IB Economics HL Paper 2 Question Bank

Check Out Our Results

OXFORD UNIVERSITY

(QS:3)

IMPERIAL COLLEGE

(QS:6)

CORNELL UNIVERSITY (QS:16)

45/45 (IBDP)

GEORGIA INSTITUTE

43/45 (IBDP)

KELLY SCHOOL

Our IB Economics HL Paper 2 Question Bank is an incredible resource for students preparing for the IB Economics exam. The Question Bank is full of high-quality, properly formatted questions that cover all aspects of the IB Economics syllabus. The questions are clearly laid out and easy to understand, and the answer key provides detailed explanations for each question. This is an essential tool for any student who wants to do well on the IB Economics exam.

Economics Higher Level Paper 2

1 hour and 45 minutes

Instructions to candidates

- Do not open this paper until instructed to do so.

- You are permitted access to a calculator for this paper.

- Unless otherwise stated in the question, all numerical answers must be given exactly or correct to two decimal places.

- You must show all your workings.

- Answer one question.

- Use fully labelled diagrams and references to the text/data where appropriate.

- The maximum mark for this examination paper is [40 marks].

1.) Read the extracts and answer the questions that follow.

Case study reference: https://www.azernews.az/business/155766.html

Text A: A sharp increase in subsidies in Azerbaijan to contribute to agriculture production growth

Incredible work has been done in Azerbaijan to improve the business environment and support entrepreneurship, Chairman of the Azerbaijan Pomegranate Manufacturers and Exporters Association Farhad Garashov told Trend. He made the remarks as part of the video project entitled “PREZIDENT. Musteqillik. Tehlukesizlik. Rifah”.

The geography of export of Azerbaijani non-oil products is expanding, and trading houses are opening in foreign countries, he said.As a result, the flow of currency into Azerbaijan increased, entrepreneurs made big profits, and thanks to the efforts of Azerbaijani President Ilham Aliyev, a favorable business environment has been created in the country, the state provides special benefits in this area, long-term loans are granted to farmers.

Garashov added that entrepreneurs shouldn’t depend only on state support.“We ourselves must be aware of our responsibility,” he said. “The Association supports the fulfillment of the requirements set by the president before state bodies in order to solve all problems of entrepreneurs, as well as steps taken to improve the business environment. Members of the Association present a single pavilion under the brand ‘Made in Azerbaijan’ at the biggest exhibitions of the world. Naturally, we set ourselves the goal of using all the conditions created for us.”

Garashov noted that the quality of products in Azerbaijan is growing from year to year. In his opinion, a sharp increase in the amount of subsidies for agriculture producers will contribute to the growth of agriculture production. “All this is related to the policy of President Ilham Aliyev,” he said. “Each of us expresses gratitude to the head of state for the conditions created for the entrepreneurs.”

Text B: Economic Reforms in Azerbaijan

A reform that Azerbaijan implemented to boost its economy was the introduction of the “ASAN Service” in 2012. The ASAN Service is a one-stop-shop public service model aimed at simplifying and streamlining the delivery of various government services to citizens and businesses.

Prior to the ASAN Service, obtaining government services in Azerbaijan was a lengthy and bureaucratic process, often requiring multiple visits to different government agencies and lengthy paperwork. This deterred many businesses and investors from investing in Azerbaijan and hindered the growth of the economy.

The ASAN Service addressed this issue by consolidating the delivery of public services into a single location. Citizens and businesses can visit an ASAN Service center and receive various services such as issuing ID cards, passports, driver’s licenses, business registration, tax filings, and more. The centers are equipped with advanced technology, including biometric identification systems, to facilitate a faster and more efficient service delivery.

The introduction of the ASAN Service has had a significant positive impact on Azerbaijan’s economy. It has simplified the process of obtaining government services and reduced bureaucracy, thereby making it easier to do business in Azerbaijan. This has led to an increase in foreign investment and a boost in the country’s overall economic growth.

Furthermore, the ASAN Service has improved the quality and transparency of public services in Azerbaijan, leading to higher levels of trust and satisfaction among citizens and businesses. The success of the ASAN Service has also inspired other countries to adopt similar models for public service delivery, further enhancing Azerbaijan’s reputation as an innovative and forward-thinking nation.

Text C: Trade relations between Azerbaijan and Italy

Trade relations between Azerbaijan and Italy have been growing steadily in recent years, with both countries benefiting from increased trade and investment. In 2019, Italy was Azerbaijan’s third-largest trading partner, with a total trade volume of $2.6 billion.

One significant example of trade relations between Azerbaijan and Italy is the Trans Adriatic Pipeline (TAP) project. The TAP project is a 878 km natural gas pipeline that will transport natural gas from Azerbaijan’s Shah Deniz II field to Italy, via Greece and Albania. The project is a joint venture between several companies, including the Azerbaijan state oil company SOCAR, and Italian energy company Snam.

The TAP project has been hailed as a significant development in Europe’s energy security, as it will provide a new source of natural gas to the region, reducing dependence on traditional suppliers such as Russia. The project is also expected to boost trade and investment between Azerbaijan and Italy, with Italian companies involved in the construction and maintenance of the pipeline, and Italian consumers benefiting from increased access to natural gas.

In addition to the TAP project, Italy and Azerbaijan have been working to strengthen trade relations in other areas, such as agriculture and tourism. In 2018, Azerbaijan and Italy signed a memorandum of understanding on cooperation in the field of agriculture, with a focus on increasing trade in agricultural products.

