Demand-Side And Supply-Side Policies Notes

Demand-side and Supply-side Policies

Introduction to demand-side policies

GOALS OF DEMAND-SIDE PRINCIPLES

- In order to achieve price stability, full employment, and economic expansion, demand-side policies concentrate on modifying AD (shifting the AD curve). It is based on the idea that actions that affect AD and create gaps between inflation and recession cause short-term fluctuations in real GDP.

- Request side strategies attempt to carry Promotion to expected Gross domestic product and can likewise add to potential Gross domestic product increments.

- Because the policy is at the government’s discretion, government intervention in the economy to influence AD is referred to as discretionary policy. Two kinds: monetary policy and fiscal policy) Automatic stabilizers, which reduce the size of economic fluctuations, have an impact on AD; These are not optional.

- Stabilization policies are approaches to fiscal and monetary policy that aim to lessen short-term fluctuations.

Fiscal policy

THE GOVERNMENT BUDGET

- Sources of government revenue:

- Taxes

- Sales of goods and services

- Sales of government-owned property (privatization)

- Types of government expenditure:

- Current expenditures

- includes spending by the government on consumables and everyday recurring items. Wages, salaries for government employees, school supplies, and so on are examples.

- Capital expenditures

- includes public investments and physical capital production

- Transfer payments

- GDP measurement does not include transfer payments.

- Example: Unemployment benefits, children allowances, etc.

- Current expenditures

- Government budget – type of plan of a country’s tax revenues and expenditures.

- Balanced budget – tax revenues = government expenditures

- Budget deficit – tax revenues < government expenditures

- Budget surplus – tax revenues > government expenditures

- When there is a deficit, the government borrows money to cover overspending.

- The term “public debt” or “government debt” refers to the deficit accumulation by the government.

- Take note that because they are one-time sources of revenue, revenues from the sale of g/s and government-owned enterprises are not included in the budget; The government cannot continue to sell businesses to pay off its debt.

- A debt that has accrued over a period of deficits can be paid off with proceeds from the sale of state-owned businesses. Due to the lower interest rates on previous loans, those funds can be used for other expenses.

ROLE OF FISCAL POLICY

A discretionary policy known as fiscal policy refers to changes made by the government to taxes and expenditures in order to influence AD. Fiscal policy has the ability to influence the level of government spending, consumption spending (which is funded by taxes), and investment spending, which are the four components of AD (C, I, G, and X-M).

EXPANSIONARY FISCAL POLICY

Fiscal policy that aims to close a recessionary gap by increasing aggregate demand is called expansionary fiscal policy.

- Expansionary fiscal policy can comprise: increasing government spending, lowering individual and corporate income taxes, or a combination of the two.

- AD rises directly as government spending increases.

- Consumption will rise in tandem with an increase in AD as a result of tax reductions.

- Reduced business taxes boost profits, which in turn boost investment spending and AD.

- A surplus will turn into a deficit if the government increases spending and reduces taxes.

