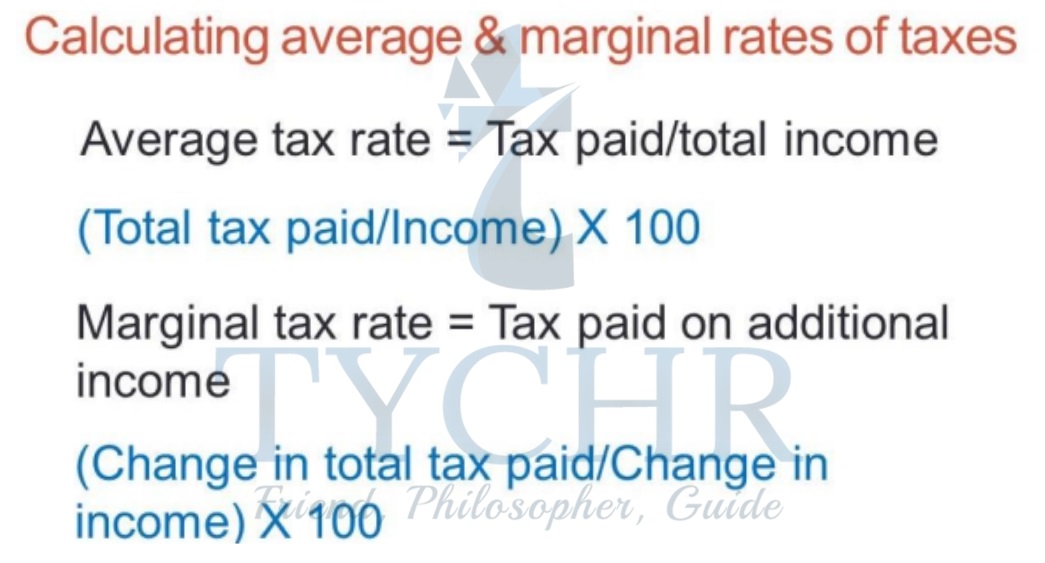

TAXES

- Direct taxes – taxes paid directly to the government by taxpayer, and the revenue is used to fund many gov’t spending

- Personal income taxes – most important source of tax revenue; paid by households on all forms of income

- Corporate income taxes – corporations are businesses that have formed a legal body that is separate from its owners. corporate income taxes are taxes on corporation profits

- Wealth taxes – property taxes and inheritance taxes

- Social insurance contributions (payroll tax) – taxes paid by workers and their employers that are paid into specific funds, like insurance and health care. Because they are used for a specific purpose, they are designated.

Taxes that are paid

- indirectly through suppliers are known as indirect taxes.

- General expenditure (sales) tax – tax on good/service spending and are a fixed % of retail price. The EU and other countries use a value added tax and is a tax paid on value added by each producer.

- Excise tax – tax paid on specific goods and services

- Customs duties (tariffs) – tax applied on imports

- Proportional taxation – constant tax rate; as income increases, fraction income paid is constant

- Progressive taxation – increasing tax rate; as income increases, fraction of income paid increases • The more progressive the tax system, the more equal the distribution of income becomes

- Regressive taxation – decreasing tax rate; as income increases, fraction paid decreases • Makes income distribution less equal

- Corporate income taxes and social insurance contributions are usually proportional.

- Indirect taxes are regressive.

ACHIEVING PROGRESSIVITY THROUGH PROPORTIONAL TAXATION

- The more progressive a tax system is, the more equal is the after-tax distribution of income compared to the pre-tax distribution of income. Regressive tax systems tend to make the distribution of income less equal.

EVALUATING EQUITY IN INCOME DISTRIBUTION VS. EFFICIENCY

- Taxes affect allocation of resources.

- Intended to move the economy to more efficient allocation.

- Most taxes are not made with the intention of correcting market failure, though.

- Can even cause some inefficiency because they change the relative price of goods – and since prices without market failure make the best resource allocation, taxes can cause inefficiency.

- A very progressive tax system can cause a higher degree of income distribution, but this will also be a disincentive to work or save.

- Sales taxes are usually set on all goods and services, so there is no relative price change and thus no impact. But they are regressive and lead to unequal distribution.

- Some necessities are excluded from some taxes to make them more affordable, increasing equity, but then relative price has changed.

- Some people contend that taxes have only a theoretical effect on allocation and that, in the real world, their impact on growth is insignificant..

- Progressive taxes can make business cycle fluctuations not as serious.

- Greater equality can cause more efficient use of resources.

- Some argue that transfer payments may have undesirable consequences because they are disincentives for some to accept work. Others argue that it prevents these vulnerable groups that may face poverty.

- Transfer payments also lower the effects of fluctuations.

- There are opportunity costs when the gov’t subsidizes or provides merit goods.

- Government intervention conflicts with resource allocation and leads to loss of social surplus and inefficiency.