government intervention Notes

GOVERNMENT INTERVENTION

Indirect Tax

It is a tax that is levied on the producer—his goods and services—and is then passed on to the consumer in the form of higher prices—partly paid by the producer and partly by the consumers. Examples of Indirect Taxes: Excise Tax, VAT, GST, Service Tax, etc.

NOTE: Excise Taxes are imposed because they are a source of Government’s revenue and can discourage consumption of harmful goods like cigarettes, alcohol, etc. They are also imposed on goods produced or manufactured in India.

Indirect Taxes and allocation of Resources

Taxes can change allocation of resources because they raise the price paid by consumers and lower the price received by producers and it causes the consumers to buy less and producers to produce less.

Reasons for Indirect Taxes

- Source of government revenue.

- Used to discourage use of harmful goods, such as cigarettes and alcohol.

- Redistribution of income: Taxing goods that can be affected by high income individuals.

- Improves allocation of resources.

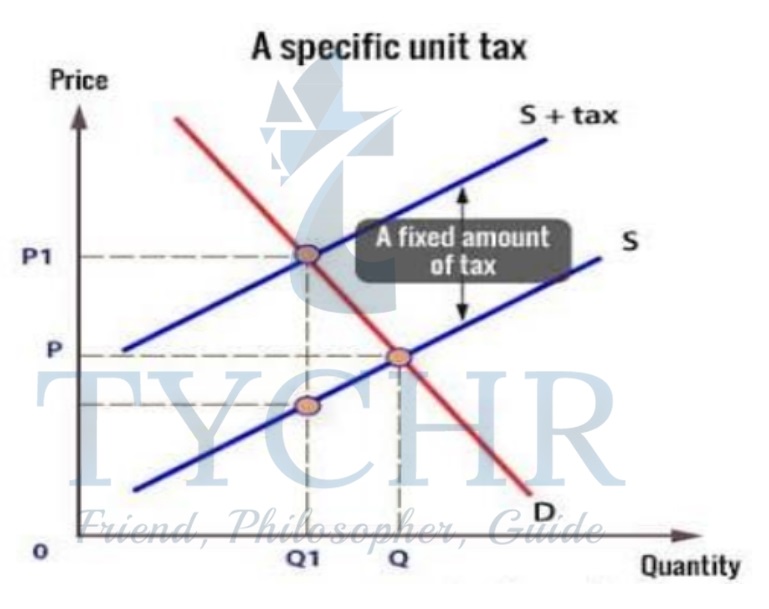

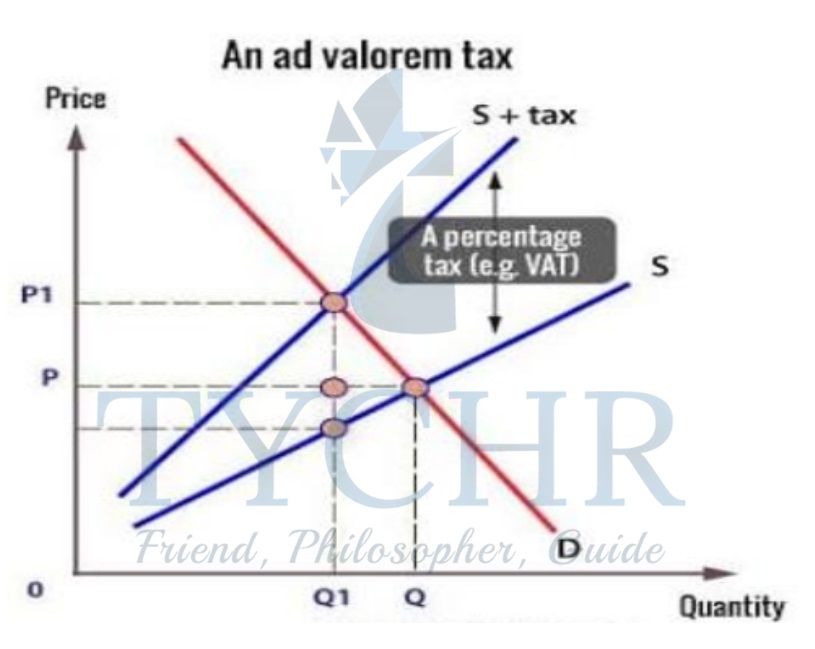

Types of Excise Tax

- Specific Tax: Fixed amount of tax per unit. Eg- 5$ per packet of cigarettes.

- Ad Valorem Tax: Fixed percentage of price of goods.

