international trade Notes

The benefits of trade

- International trade – buying and selling of goods/services across international boundaries.

- Imports – goods and services that a country buys from other countries

- Exports – goods and services that a country sells to other countries.

BENEFITS OF TRADE

- Increases in domestic production and consumption due to specialization

- Specialization – when one concentrates production on a few goods and services that it can produce efficiently. Countries that don’t trade can’t specialize because they need to make more resources.

- Factor endowments – factors of production a country possesses.

- Countries can make use of the differences in quantities and qualities of the factors of production to increase consumption and production.

- Economies of scale in production

- EoS – ability of firms to decrease costs of production by becoming larger and increasing the quantity of output.

- Without trade, the size of the market is limited and it’s hard to take advantage of economies of scale.

- Greater choice for consumers

- Countries can have a larger variety of goods and services.

- Increased competition and greater efficiency in production

- Domestic firms gain extra competition which forces them to be more efficient

- Lower prices for consumers

- Increased efficiency results in lower costs

- Acquiring needed resources

- Countries are able to import the necessary inputs for domestic production thanks to trade.

- Free trade and a more efficient allocation of resources

- Free trade means there is no government intervention with restrictions

- Source of foreign exchange

- Allows countries to make payments to other countries

- Flow of new ideas and technology

- Reduces hostilities and violence

- Countries become interdependent and reduce the possibility of war.

- “Engine for growth”

- All of the above allow an increase in output which can cause economic growth.

Free Trade: Absolute and Comparative Advantage

FREE TRADE

It is defined as the absence of government intervention in international trade, so that trade takes place without any restrictions (or barriers) between individuals or firms in different countries.

THE THEORY OF ABSOLUTE ADVANTAGE

- The theory of absolute advantage states that increased production and consumption in each nation is the outcome of countries focusing on and exporting the product in which they have an absolute advantage (can produce with fewer resources).

- PPC CURVE showing absolute advantage:

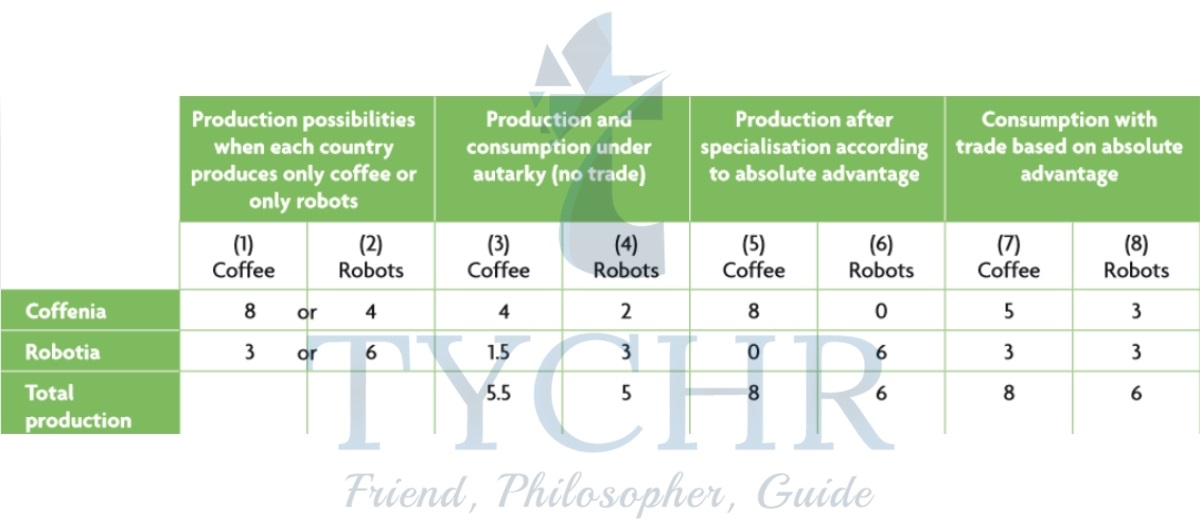

- From the above table, we can conclude by saying that Coffenia has an absolute advantage in coffee because it can produce 8 units of coffee compared to only 3 in Robotia. Similarly Robotia has an absolute advantage in robotics since it can produce 6 robots compared to only 4 in Coffenia.

- Production and Consumption with no trade:

In the absence of trade (known as autarky), both the countries produce both robot and coffee, so that they consume both (produces anywhere along their PPC). - Production and Consumption with trade:

Due to a “global” reallocation of resources in which production is carried out by the most cost-effective producers, both nations can consume outside of their PPC because they engage in trade and produce within it.