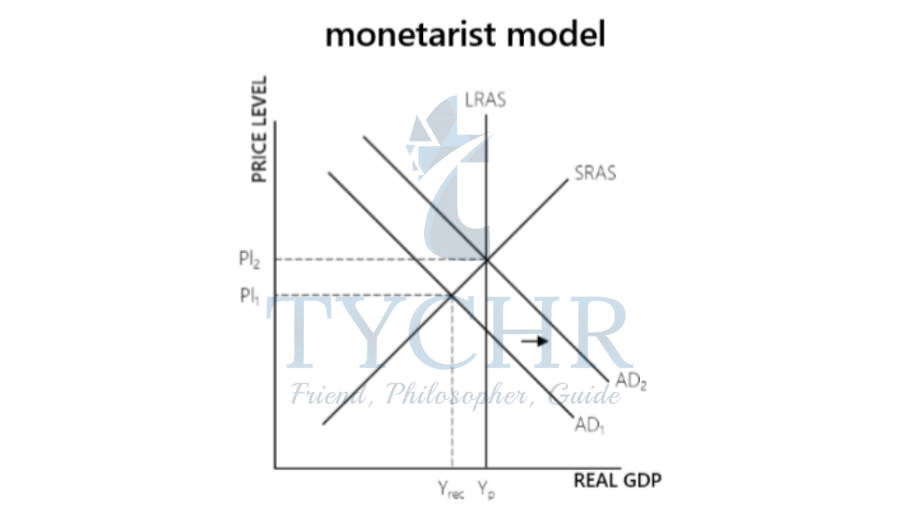

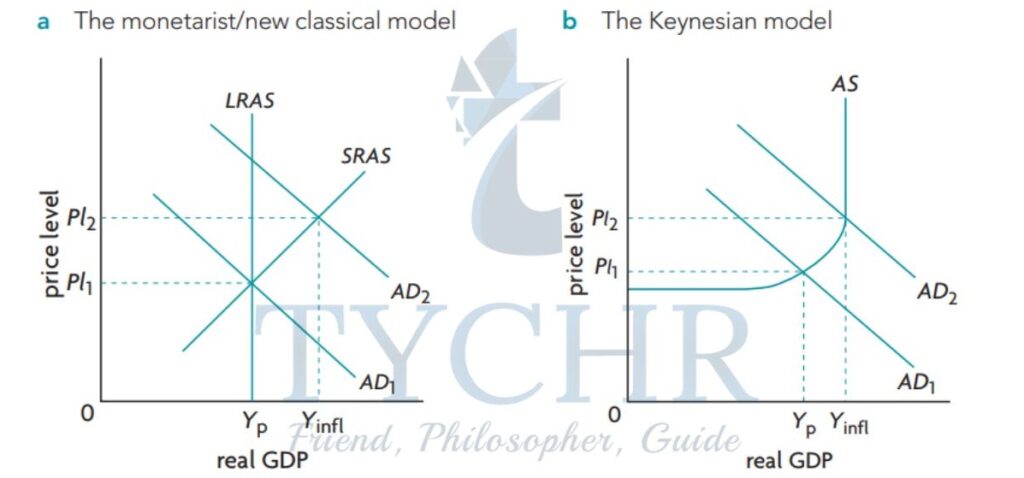

- While both Keynesian and monetarist models indicate that an increase in AD will result in an increase in real GDP, the magnitude of this increase will differ. Due to an increase in price level and an upwardly sloping SRAS curve, the monetarist model’s GDP increase will typically be smaller.

CONTRACTIONARY FISCAL POLICY

- Fiscal policy that aims to reduce AD in order to close an inflationary gap is called contractionary fiscal policy.

comprised of:- reducing spending by the government, raising personal income taxes, raising business income taxes, or a combination of the two

- Government spending decreases directly decreases AD.

- Increases in tax will decrease consumption and decrease AD.

- It’s possible that the government will turn a deficit into a surplus by cutting spending and raising taxes.