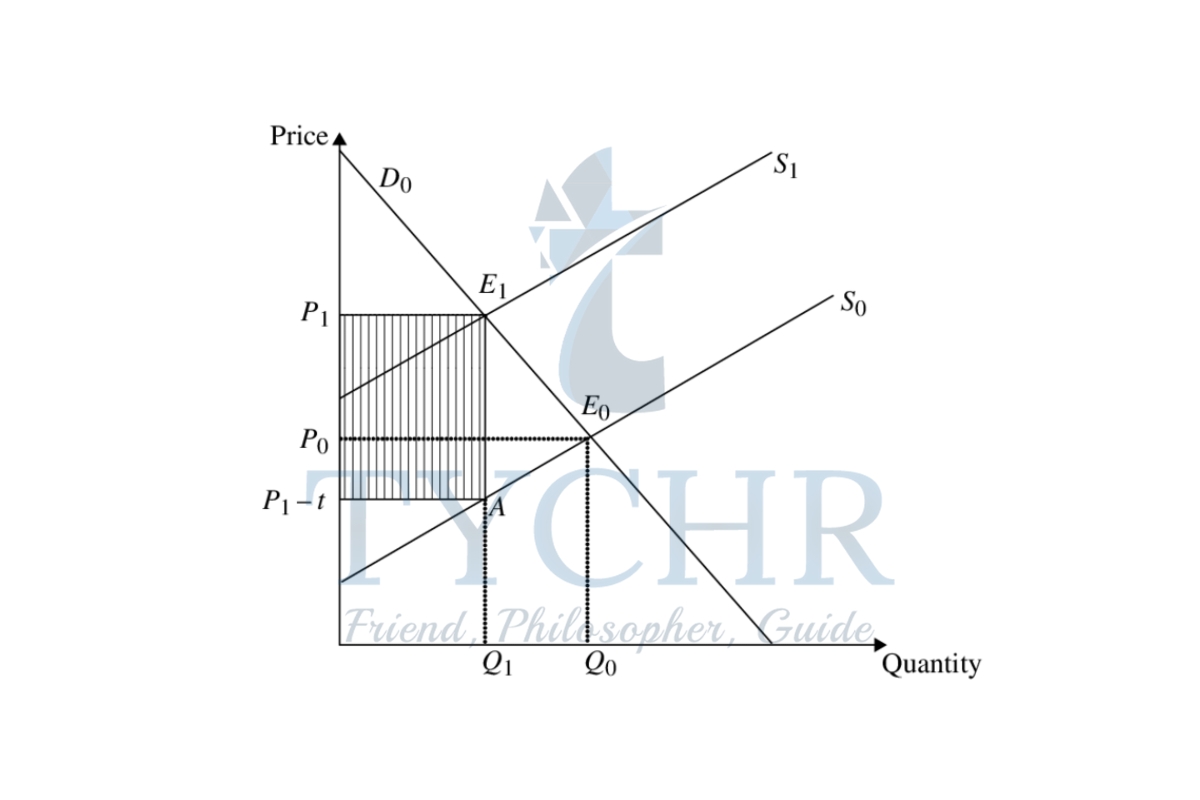

Note: A firm pays the government when a tax is imposed on a good. For every level of output, the firm needs to make more revenue than the original price. This causes an upward shift of the supply curve.

Note: Given a supply function of the general form Qs= c+dP, whenever there is an upward shift of the function by ‘t’ units, where ‘t’= tax per unit, we replace P by P-t. The new supply function therefore becomes Qs= c+d(P-t).

Effects of Excise Taxes on Market, Customer and Social Welfare

Consumer expenditure:

Before Tax, Consumer paid P* X Q*

After Tax, Consumer paid Pc x Qt T

here was a fall in expenditure.

Producer Revenue:

Before Tax, producer revenues is P* X Q*= Consumer expenditure After Tax, Producer revenue is Pp X Qt < Consumer expenditure There is a fall in producer revenue.

Government Revenue:

Government revenue= tax= Pc-Pp (Consumer expenditure- Producer revenue).

Impact on Stakeholders:

Consumers are worse-off.

- There is a price increase but less quantity. Consumers pay more for less of the goods.

Producers are worse-off.

- Producers receive less and sell less. There is a revenue decrease.

The government gains.

- They earn revenue.

Workers are worse-off.

- Fewer workers are needed to produce less output. This may lead to unemployment.

Society as a whole is worse-off.

- Mainly because of under allocation of resources.

NOTE: When resources are inefficiently managed, it leads to under or over allocation of resources. Under allocation means resources are under-utilized. Over allocation means resources are over-utilized.

