economic integration and the terms of trade Notes

Economic integration

TRADE AGREEMENTS

- Economic integration – economic cooperation between countries and coordination of economic policies that increase economic links.

- Preferential trade agreement (PTA) – agreement between two or more nations to lower certain products’ trade barriers.

- Also involves cooperation on other issues: environmental, labor, intellectual properties

- Bilateral trade agreement – agreement between two countries

- Multilateral trade agreement – agreement between multiple countries

- Regional trade agreements – agreements between countries within region

- These agreements promote trade liberalization – the reduction of trade barriers.

- WTO trade agreements are multilateral. WTO principle “non-discrimination,” although there are exceptions.

TRADING BLOCS

- Trading bloc – group of countries that agree to reduce barriers for freer trade and cooperation.

- Free trade area (FTA) – group of countries that agree to slowly eliminate trade barriers; these countries still can have their own trade barriers with other countries. Lowest form of integration.

- Examples: North American Free Trade Agreement, Association of Southeast Asian Nations, South Asian Association for Regional Cooperation.

- A product may be imported into country with lowest barriers then sold to countries with high barriers – FTAs make “rules of origins” to deal with the problem

- Customs union – group of countries, like the FTA, but also adopts a common policy towards all non-member countries.

- Examples: Central European Free Trade Agreement, South African Customs Union, Pacific Regional Trade Agreement

- Don’t have to make the rules of origin, but have to coordinate policies with non- members

- Common market – even higher integration; customs union but also includes the elimination of restrictions of factor of productions movement.

- Examples: Caribbean Community, European Economic Community, and Single Market and Economy

Encourages unemployed workers to go to other member countries, but also requires even more. Governments need to accept that they might lose some authority to the organization.

- Examples: Caribbean Community, European Economic Community, and Single Market and Economy

EVALUATION

Strengths

- Increased competition: Forces producers to compete with other producers

- Expansion into larger markets: firms can sell beyond their boundaries

- Lower prices and more choices

- Increased investment: larger markets give rise to increased investment

- Better use of factors of production (resource allocation): FoPs can move freely, if there is a common market

- Improved efficiency in production, greater economic growth

- Political advantages: reduction of hostilities because countries are more interdependent.

Weakness

- Liberalization may not be possible through trading blocs: inferior to the multilateral approach taken by the WTO to lower barriers for all nations; Blocks are selective.

- Creation of obstacles to achievement of free trade: breakup of trading system into blocs can cause trade conflicts

- Unequal distribution of gains/losses: Countries forming a bloc are unlikely to gain equally – can cause conflicts within members. Same with losses

TRADE CREATION AND TRADE DIVERSION

- Trade Creation – It refers to a situation in which nations are able to trade with minimal or no trade barriers. Through imports, higher-priced goods are substituted for lower-priced ones. For instance, if the United States and China develop a trade agreement for computers at a price of $100 per computer, companies that manufacture computers locally in China will lose business. This is due to the fact that they charge $ 130 per computer, and customers would rather pay less.

- Trade Diversion – After a trading bloc is formed, lower-cost imports from one member are replaced by higher-cost imports from another member.E.g. suppose.

There are three countries X, Y and Z producing cotton. X is the lowest cost producer followed by Y and Z is the highest cost producer. Initially, Z imposes a tariff on all imports of cotton. Since, X is the lowest cost producer, Z decides to import from X. But, Z decides to form a trading bloc with Y, thus Y eliminates the tariff whereas X is charging the tariff. Now because of the trading bloc, Y’s cotton has become cheaper. Z imports from Y instead of X, erstwhile lowest cost producer.

MONETARY UNION

- Monetary union – a higher level of integration than before. Common market with a common currency and central bank for all members.

- Monetary unions in the European Union (the euro zone countries) use the euro. The euro came into use on 1 January 1999. For one year starting from 1 Jan 2002, euro coins and notes coexisted with national currencies.

- Members had to agree to convergence requirements, such as limiting their budget deficit and limiting their government debt. Members gave up their economic sovereignty to the European Central Bank.

- Monetary union thought of a system of fixed exchange rates but there is no possibility of revaluing/ devaluing currency.