THE THEORY OF COMPETITIVE ADVANTAGE

- It describes a circumstance in which one nation has a lower opportunity cost—also known as the relative cost of producing a product—than another nation.

- Graphical Explanation:

- In the production of both goods, Microchippia has a clear advantage. As a result, its PPC is significantly higher than that of Cottania.

- If PPC’s intersect: When one country has the absolute advantage in one or both the goods.

- If PPC’s do not intersect: PPC of the country lying fully above has the absolute advantage in both the goods.

When the opportunity cost (lower relative cost) of producing a good is lower, a nation has a competitive advantage.

LAW OF COMPETITIVE ADVANTAGE

- When a good can be produced at a lower opportunity cost than its trading partner, a nation has a comparative advantage. All nations can benefit from specialization and trade based on their comparative advantage, as long as opportunity costs in two or more countries differ. This is the theory or law of comparative advantage. Countries can consume outside of their PPC as a result of improved resource allocation, which increases global output and consumption.

- A highly skilled and educated worker using more advanced technology adds more to the output.

UNREALISTIC ASSUMPTION OF THEORY OF COMPETITIVE ADVANTAGE

- Factors of production are immobile.

- Technology is fixed (new technologies are always introduced).

- There exists a perfect competition (which is a rare scenario).

- Imports and exports balance each other (in reality there exists several trade imbalances).

- Ignore transportation costs.

- It leads to excessive specialization.

- Assumption of free trade is unrealistic (in reality there exists a lot of Government interference).

The World Trade organization (WTO)

HISTORY

- During the Great Depression, countries imposed tariffs to limit imports and resulted in tariff wars which reduced trade without affecting output and employment.

- 29 countries formed the General Agreement on Tariffs and Trade (GATT) to prevent outbreak of tariff wars in 1947.

- Principles that the GATT was based on:

- Non-discrimination

- Elimination of non-tariff trade barriers

- Consultations to resolve trade disputes

- They would conduct rounds to achieve the objectives. In Jan 1995, the GATT was replaced by the World Trade Organization (WTO).

FUNCTIONS & OBJECTIVES

- Contains: 153 members and 31 “Observers”

- Functions:

- Administers WTO trade agreements

- Helps in implementation/admin of trade agreements

- Provides forum for negotiations

- Most important; allows members to discuss problems

- Handles trade disputes

- Monitors national trade policies

- Conducts reviews of trade policies

- offers training and technical assistance to developing nations

- Facilitates cooperation with other international organizations

- Such as the World Bank and International Monetary Funds

Principles:

- Non-discrimination

- Emphasis on equal treatment for all member countries (excluding trading blocs)

- Free trade

- Trade barriers should be lowered

- Predictability

- Firms, gov’ts, etc., should have confidence that barriers won’t be raised

- Promotion of fair competition

- Unfair practices are discouraged

- Development and economic reform should be encouraged

- Developing countries should be offered flexibility

Restrictions on free trade: Trade Protection

TRADE PROTECTION

- Free trade – trade without government intervention so no restrictions take place; efficient global allocation of resources and maximization of global output

- Trade protection – Government intervention with trade barriers to prevent free entry of imports or protect the economy from foreign competition.