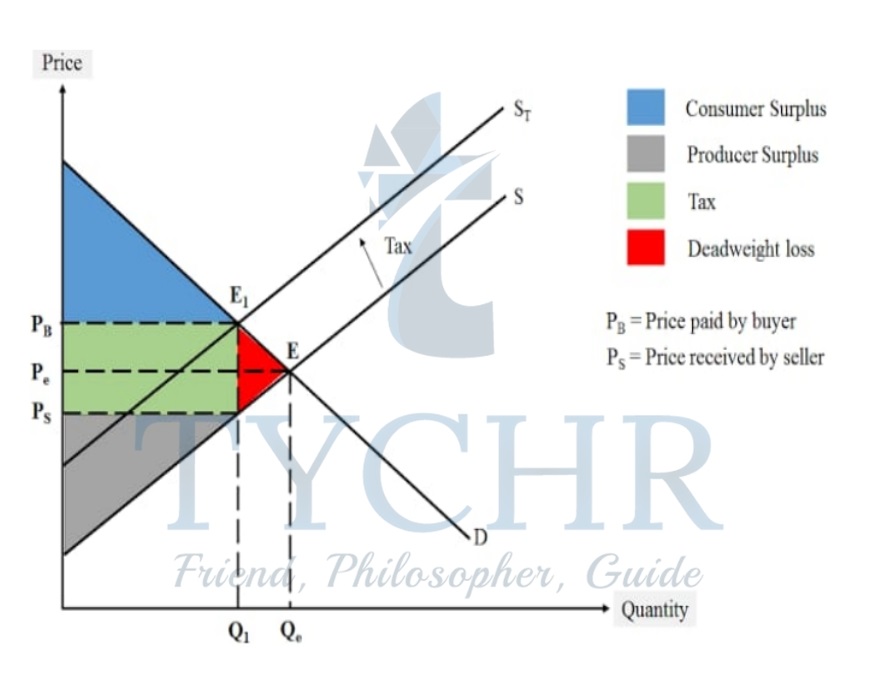

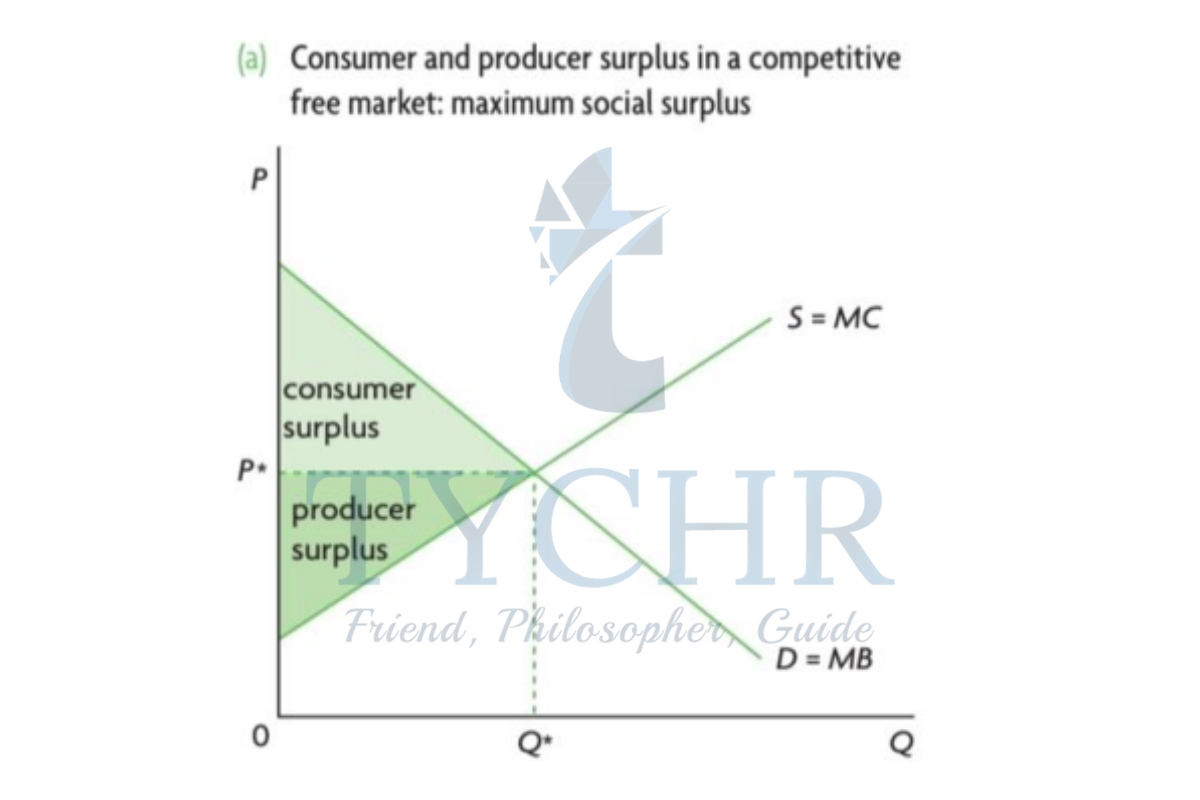

Consumer Surplus and Producer Surplus:

The imposition of an indirect tax results in reduced consumer and producer surplus, part of which is transformed into government revenue and part of which is a welfare (deadweight) loss. The welfare loss in this case is the result of under allocation of resources to the production of goods. This is also indicated by MB>MC, too little of the good is produced and consumed relative to the social optimum.

Note: Welfare benefits that are lost to society as a result of inefficient resource allocation are referred to as welfare losses.