EVALUATION

Strengths

- Single currency eliminates exchange rate risk and uncertainty.

- reduces the costs of converting money through transactions.

- facilitates open pricing.

- Higher level of inward investment – inward investments are investments from outsiders

- Low rates of inflation → low interest rates, more investment, and increased output.

Weakness

- Loss of exchange rates as a mechanism for adjustment.

- Loss of monetary policy. Individual countries cannot carry out their own policies.

- Fiscal policy constrained by convergence requirements – governments cannot pursue specific policies if it violates the convergence requirements.

- Monetary policy pursued by the central bank impacts each country differently.

MEASURING TERMS OF TRADE:

Terms of trade = (𝐼𝑛𝑑𝑒𝑥 𝑜𝑓 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑒𝑥𝑝𝑜𝑟𝑡 𝑝𝑟𝑖𝑐𝑒𝑠 / 𝐼𝑛𝑑𝑒𝑥 𝑜𝑓 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑖𝑚𝑝𝑜𝑟𝑡 𝑝𝑟𝑖𝑐𝑒𝑠) 𝑥 100

- An improvement in the terms of trade can be seen in the ratio of the index of average export prices to the index of average import prices.

A decrease in the ratio shows deterioration in the terms of trade.

CAUSES OF CHANGES IN TERMS OF TRADE:

If the world price of a product increases, countries who export – benefit whereas countries who import – are at a disadvantage

Causes Of Changes In The Short Term

- Changes in Global demand: Increases the price of the product and benefits the exporters and vice-versa.

- Changes in Global supply: Increase in supply lowers the price, benefitting the importers.

- Changes in domestic rate of inflation relative to other countries: High rate of inflation means higher price resulting in increased exports.

- Changes in exchange rates: Appreciation leads to improvement in the terms of trade on account of fall in import prices.

Causes Of Changes In The Long Term

- Growth in incomes affecting global demand: As income increases, demand for goods also increases. Countries that export primary products and import manufactured products face deterioration in terms of trade.

- Changes in productivity: If productivity increases in industries producing goods for exports, the term of trade will deteriorate as export prices fall.

- Technological Advances: It results in falling prices and changing terms of trade for exporters and importers.

Trade protection: It deteriorates the terms of trade.

OPTIMUM CURRENCY AREA (OCA) AND EUROPEAN MONETARY UNION (EMU)

- Optimum currency area (OCA) – area where members have fixed exchange rates with each other but flexible rates with outsiders.

- OCA likely to be successful when: greater mobility of capital and labor resources close cooperation/coordination of fiscal policies greater synchronization of business cycle phases

European Monetary Union (EMU)

- faces some disadvantages: Lack of labour mobility due to language and cultural barriers.

There is no common fiscal policy. - Common policy is well suited where all countries are going through the same phase. But in EMU, if in one country there is inflation and in another there is unemployment, no common policy can work.

Terms of Trade

- A term that compares the price a nation pays for its imports to the price it receives for its exports.Terms of trade =