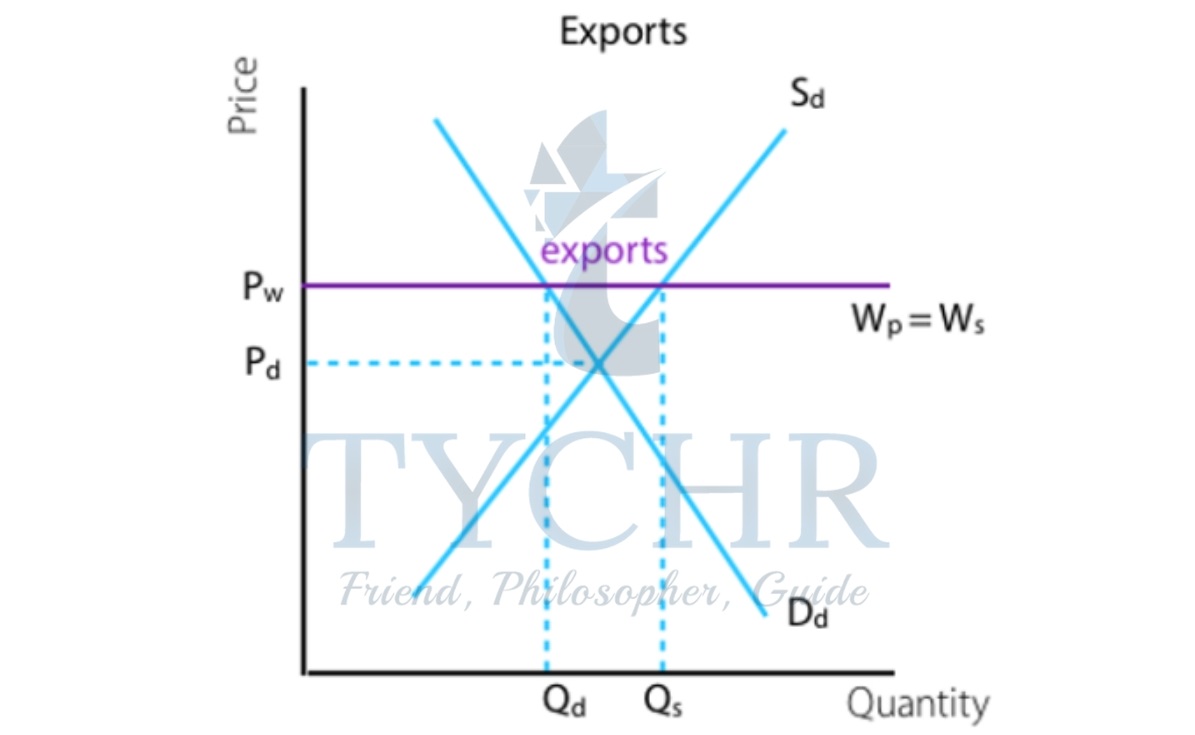

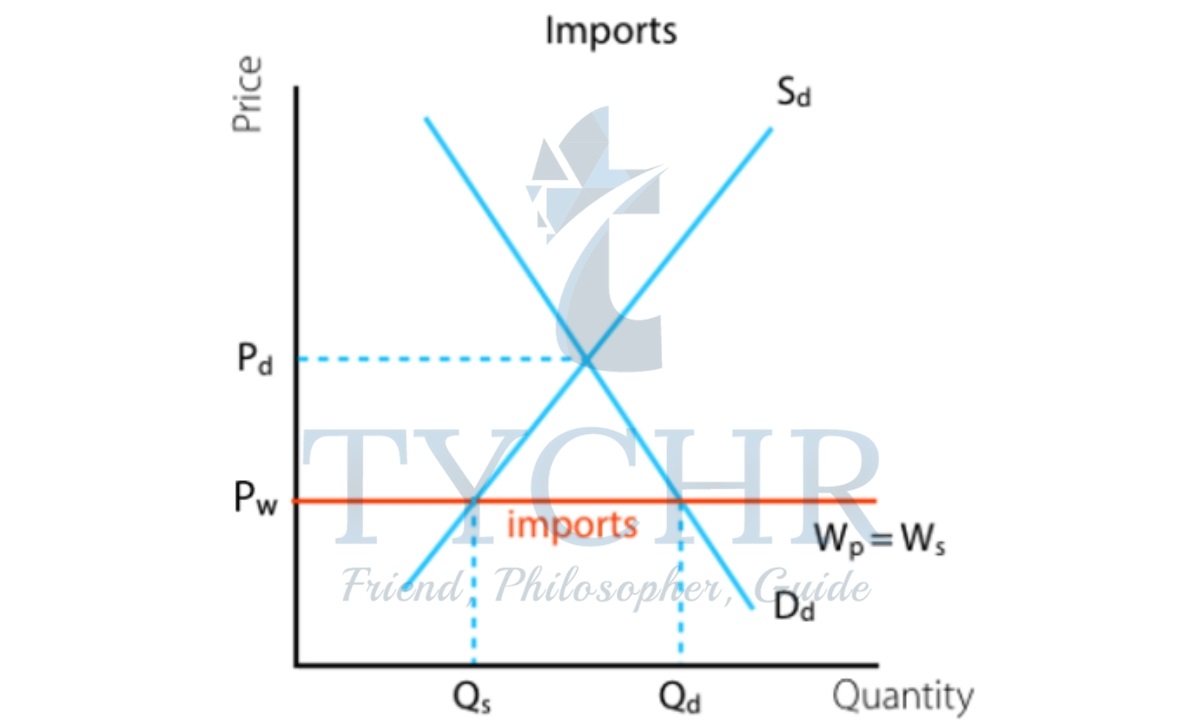

- Under free trade, goods are exported when the global price is higher than the domestic price. The product is imported if the international price is lower than the domestic price.