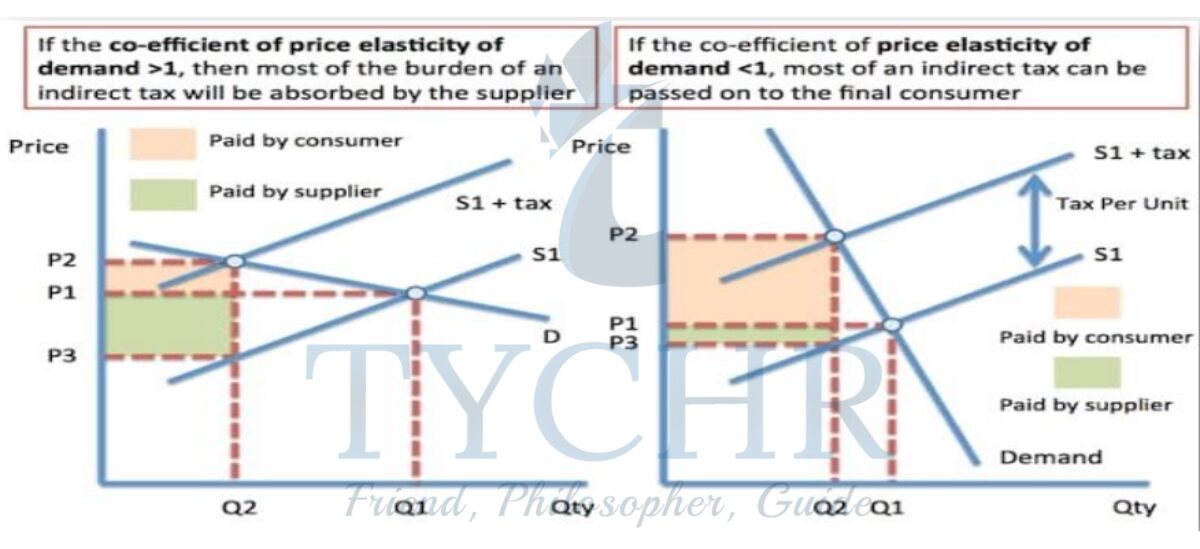

Tax Incidence and Price Elasticities of Demand and Supply

Note: Tax incidence means the burden of a tax.

Incidence of Indirect Tax and PED

Incidence of Indirect tax and PES

When supply is inelastic, tax incidence is on producers. When supply is elastic, tax incidence of consumers.

Putting PED and PES together:

The more elastic a schedule, the more of the tax burden will fall on the other side.

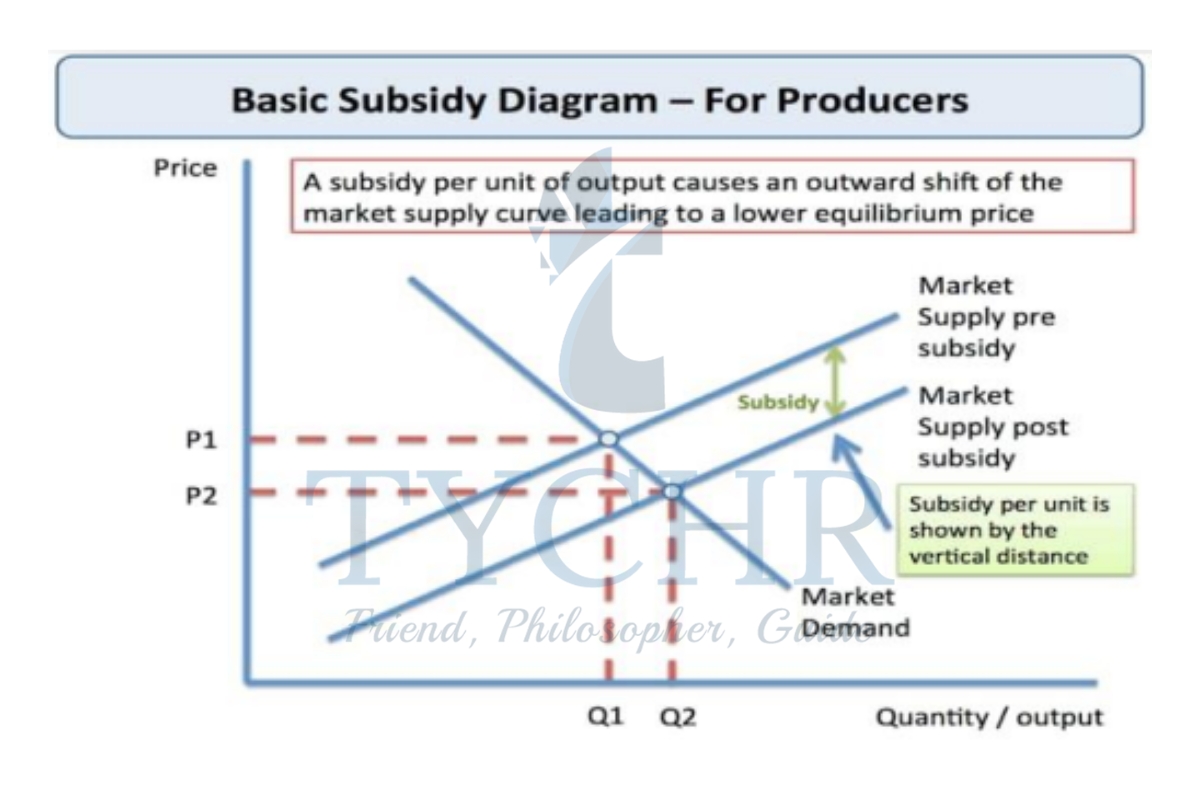

Subsidy

It is the provision of goods and services at a price lower than the market price by the government to individuals or businesses, such as low-interest or interest-free loans for students.