AVERAGE SIZE OF EXPORTSAVERAGE SIZE OF IMPORTSX 100

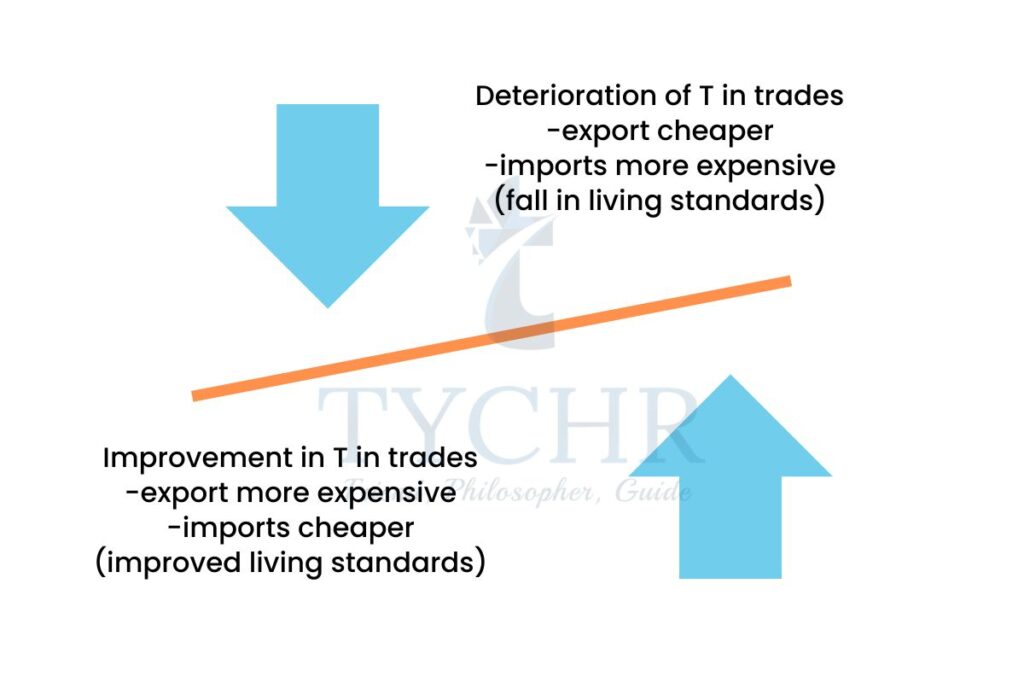

IMPROVEMENT AND DETERIORATION OF TRADE:

- Improvement in the terms of trade improves the standard of living – the same volume

of exports will buy more imports. - Deterioration in the terms of trade reduces the standard of living as more exports have to be sold to pay for the same volume of imports.

CONSEQUENCES OF CHANGES IN TERMS OF TRADE:

- Changes in the terms of trade lead to global redistribution of income and output.

The current account is affected by trade terms. - If it increases the value of exports or decreases the value of imports, a change in the terms of trade results in an improvement in the balance of trade—either a smaller trade deficit or a larger trade surplus.

- Global demand is affected by trade terms.

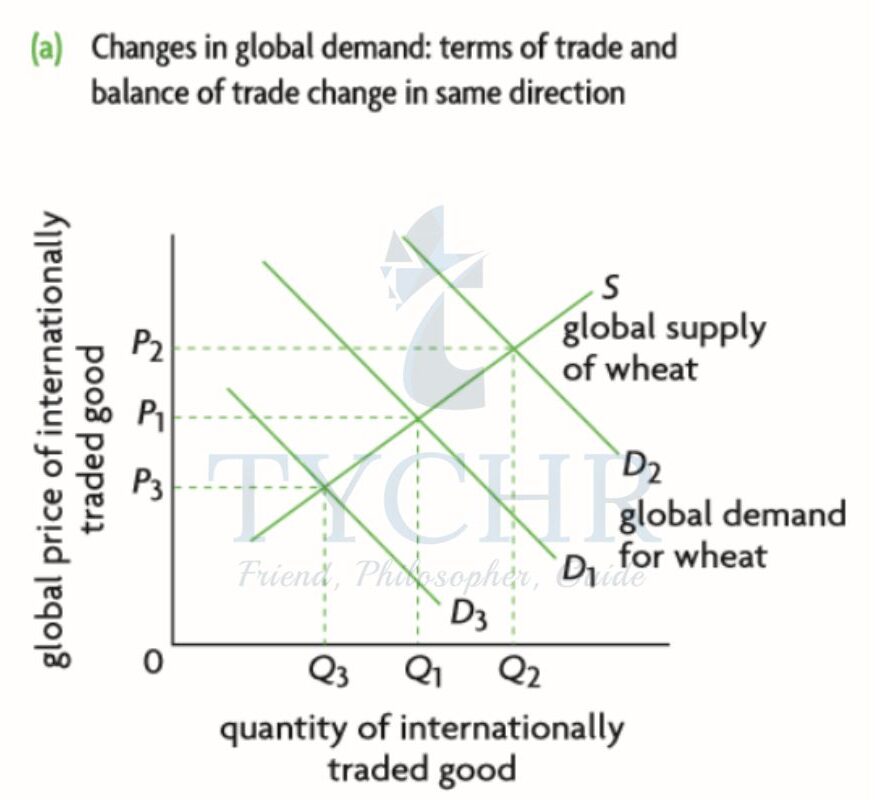

- The terms of trade and the balance of trade both shift in the same direction when a change in global demand for a good alters the terms of trade:

- either they both improve or they both deteriorate. This applies to both exporting and importing countries.