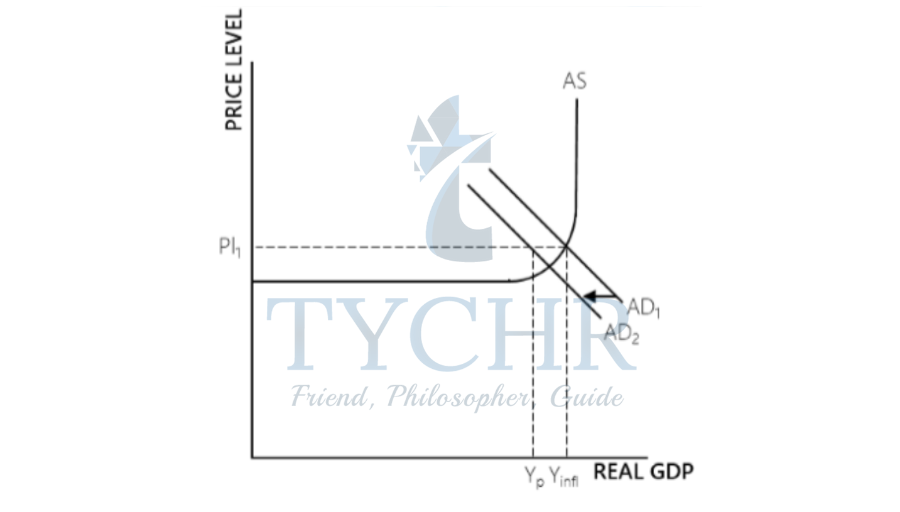

Depending on the model, the AD decrease may have different effects. - In the Keynesian model, if AD falls in the part of the AS curve that slopes downward, the effects on real GDP and price level are the same.

- The price level fall will be smaller, but the real GDP decrease will be greater, if AD falls into the horizontal part of the curve.

- In the Keynesian model, the price level can increase with AD, but doesn’t fall easily with AD.

- Ratchet effect – price level moves up when there’s an increase in AD and remains at that level until a further increase in AD.

MULTIPLIER AND FISCAL POLICY

AUTOMATIC STABILIZERS

- Factors that automatically work to stabilize the economy by reducing business cycle fluctuations are known as automatic stabilizers. There are two significant varieties: income taxes and unemployment benefits that are progressive.

- Income tax increases: As real GDP and income rise, tax revenues rise, reducing disposable income, which hinders growth. As disposable income rises during a recession, the severity of the recession decreases. The stabilizing effect is greater when an income tax system is more progressive.

- Benefits for the unemployed: Benefits rise and are made available to more workers as unemployment rises and real GDP decreases. AD will decrease as a result of these workers spending less without benefits. Benefits decrease during expansion, resulting in slower consumption growth.

- The economy cannot be stabilized and gaps eliminated solely by automatic stabilizers. They can only make fluctuations less severe.

IMPACT ON POTENTIAL OUTPUT

- While short-term stabilization is the primary goal of fiscal policy, it can have an impact on potential GDP growth in the long run.

- Side effects: Stabilization of the economy has the potential to create a macroeconomic environment that fosters growth-influencing activities. If the economy is stable, businesses can plan more effectively.

- Effects directly: Fiscal policies can decide how much money the government spends on various types of capital.

EVALUATION: FISCAL POLICY

Strengths

- Pulling economy out of deep recession

- Dealing with rapid and escalating inflation

- The rapid price level increases can be controlled with contractionary fiscal policy.

- Ability to target sectors of the economy

- can alter the priorities for government spending, including infrastructure, health care, education, and other areas.

- Direct impact of government spending on AD

- Government spending changes directly impact AD (taxes, not so much).

- Ability to affect potential output

- Affects output indirectly and directly (see above).

Weakness

- Time lag (number of delays in timing)

There is a lag until the problem (gap) is recognized. There is a lag until the appropriate policy is decided upon. There is a lag until the policy takes effect. By the time the policy takes effect, the problem may have changed. - Political constraints

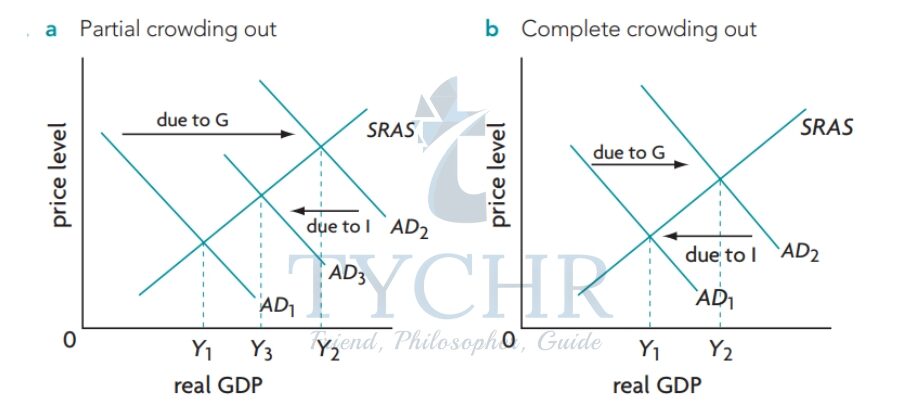

If a contractionary policy is required, some spending cannot be reduced, such as on merit-based goods. Unfavorable policies may be implemented because tax reductions are popular and tax increases are not. - Crowding out