Examples: Subsidized LPG Gas cylinders provided by the Government, leading to a reduction in price of cylinders, causes an increased demand of quantity required.

Specific subsidy is a cash payment subsidy of a fixed amount per unit.

Note: Subsidies change the allocation of resources by decreasing the price paid by consumers and increasing the price earned by producers.

Reasons for Subsidies:

- Increase revenue and income of producers.

- Makes certain goods affordable to low income groups such as bread or rice.

- Produce and make use of desirable products and services. e.g., vaccinations and education.

- Support growth of specific industries. Eg- solar power manufacturing industries, chemicals, textiles, etc

- Encourages exports.

- Improves allocation of resources.

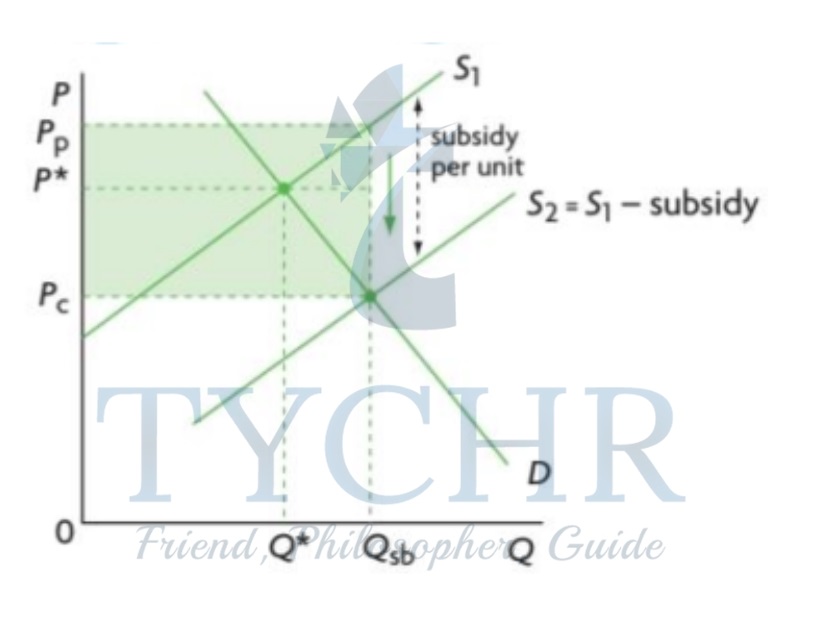

Impact of Subsidies on market outcomes:

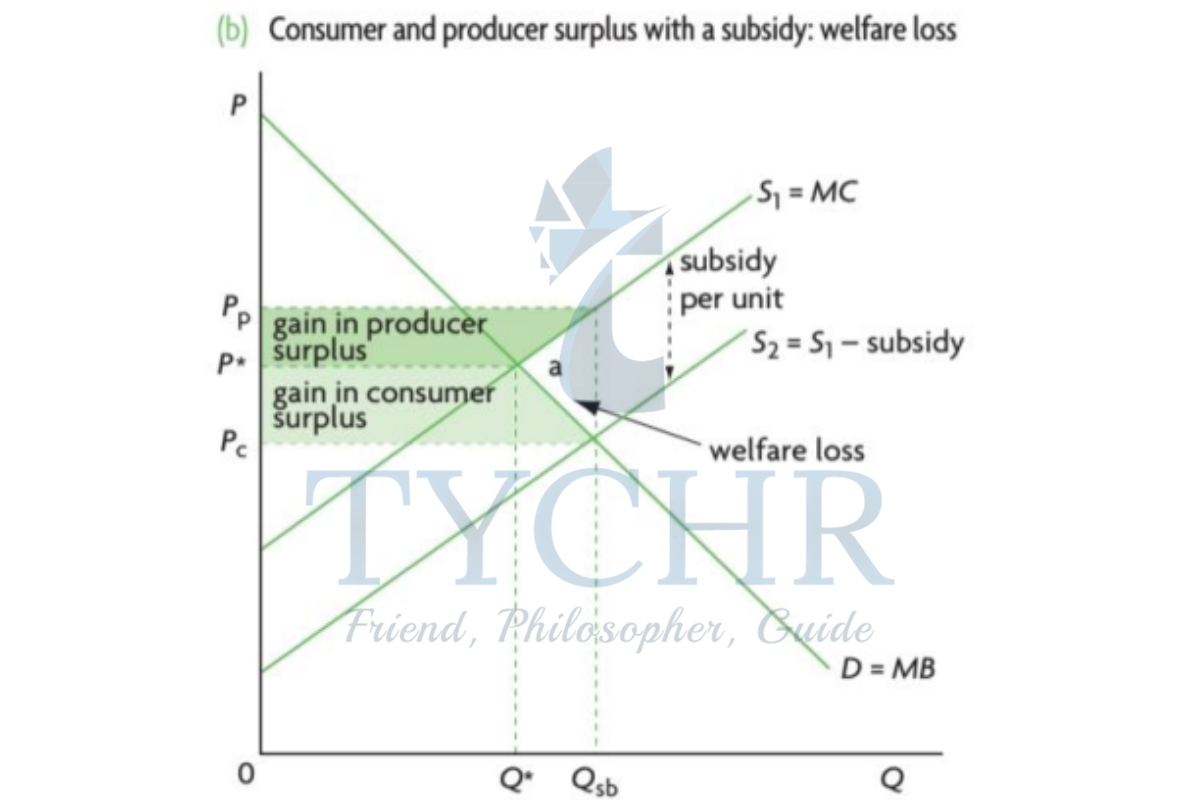

- Equilibrium Q increases from Q* to Qsb.