- The world price (Wp = Ws) curve is the perfectly elastic curve. Once a country opens up to international trade, the domestic price (Pd) is no longer relevant.

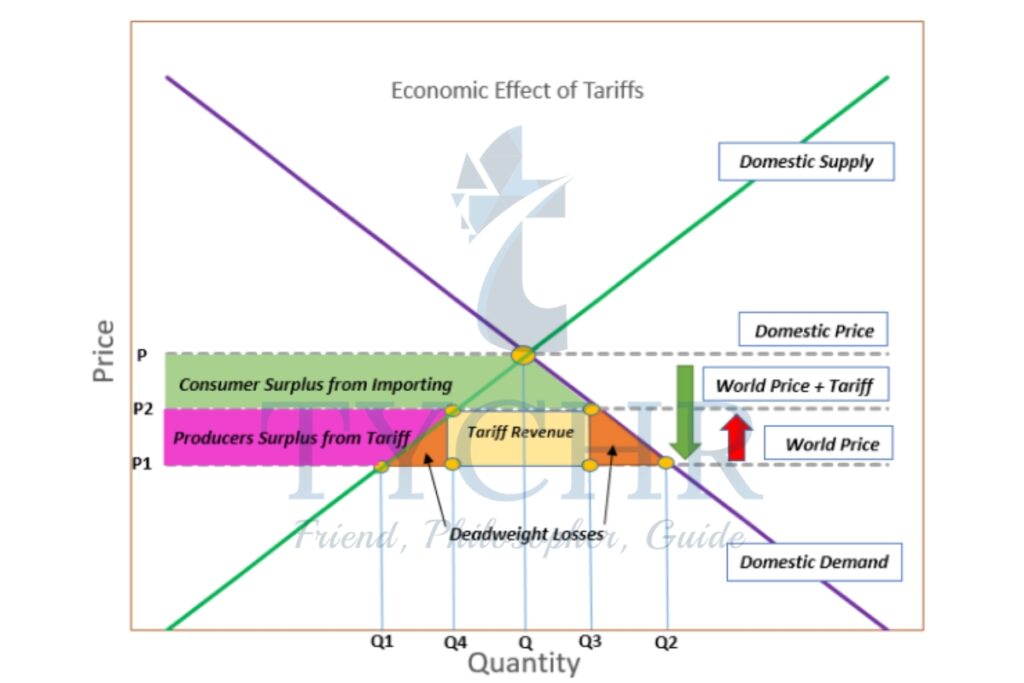

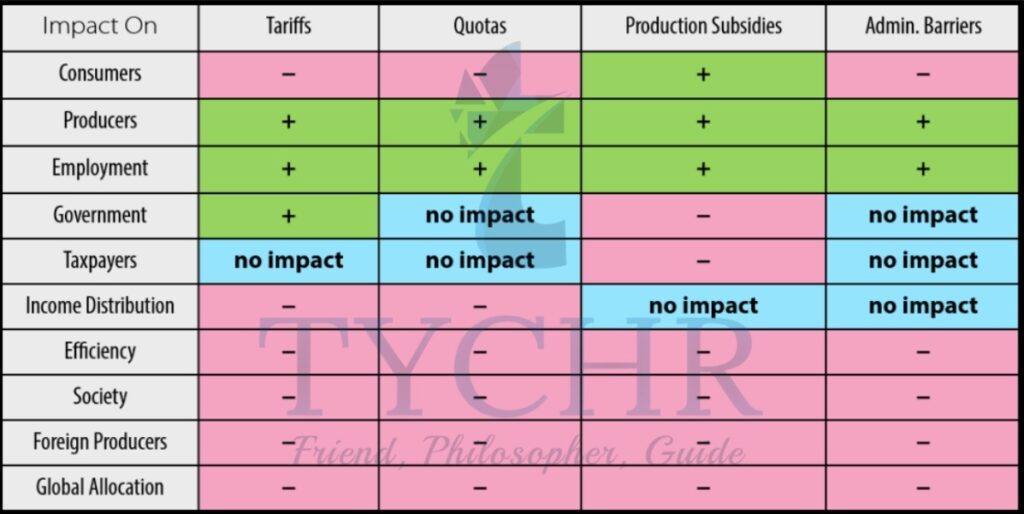

TARIFFS

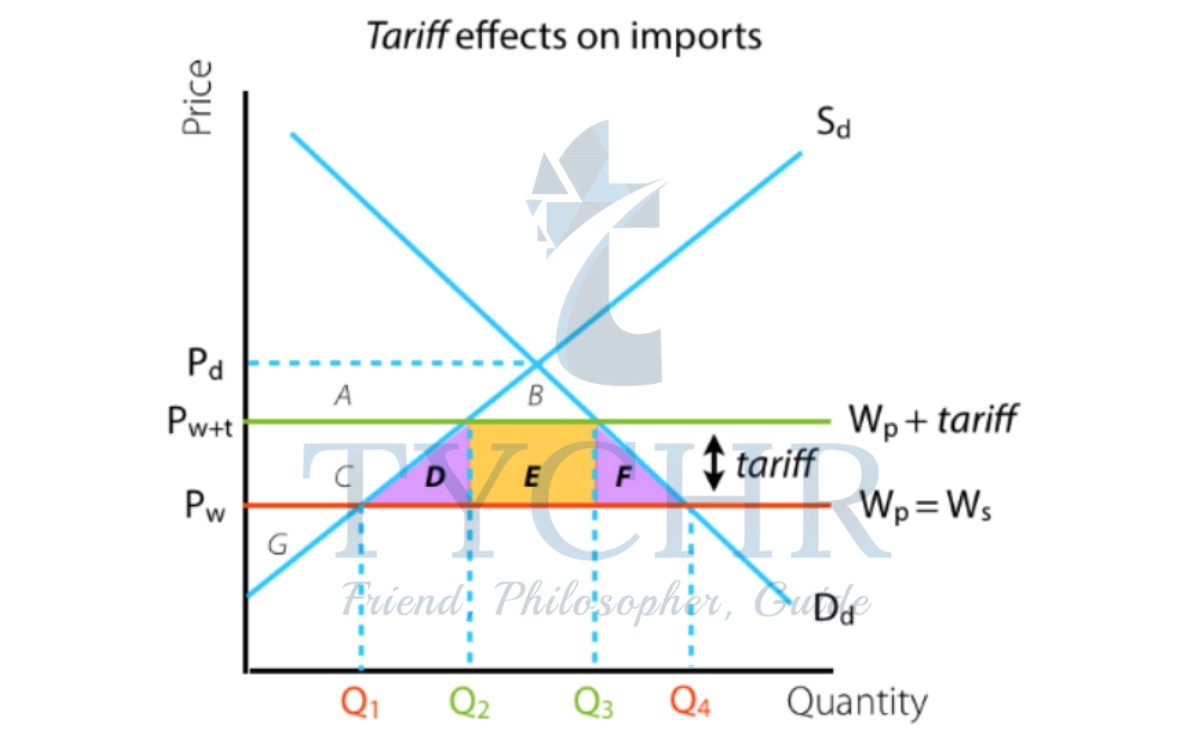

- Tariffs (custom duties) are taxes on imported goods. They are used to protect a domestic industry from competition (protective tariff) or to raise government revenue (revenue tariff).

- Under free trade, the country will produce Q1, demand Q4, and import Q4 – Q1. The tariff will increase the price to Pw+t.

- Increase in Qs, decrease in Qd, decrease in imports

- Qs to Q2, Qd to Q3, quantity of import to Q3 – Q2.

- Domestic consumers worse off

- Pay higher price at Pw+t and buy quantity Q3 instead of Q4

- Domestic producers better off

- Receive higher price Pw+t and sell quantity Q2 instead of Q1

- Domestic employment increases

- Producers sell more, so employment increases

- Gov’t gains tariff revenues

- Revenue gained: amount of tariff * quantity of imports. Orange shaded (E)

region.

- Revenue gained: amount of tariff * quantity of imports. Orange shaded (E)

- Domestic income distribution worsens

- Tariff is a regressive tax which burdens those with low incomes.

- Increased inefficiency in production

- Increase in output increases production by inefficient producers which results in a waste of resources.

- Foreign producers worse off

- Since there are fewer imports, the foreign exporters export less.

- Global misallocation of resources

- Decreased consumption, inefficient domestic producers

- Welfare loss at purple shaded (D + F) region.