The government will have to borrow money (deficit spending) if it increases spending without increasing revenue. Both the interest rate and the demand for money go up as a result. A higher interest rate reduces spending on private investments, which weakens fiscal policy.- Partial crowding out: where the investment spending decrease is less than government spending increases

- Complete crowding out: where the fall in I is equal to the increase in G.

- Controversial and some Keynesians believe that the government spending can

improve expectations and raise output during a recession.

- Controversial and some Keynesians believe that the government spending can

- Inability to deal with supply-side causes of instability.

- Fiscal policy cannot deal with stagflation, as inflation needs a Contractionary policy

but the recession requires an expansionary policy

- Fiscal policy cannot deal with stagflation, as inflation needs a Contractionary policy

- Tax cuts may not be effective

- In a recession, part of the increase in after-tax income is saved. Government

spending increases can be more powerful.

- In a recession, part of the increase in after-tax income is saved. Government

- Inability to fine tune the economy

- Fiscal policy can’t reach a precise target with respect to output level, employment,

and price level. Many factors affect AD simultaneously so the government can’t

control it all.

- Fiscal policy can’t reach a precise target with respect to output level, employment,

Monetary policy

CENTRAL BANKS AND INTEREST RATES

- Each nation’s central bank is in charge of monetary policy.

- Financial institutions that hold deposits, make loans, transfer funds via check, and purchase government bonds are known as commercial banks.

- The government’s financial institution with a variety of responsibilities is the central bank.

- Every country has a central bank. In the Eurozone countries, the responsibility of monetary policy is given to the European Central Bank.

- In some countries, the central bank works independently without any government interference.

- Monetary policy impacts AD indirectly through the rate of interest.

- Borrowing money: payment for the loan (interest) and a principal. Different rates of interest depending on: risk of loan, period of time over which loan must be paid (maturity), size of the loan, degree of monopoly power, etc.

The duties of the central bank include:

- Banker to the government: the bank manages the government’s borrowing, writes checks, receives payments, and holds the government’s cash.

- Banker to commercial banks: The bank can hold deposits on behalf of commercial banks and serves as a banker to them.

- Commercial banks are regulated by the central bank, which makes sure that commercial banks follow the rules.

- Conduct monetary policy: The central bank is in charge of monetary policy in response to changes in interest rates or the money supply.

- Anything that can be used to pay for goods and services, including accounts for checking and currency.