- Equilibrium P (paid by consumer) falls from P* to Pc.

- Price received by producers rises from P* to Pp.

- Government pays for (shaded) subsidy (Pp – Pc) X Qsb.

- Overallocation Qsb>Q*.

Consequences on stakeholders:

- Consumers are better off – Pay less and receive more.

- The producers benefit because they can produce more and receive a higher price.

- The government is worse off –

- The subsidy is paid for out of the budget of the government.

- Workers are better off – Firms hire more workers to produce more.

- Society is worse off – Overallocation of resources to subsidized products.

- It depends on foreign producers: If exports receive subsidies, export prices fall and quantity rises. This is beneficial for domestic producers but detrimental for international ones.

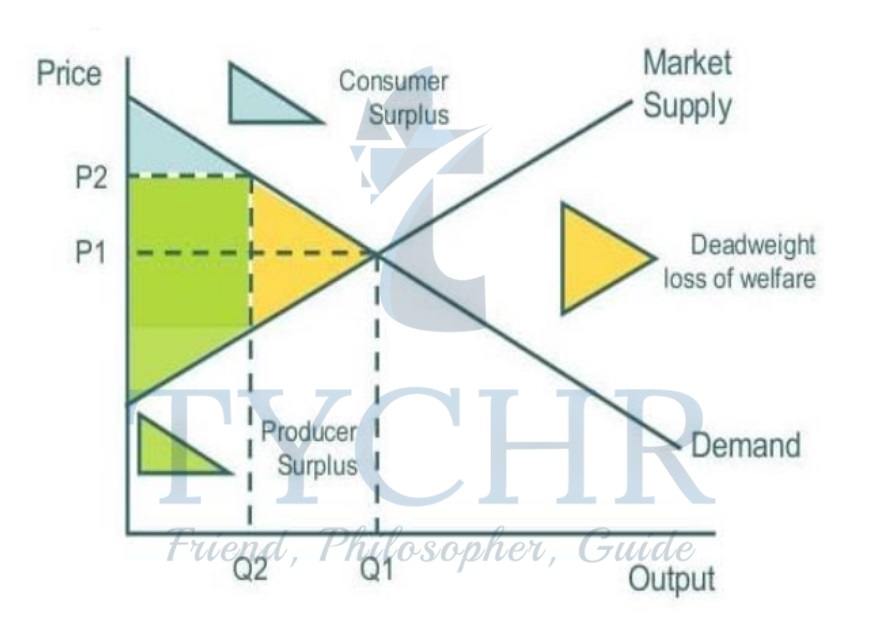

Subsidies: Market outcome and social welfare:

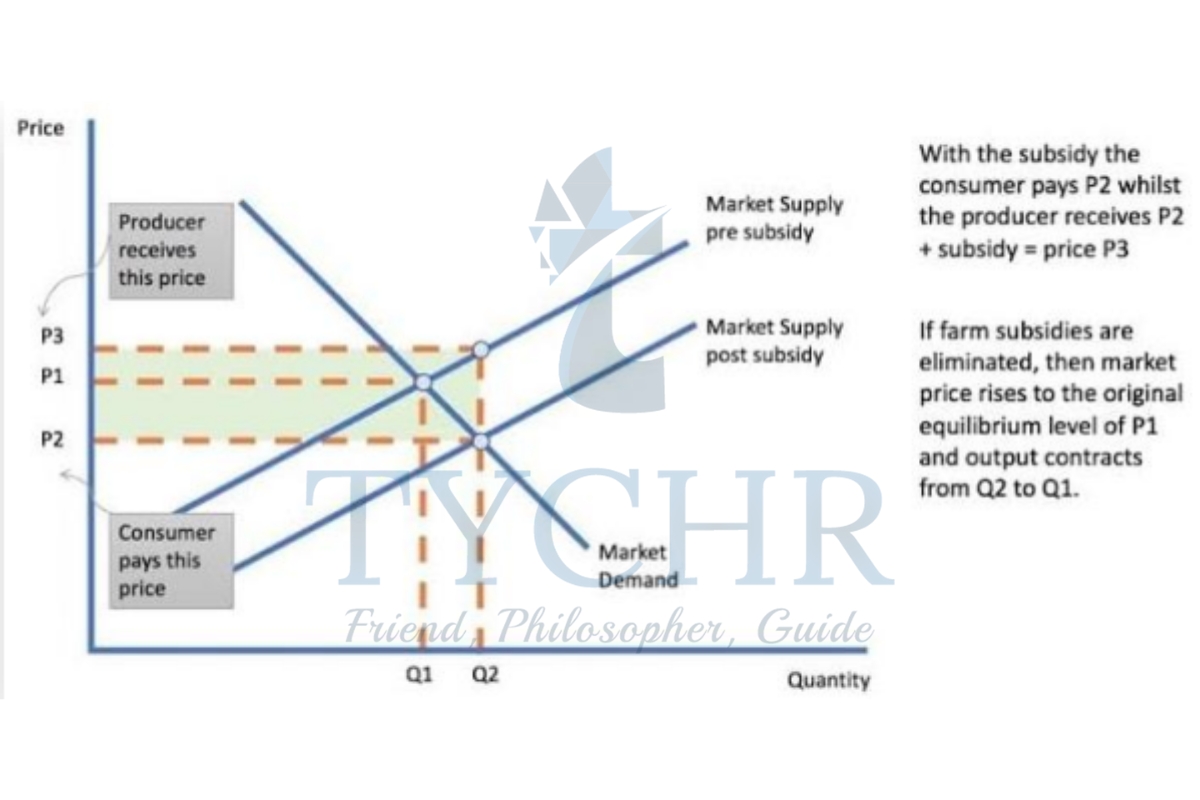

Price received by producer and price paid by consumer after subsidy:

Illustrating consumer and producer surplus:

The granting of a subsidy results in greater consumer and producer surplus, however, society loses due to government spending on the subsidy.

Since the loss from government spending is greater than the gain in consumer and producer surplus, welfare loss results, reflecting allocative inefficiency, which in this case is due to overallocation of resources. This is also illustrated by MB<MC. Too much of the good is being produced and consumed, relative to the social optimum.

Price Control

It is the setting of maximum/minimum prices by the government so prices can’t adjust to equilibrium. Disequilibrium results in either excess supply or excess demand.

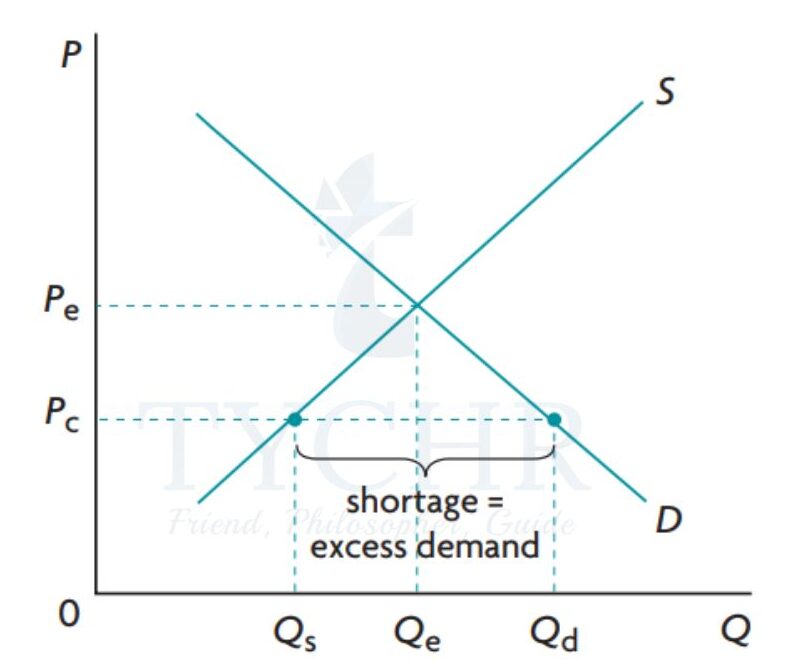

Price Ceilings:

- A Price ceiling is a maximum legal price for a good. It needs to be set below the

equilibrium price for it to work. - The businesses supply Qs at the Pc, but there is a demand for Qd.

- The market cannot clear. There is a shortage (excess demand) of Qd-Qs.

Consequences for the Economy

Rationing

It is a method for distributing something among users. In a free market, the price system helps by letting people who are willing and able to pay get what they want.

The price mechanism cannot assist with rationing because there is a shortage.

Non- price Rationing: –

The methods used to distribute the quantity among all the buyers.

- “First come first serve”

- distribution of coupons

- favoritism

Underground (parallel) markets: –

They involve buying and selling that are unrecorded and usually illegal. They involve buying a good at the legal price and selling it at the equilibrium price.

Underallocation of resources: –

Qs is lower when the price is lower than the equilibrium. The quantity of resources used to produce this product is insufficient. Society is in worse shape.

Negative welfare impacts

- Consumer surplus is the

- region of (a+b)

- Producer surplus is the region of (c+d+e)

- When there is allocative

- efficiency MB=MC, CS and Ps is maximum (a+b+c+d+e).

- If the price ceiling Pc is imposed, we move from Qe to Qs, CS is now (a+c) and PS is (e).

- The social surplus now is the region of (a+c+e).

- The shaded section, (b + d) is welfare (deadweight) loss. These benefits are lost due to misallocation.

- We can see that MB>MC at Qs. The benefit of an extra good purchase is greater than the cost of producing it.

Consequences on Stakeholders

Consumers gain and lose.

- Consumers gain area c, but lose region b. Consumers that can buy it are better off.