- Effect of tariff on consumer and producer surplus

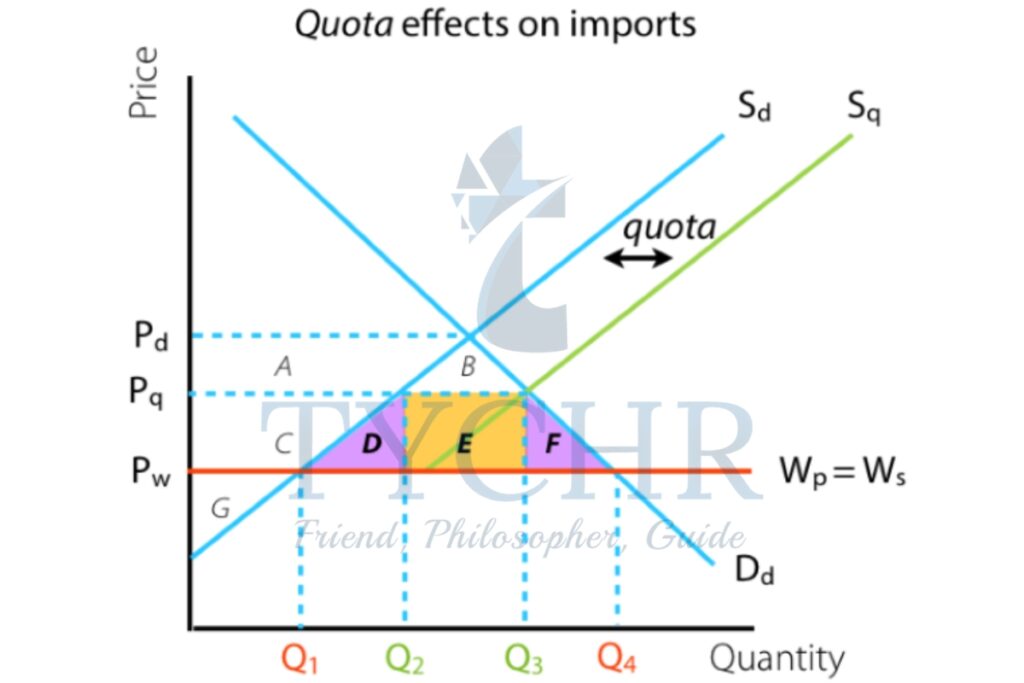

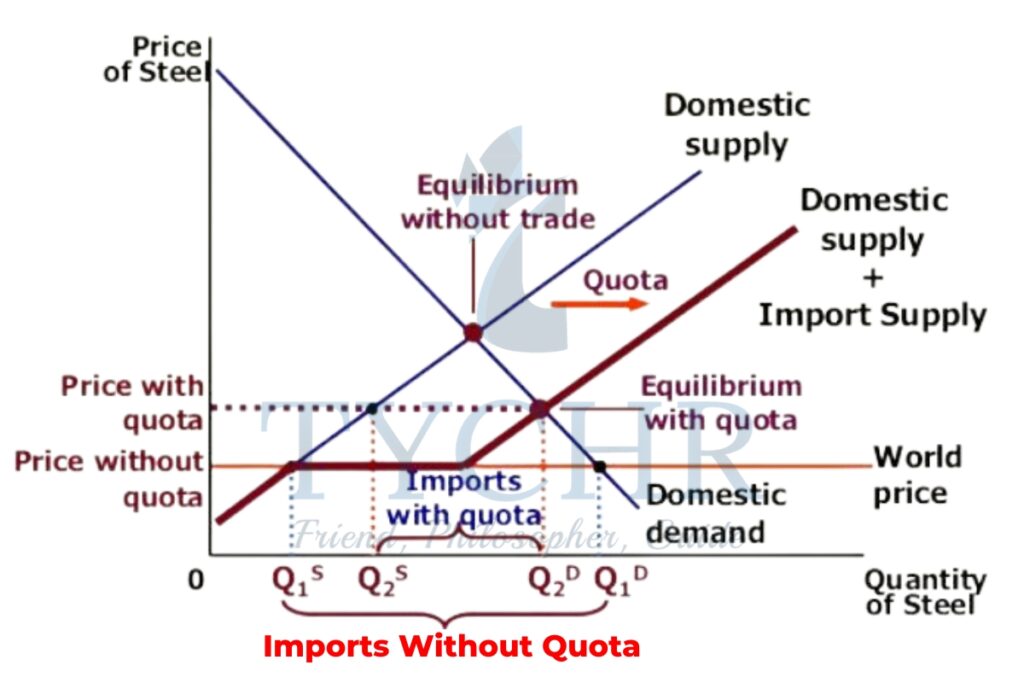

IMPORT QUOTAS

- Quotas – legal limit to quantity that can be imported over a time period. Similar effects as tariffs, but without gov’t revenue.

- Under free trade: Q1 supplied and Q4 demanded; Q4 – Q1 imported.

- With a quota, the quantity imported is limited to Q3 – Q2.