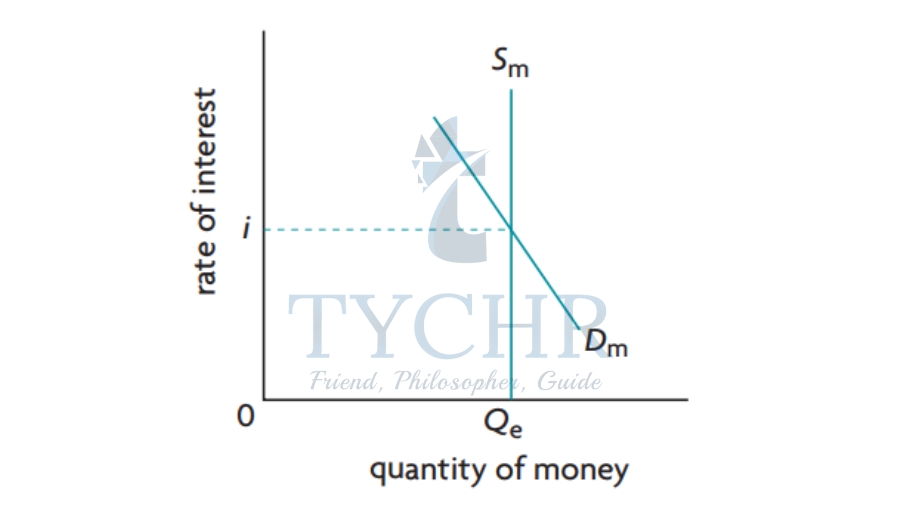

Market of money: The quantity of money is shown on the horizontal axis, and the interest rate is shown on the vertical axis. - The “price” of money is the interest rate. The level of the money supply, which is fixed, is set by the central bank.

- Typically, it is a straight line.

- The equilibrium interest rate (i) is the point where demand and supply meet.

- The rate of interest falls when there is more money available, and vice versa.

- The money supply or the interest rate can be controlled by the central bank. They usually focus on the interest rate because the money supply is harder to control.

- A central bank will reduce the amount of money available if they want to raise the interest rate. Because of this, the market can set interest rates.

- The desired interest rate varies by nation: Base rate for the UK, federal funds rate for the US, and minimum refinancing rate for the Eurozone

- Base Rate: Rate at which Bank of England lends to commercial banks Federal Funds Rate: Rate used by commercial banks to borrow and lend (both to and fro) over a 24 hour period.

- Minimum Refinancing Rate: Interest paid by commercial banks when they borrow from the central bank to refinance their accounts.

- Central banks influence the supply of money.

- Open market operations when commercial banks receive deposits from customers they do not keep all their money within their vaults. The funds they must legally keep are called required reserves, determined by required reserve ratio and the excess money over this reserve can be lent out by banks.

- Excess reserves means more loans means more money creation.

ROLE OF MONETARY POLICY

- The ultimate objective is to alter AD through interest rate changes. The following aspects of AD are affected: C is consumption, and I is investment.

- AD will decrease as borrowing decreases and spending decreases if interest rates rise.

TYPES OF MONETARY POLICY

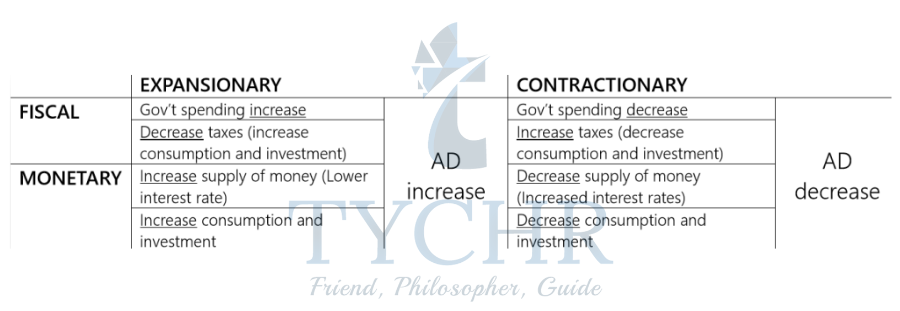

The policy of increasing the money supply in order to expand AD is known as easy (expansionary) monetary policy.

AD will rise as a result of consumers and businesses being more likely to consume and invest as a result of an increase in the money supply.

The policy that reduces the money supply to lower AD is referred to as tight (contractionary) monetary policy.

Interest rates rise as a result of a decrease in the money supply, which reduces AD because consumers and businesses consume less and invest less.

COMPARISONS

Monetary policy is carried out by the central bank, which aims at changing interest rates to influence the T and C components of aggregate demand. In a recessionary gap, the central bank may pursue an expansionary (easy monetary) policy through lower Interest rates to encourage T and C spending, the objective being to shift the AD curve to the right leading to equilibrium at the full employment level of real GDP (potential GDP). In an inflationary gap, the central bank can pursue a contractionary (tight monetary) policy through higher interest rates aimed at discouraging T and C spending, causing the AD curve to shift to the eft leading to equilibrium at the full employment level of real GDP (potential GDP).