Producers are worse- off

- Makers can sell a more modest amount and have a misfortune in income.

The Government is not affected

- The economy is unaffected, but the government may gain popularity.

Workers are worse-off

- To produce less output, fewer workers are required. This could result in unemployment.

Rent Controls

It limits the maximum rent on housing so low income earners can get housing.

- Housing is now more affordable.

- There is a shortage of housing.

- There is a smaller quantity of housing.

- There are long waiting lists for people to get a house/apartment.

- Underground markets may appear.

- Poor house maintenance because of unprofitability.

Food Price Controls

- It can be used to make food more affordable when the price of goods rises.

- Lower food prices.

- Food shortages.

- Non-price rationing.

- Underground markets.

- Falling farmer incomes and unemployment.

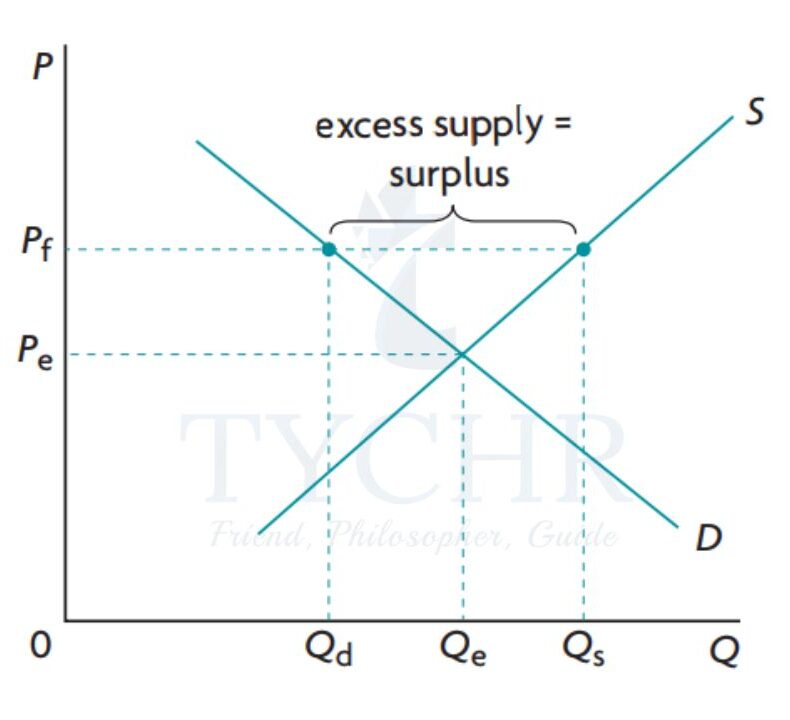

Price Floors

- A price floor is a legally set minimum price set by the government. It needs to be above the equilibrium price for it to be effective.

- At the price floor Pf, firms supply Qs, but the demand is at Qd. The market cannot clear. There is a surplus of Qs-Qd.

- The Government imposes price floors to:

- Provide income support for farmers.

- Protect low-wage workers.

Price Floors (Agricultural)

- Farmer’s incomes are usually unstable because of low elasticities.

- In order to push agricultural products above the equilibrium price, governments employ price supports known as floor prices.

- Because markets are unable to clear, this results in surplus. Typically, the government purchases excess supply to maintain the floor.

Agricultural Price Floor Consequences

- There is an excess supply (surplus) of Qs-Qd.

- Government needs to decide what to do with the surplus.

- Store it – additional costs are .

- Export it – a subsidy is required as the price floor increases.

- Send as aid; create additional difficulties for the nations that are supposed to benefit from it..

- Inefficient production because they are protected by the price floor and have no incentive to use effective production methods.

- Overallocation of resources to produce goods. Society is getting too much!

- Negative welfare impacts.

- At equilibrium, CS is (a+b+c); PS is (d+e).

- After a price floor is imposed, CS falls to (a), and PS becomes (d+e+b+c+f).

- The government needs to pay Pf X (Qs-Qd) to buy the excess.

Consequences on the Stakeholders

Consumers lose.

- Consumers must pay more and receive less.

Producers gain.

- Producers increase revenue from Pe X Qe to Pf X Qs.

Producers are also protected and don’t have to be as efficient.

The Government loses.

- The Government has the burden of buying the entire surplus.

Workers Gain.

Employment increases

Stakeholders in other countries.

- Farmers are supported by price floors in developed nations. After that, the surplus is exported, lowering the overall cost. In order to compete, these countries without price floors will need to lower their prices, prompting the farmers there to reduce production.

Minimum Wages

- Determines minimum price of labour an employer must pay. Similar to the effect of a price floor, the market does not clear if one is imposed.

- There is a surplus of labour (or unemployment).

- Illegal workers – Workers may be paid less than the minimum wage. Generally includes unlawful foreigners.

Misallocation – Production costs will rise for businesses that employ unskilled workers, resulting in lower output.

Consequences on Stakeholders

Firms lose.

- Firms now have a higher cost of production.

It depends on workers.

- some get a higher wage . Others lose their jobs.

Consumers lose.

- Supply will decrease if there is an increase in labor costs.