- Governments issue a number of quota licenses that determine the legal limit on the quantity of imports, and the license holders gain revenues.

- Usually given to exporting countries.

- Increase in Qs, decrease in Qd and imports

- Domestic consumers worse off

- Pay higher for less

- Domestic producers better off

- Receive higher price and sell more

- Domestic employment increases

- Output increases, so employment increases

- The government does not gain nor lose

- Import license given to foreign gov’ts, so the domestic government budget isn’t affected

- Domestic income distribution worsens

- Higher price has the same regressive effect

- Increased inefficiency

- Increase in production by the inefficient domestic producers

- Exporting countries better/worse off

- Loss of export revenues but gain quota revenues

- Global misallocation of resources

- Decrease in consumption, shift of production to inefficiency, etc.

- Effect of quotas on consumer and producer surplus

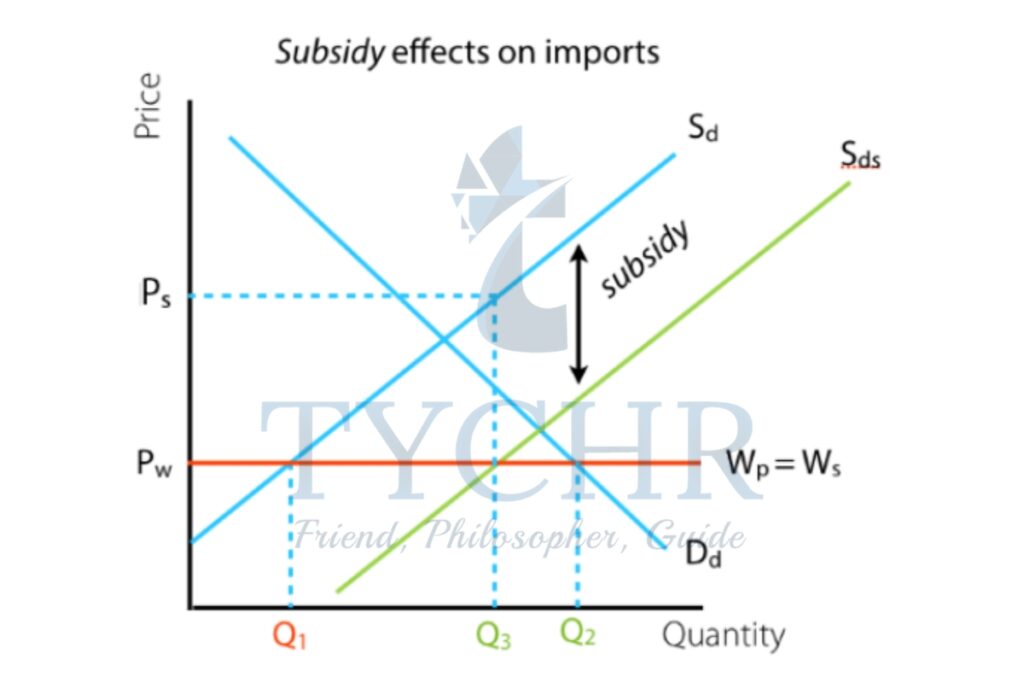

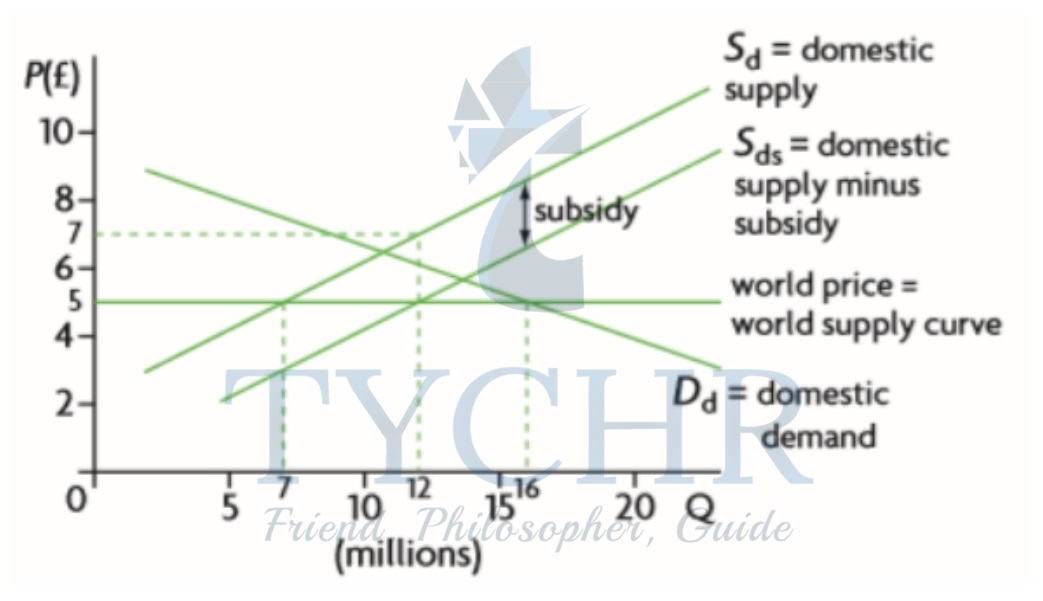

SUBSIDIES

- Production subsidies are government payments made to domestic businesses that compete with imports.

- Under free trade: produce Q1, demand Q2, and import Q2 – Q1.

- Increase in Qs, decrease in imports

- Qimports to Q2 – Q3 from Q2 – Q1

- Consumption unaffected

Consumers buy more of the- domestic good and less of the imported, so it stays the same

- Domestic producers better off

- Receive more (Ps, or Pw + subsidy)

- Government budget worse off

- Must spend tax revenues on subsidies

- Taxpayers worse off

- Taxpayer funds could be spent elsewhere

- Domestic employment increases

- Output increases; employment increases

- Increased inefficiency

- Domestic producers more inefficient compared to foreign producers

- Exporting countries worse off

- Global misallocation of resources

- Economists prefer subsidies to tariffs or quotas because they don’t have negative effects on consumption

- Subsidies result in exports of the protected goods

- If the subsidy is large enough, the country can become an exporter of the good even though it has a comparative disadvantage in its production.

- Effect of production subsidies

- Subsidy per unit = Vertical difference between two supply curves.

- Quantity of imports = imports before subsidy ( 9 million units)

Imports after subsidy (4 million units) - Domestic consumers: Consumers are not affected. They pay the same price.

- Domestic producers: The price received by producers increases by the amount of subsidy.

- Government expenditure and tax payers: Government expenditure increases from zero to an amount equal to the subsidy per unit.

- Foreign producers: The decline in imports from a country equals the decline in exports from foreign producers.

ADMINISTRATIVE BARRIERS