INFLATION TARGETING

- Recently, a number of central banks have tried monetary policy that keeps a certain rate of inflation the same.

- The term “inflation targeting” refers to monetary policy that focuses on achieving a specific inflation target.

- The target is typically between 1.5 and 2.5 percent, with a tolerance margin of one percentage point.

- The inflation target is calculated in terms of the Consumer Price Index (CPI), but it is typically determined by forecasts of future inflation.

Strengths

- Lower and more stable rate of inflation

- Improved ability to anticipate future rate of inflation

- Coordination between monetary and fiscal policy

- Inflation targets allow governments to plan fiscal policy to work with monetary policy

- Greater transparency and accountability

- Central bank becomes more open to the public

Weakness

- Reduced ability to pursue other objectives

- If bank focuses only on inflation, it can’t pursue other goals like real GDP stability or full employment levels

- Reduced ability to respond to supply-side shocks

- If a supply-side shock leads to stagflation, the central bank may need expansionary monetary policy, but it could cause inflation

- Reduced ability to deal with unexpected events

- Finding an appropriate inflation target

Too low: unemployment, too high: problems regarding unemployment - Difficulties of implementation

Forecasts can be unreliable

EVALUATION: MONETARY POLICY

Strengths

- Implementation is relatively quick and does not go through the political process

The independence of the central bank from the government lets them make decisions that are unpopular politically - There are no political constraint

- There is no crowding out

- You can incrementally adjust interest rates

Weakness

- Time lags

There is still a lag until the problem is recognized and a lag until the policy takes effect - Possible ineffectiveness in recession

During a recession, banks may not want to increase their lending because borrowers might not be able to pay back. - Conflict between government objectives

- Inability to deal with stagflation

Supply-side policies

SUPPLY-SIDE OBJECTIVES

- Supply-side policies focus on the economy’s supply and production sides, particularly on reversing the LRAS or Keynesian AS curve.

- These policies increase the quantity and quality of production factors rather than focusing on reducing the severity of the business cycle.

- Two kinds:

- Keynesian economists support interventionist policies, which rely on the intervention of the government.

- Policies based on the market emphasize the significance of competitive markets.

INTERVENTIONIST SUPPLY-SIDE POLICIES

- These policies assume that the government must intervene because the free market cannot produce more potential output.

- Training and education as investments in human capital: better training and education can raise productivity by enhancing the quality of labor resources. Positive externalities of education justify intervention. Some measures are: training, assisting youth with grants, and other such activities.

- Healthier workers are more productive and can contribute to an increase in the economy’s potential output if health care services and access are improved. Additionally, health care has positive externalities.

Investing in human capital raises AD in the short term and potential output in the long term. - Capital goods that are new or improved as a result of investments in research and development for new technologies can increase output.

- It has good effects on other people. Patent protection or tax breaks can be provided by governments.

- investment in infrastructure A well-designed infrastructure can cut down on time and effort. Transport costs and travel times can be reduced by having good roads.

- Government policies that encourage the expansion of the industrial sector are known as industrial policies. Investing in human capital, technology, and infrastructure are examples of these policies.

- Assistance for SMBs (Small and Medium-Sized Enterprises): Small and medium-sized businesses may be eligible for low-interest loans, grants, and tax breaks from the government. This is beneficial to the private sector.

- Assistance for emerging industries: In developing nations, infant industries are industries that are just beginning to develop.

MARKET-BASED SUPPLY-SIDE POLICIES

- Real GDP, in this view, tends to be in equilibrium over the long term, so the government doesn’t have to worry as much about stabilization as it does about creating conditions that allow market forces to work well.

- There are three main types:

- Encouraging competition

- Labor market reforms

- Incentive-related policies

- Competition promotion: Companies are forced to cut costs as a result of competition, which improves efficiency, resource allocation, and possibly quality. As a result, resources that could be used more effectively are utilized.