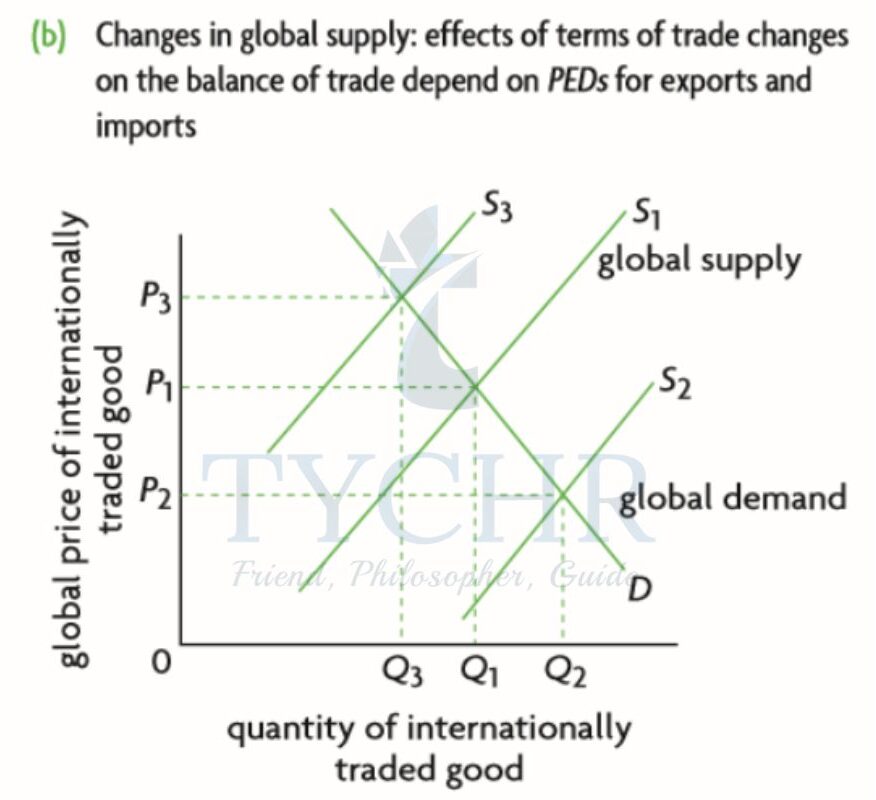

Changes in global supply: The role of PED for exports and imports.

- PEDx = percentage change in quantity of exports demanded /percentage change in price of exports.

- PEDM= percentage change in quantity of imports demanded /percentage change in price of imports.

- When PEDx 1 or PEDM 1 (inelastic demand), the terms of trade and balance of trade move in the same direction (both improve or deteriorate) given a change in global supply that changes a country’s terms of trade.

- The terms of trade and balance of trade move in opposite directions when either PEDx or PEDM (elastic demand) are greater than one: A rise in the terms of trade leads to a decrease in the trade balance, while a fall in the terms of trade leads to an increase in the trade balance. Countries that import as well as export are affected by these findings.

IMPACTS OF SHORT-TERM FLUCTUATIONS AND LONG-TERM DETERIORATION IN THE TERMS OF TRADE IN ECONOMICALLY LESS DEVELOPED COUNTRIES:

Short term fluctuations in terms of trade has some negative effects:

- Leads to uncertainties, have negative effects on investment and consumption.

- Poor resource allocation.

- Windfall gains lead to income inequality.

- It affects the banking system too, through large deposits and withdrawals.

- causes government spending to fluctuate and inappropriate fiscal policies.

Long term fluctuations in terms of trade includes:

- Primary product demand has a low elasticity of income.

- Agriculture’s technological advancements.

Market structures that are oligopolistic in more developed nations.

Effects of deteriorating terms of trade:

- A transfer of income away from countries.

- Increased opportunity cost for imports.

- Increased poverty.

- Deteriorated growth and development.