- Administrative barriers are obstacles to imports.

- Such as: custom procedures with inspections, valuations, and red-tape checks. These make it harder to import and use up more time.

- Health, safety, environmental standards also require time-consuming tests.

- Believed to be an attempt to reduce imports sometimes

ARGUMENTS AGAINST TRADE PROTECTION

- Protection worsens the allocation of resources.

- Trade protection benefits only workers and producers. Producer gain comes at the expense of higher production costs and reduced efficiency.

- Consumers lose in most cases

- Higher cost and lower quantities available. (Consumer losses usually greater than producer gains)

- Income distribution worsens

- Except with subsidies and barriers

- Foreign producers worse off

- Society as a whole / global resource allocation loss

- Trade protection may have negative effects on a country’s export competitiveness.

- Some protected domestic goods may be inputs to other exported goods.

- Price of protected fertilizer increases, and agricultural products now have increased in price.

- Lower competitiveness in export markets

- Trade wars

- Other countries can retaliate by imposing barriers should a country impose a barrier.

- Potential for corruption

- Bribery and smuggling can occur as a result of import restrictions.

ARGUMENTS FOR TRADE PROTECTION

- Infant industries

- Infant industry – new domestic industry that is unable to compete with other competitors as it hasn’t reached economies of scale.

- An industry might need protection before it can specialize in it.

- Needs to be temporary, or governments may continue to protect it after maturity

- Difficult for gov’t to decide what industries have potential.

- Industry may not have incentive to become efficient

- Strategic trade policy

- Strategic trade policy – argument in favor of protection that calls for high tech industries to help developed countries achieve economies of scale.

- Certain industries important to future economic growth.

- Difficulties in identifying industries

- Difficulties in selecting policies

- National security

- National defense industries should be protected so a country can produce them by themselves.

- Used by industries that have indirect use in defense to gain protection.

- Hard to draw a line between national defense and not national defense.

- Health, safety, and environmental standards

- Concern: hidden protection

- Efforts of a developing country to diversify

- Countries need to keep out imports of goods that they want to produce themselves.

- Applies only to developing countries.

INCORRECT ARGUMENTS

- Wage protection argument

Foreign countries can produce at lower costs because of low wages.

Low-wage countries probably have a comparative advantage in producing goods that make use of the resources because they are cheaper.