- A company’s ownership is transferred from the public to the private sector through privatization. Because of improved management, this may result in increased efficiency. Because of high costs, inefficient employees, and other processes, government businesses frequently fail.

- Deregulation is the reduction or elimination of government oversight of private sector endeavors. Regulated by the government, growth is slowed and efficiency is increased.

- Economic regulation is the government’s control of outputs and prices to protect them from competition. Companies can enter monopolistic industries as a result of deregulation to force competition.

- Consumer protection from undesirable effects (some with negative externalities) is the goal of social regulation. Public safety is actually bolstering this, but some argue that it is inefficient and expensive.

- Private financing of public sector projects: companies in the private sector will compete with one another to take on projects for the public sector.

- outsourcing or contracting out – public services are provided by private companies under contract.

- Trade liberalization: Trade barriers have been reduced, allowing for more open international trade.

- This has led to a reduction in the power of monopolies and an increase in competition.

- Reforms to the workforce: increasing the flexibility of the labor market and reducing its rigidities, which results in labor markets becoming more competitive, wages responding to supply and demand, and lower labor costs.

- Eliminating minimum wage laws can help reduce unemployment by lowering the equilibrium wage. Flexibility can lead to more investment and expansion.

- Reducing job security – This makes it easier and cheaper for businesses to lay off workers, which can increase profits. Weakening the power of labor and trade unions – Unionized labor groups typically succeed in obtaining wage increases.

- Reducing unemployment benefits – Unemployment benefits can reduce the incentive for looking for a new job.

- Policies related to incentives: This involves lowering a variety of taxes, including personal income taxes. In addition to lowering taxes as part of fiscal policy, tax cuts can raise after-tax incomes, which encourages people to work more and makes more people looking for work; these may cause the LRAS curve to move outward.

- lowering taxes on interest income and capital gains—the capital gains tax is a tax on financial investment profits. People will be more motivated to save if this is cut down, which will make more money available for investment.

- lowering business taxes: lowering business taxes not only raises AD, but it also raises profits after taxes that can be invested.

EVALUATION: SUPPLY-SIDE POLICIES

- Time lags These policies work after time lags because all policies need time to work.

- Favoring Interventionist

- The market is unlikely to provide investment, R&D, training, education, and other types of support.

The government can target industries for growth with interventionist policies.

- The market is unlikely to provide investment, R&D, training, education, and other types of support.

- Favoring Market-based

- Inefficiency and misallocation may result from government intervention.

- Political pressure may make government intervention less effective and ultimately lead to government failure.

- Spending is required for government intervention, which comes with opportunity costs.

- Debate over incentive-related policies

- There are effects on both the supply and demand sides of ax cuts. However, people may work fewer hours and have more free time as their disposable income rises.

- Creating employment

- By lowering the natural rate of unemployment, supply-side policies can create employment.

Increased training and skills can help with structural unemployment, and information that reduces frictional or seasonal unemployment is provided by interventionist policies, which reduce unemployment. - By making the labor market more responsive to supply and demand, market-based policies have the potential to reduce unemployment.

Unemployment can rise as a result of market-based policies that encourage competition. Employees may be let go by privatized businesses in an effort to cut costs and improve efficiency. However, these may only be a temporary increase until the benefits become more substantial.

- By lowering the natural rate of unemployment, supply-side policies can create employment.

- Reduce inflationary pressure

- Supply-side policies can shift the LRAS curve to the right, so it can reduce inflationary pressure when an AD increase is matched by a LRAS increase.

- Gov’t budget impact

- The government budget is negatively impacted by interventionist and incentive-based policies.

- Interventionist: based on government spending

- Incentive-related: tax cuts

- The government budget is negatively impacted by interventionist and incentive-based policies.

- Equity

- Interventionist with mixed effects (human capital): more favorable, particularly if dispersed, as a result of increased productivity. Inequality can be reduced by interventionist policies that naturally reduce unemployment.

- Market-based: generally negative due to the possibility of unemployment caused by competition.

Incentive-related: could make the income distribution worse Privatization: Prices can be pushed up by private businesses with more market power, which hurts the poor.

Environment effects

- Because private companies’ methods may have negative externalities, market-based policies that increase competition may harm the environment. can be restricted by the government.

Evaluating government strategies to combat inflation and unemployment

UNEMPLOYMENT POLICIES – CYCLICAL UNEMPLOYMENT

- cyclical unemployment brought on by falling or low AD. The unemployment rate can be reduced and the recessionary gap narrowed by expansionary policies.

- Time lags, political constraints, crowding, ineffective tax cuts as spending, and the inability to fine-tune all contribute to the recession’s severity. If automatic stabilizers were present, the recession would not have been as severe.

- monetary policy that is expansive and quickly implemented; incremental change without restrictions; independence, absence of crowding, delays, ineffectiveness during a severe recession, and conflict between government goals

UNEMPLOYMENT POLICIES – NATURAL UNEMPLOYMENT

- The most serious form of natural unemployment is structural unemployment.

Typically, supply-side policies can address this. - Fiscal and monetary policy can be ineffective.

- Consider the economy at its potential output level, with unemployment equal to the natural rate. The natural rate will temporarily fall as a result of an increase in AD, but inflation will occur. The natural rate will return to its original level as a result of the reduction in AD to combat inflation.

- However, there are some supply-side effects of fiscal policy.

- Interventionist supply-side policies Retraining programs Grants and low-interest loans for retraining Direct government hiring and training Subsidies to companies hiring structurally unemployed workers Subsidies/grants for relocation Methods to reduce frictional unemployment attempt to improve information flow so that job seekers spend less time looking for work.

- The spread of more information to workers about other jobs that are available outside of peak times is one way to cut seasonal unemployment. This has a positive effect on job creation but a negative effect on the government budget.

- Supply-side policies based on the market increase the flexibility of the labor market, which can lower unemployment. A lower minimum wage can also lower unemployment. Weaker labor unions reduce the pressure and make it easier to hire. A lower job security makes it easier for businesses to hire. Can reduce unemployment without affecting the budget, but it increases income inequality and reduces protections for low-income workers.

INFLATION POLICIES: DEMAND-PULL

- The inflationary gap is caused by demand-pull inflation brought on by an increase in AD. Contractionary arrangements can diminish Promotion to take the economy back to likely result.

- Time lags, political constraints, and the inability to fine-tune the economy are all factors that contribute to a contractionary fiscal policy’s ability to deal with rapid inflation. Contractionary monetary policy’s quick implementation and independence are also factors. supply-side policies cannot be utilized because demand-pull inflation has demand-side causes and a lag, and supply-side policies have a conflict with objectives. However, over extended periods, these policies can shift the LRAS curve to the right and reduce inflation.

INFLATION POLICIES: COST-PUSH

- The SRAS curve shifts to the left as a result of cost-push inflation brought on by an increase in production costs or supply-side shocks (higher price level, lower output, and rise in unemployment).

- There is no universal solution to the issue, and demand-side policies are inappropriate.

- Contractionary monetary policy is used by some governments to lower AD, but it will lead to recession.

Usually, the cause is the basis for the policy. If a wage increase is the cause of inflation, efforts may be made to reverse the increase. - The solution is more difficult to find if the inflation is brought on by an increase in the cost of imported inputs. In the case of oil, nations attempted to use alternative forms of energy to reduce demand.

- Policies that encourage competition or break monopolistic powers can be used if firms with monopolistic powers raise prices and cause inflation.

- Policies designed to reduce a nation’s reliance may be implemented in the event of inflation.

INFLATION POLICIES: INFLATION TARGETING

- A type of monetary policy known as inflation targeting does not take into account the type of inflation and instead maintains it at a predetermined rate.

- It is successful in keeping inflation rates low and stable, but it loses the ability to pursue other goals.

.