1.)

a)

i.) Define the term ‘Subsidy’ [2 marks]

A subsidy is a government payment to producers attempting to lower the price of produce and increase quantity produced (encourage production). In the international trade context, the subsidy is given to domestic producers to increase their international competitiveness.

ii.) Define the term ‘ Trade Protection’ [2 marks]

Trade protectionism is a policy that protects domestic industries from unfair foreign competition. Trade protectionism involves various tools such as tariffs, subsidies, quotas, embargos and currency manipulation.

b)

i.) Define the term ‘ Trade Deficit’ [2 marks]

A trade deficit is a negative balance of trade. This means that a country’s imports surpass its exports. It includes goods and services, the current account, and the sum of balances on the current and capital accounts.

ii.) Explain the impact of this subsidy on the various stakeholders in the economy (Text A). [4 marks]

Foreign producers are negatively affected as they receive a lower revenue from reduced imports. In retaliation, the act of dumping may occur as countries start exporting their products at a price lower than their cost of production.

Moreover, the government incurs an opportunity cost as the money used to subsidize agricultural production could have been utilized to improve areas such as education, health care, infrastructure, and perhaps even the tertiary sector. Noting that Azerbaijan is a developing country, an improvement in the tertiary sector would contribute further to economic growth and development in the form of an increase in the real Gross Domestic Production and the well-being of the citizens. Moreover, due to a reduction in the government’s budget, it may impose taxes to make future expenditures, therefore making taxpayers worse off.

Other stakeholders like the consumers do not face a loss in consumer surplus as the price remains constant. Furthermore, as there is less entry of imports, consumers do not have access to a wide range of goods or services and are dissatisfied.

c) To what extent has the introduction of the ASAN Service impacted Azerbaijan’s economy (Text B)? (3 marks)

The introduction of the ASAN Service has had a significant positive impact on Azerbaijan’s economy. By simplifying and streamlining the delivery of government services, the ASAN Service has made it easier to do business in Azerbaijan, leading to an increase in foreign investment and a boost in the country’s overall economic growth. Additionally, the ASAN Service has improved the quality and transparency of public services, leading to higher levels of trust and satisfaction among citizens and businesses.

d) What factors contributed to the success of the ASAN Service in Azerbaijan and how can they be applied to other countries (Text B)? (4 marks)

The success of the ASAN Service in Azerbaijan can be attributed to several factors. Firstly, the one-stop-shop model of service delivery streamlined the process of obtaining government services, reducing bureaucracy and saving time for citizens and businesses. This simplified process made it easier for businesses to invest in Azerbaijan, leading to an increase in foreign investment and economic growth.

Secondly, the use of advanced technology such as biometric identification systems improved the efficiency and accuracy of the service delivery process, further reducing the time and resources required to obtain government services. This technology also improved the quality and transparency of public services, leading to higher levels of trust and satisfaction among citizens and businesses.

Lastly, the ASAN Service’s emphasis on customer service and satisfaction played a significant role in its success. The centers were designed to be welcoming and accessible, and the staff were trained to be knowledgeable and helpful. This customer-centric approach to service delivery helped build trust and loyalty among citizens and businesses.

e) How has the Trans Adriatic Pipeline project benefited both Azerbaijan and Italy (Text C)?(4 marks)

The Trans Adriatic Pipeline (TAP) project has benefited both Azerbaijan and Italy in several ways. Firstly, the project has enhanced energy security in Europe by providing a new source of natural gas to the region, reducing dependence on traditional suppliers such as Russia. This is particularly significant given the ongoing political tensions between Europe and Russia.

Secondly, the TAP project has boosted trade and investment between Azerbaijan and Italy. Italian companies have been involved in the construction and maintenance of the pipeline, creating job opportunities and generating revenue for Italian businesses. Furthermore, Italian consumers will benefit from increased access to natural gas, which will help to reduce energy costs and improve energy security in Italy.

For Azerbaijan, the TAP project has provided an opportunity to diversify its export markets and reduce its dependence on Russia as a natural gas customer. The project has also generated revenue for Azerbaijan’s state oil company SOCAR, which is a joint venture partner in the project.

f) How has the visa-free travel agreement between Azerbaijan and Italy impacted tourism in Azerbaijan (Text C)? (4 marks)

The visa-free travel agreement between Azerbaijan and Italy, which was signed in 2014, has had a positive impact on tourism in Azerbaijan. The agreement allows Italian citizens to travel to Azerbaijan without the need for a visa, making it easier for Italian tourists to visit the country.

Since the agreement was signed, there has been a significant increase in the number of Italian tourists visiting Azerbaijan. In 2019, the number of Italian visitors to Azerbaijan increased by 44% compared to the previous year. This growth in tourism has had several positive impacts on Azerbaijan’s economy.

Firstly, the increase in tourism has generated revenue for Azerbaijan’s tourism industry, which is an important sector for the country’s economy. This revenue is generated through spending on accommodation, food and beverage, transportation, and other tourism-related activities.

Secondly, the growth in tourism has created job opportunities in the tourism industry, which is a labour-intensive sector. This has had a positive impact on employment in Azerbaijan, particularly in the service sector. Finally, the growth in tourism has helped to promote Azerbaijan as a tourist destination and has raised the country’s profile on the international stage. This has the potential to attract further investment in the tourism industry and promote economic growth in the long term.

g) To what extent does subsidising agricultural production impact trade? [15 marks]

The subsidies are trade protection involving a government payment to domestic producers in Azerbaijan. They are intended to lower the price of produce and increase agricultural production. As the agricultural products are exported, this policy leads to an overall rise in Azerbaijan’s international competitiveness. This type of trade protection safeguards the Azerbaijan economy from foreign competition by minimizing imports. In addition, as developing countries depend on the primary sector, agricultural production is crucial to the health of the economy.

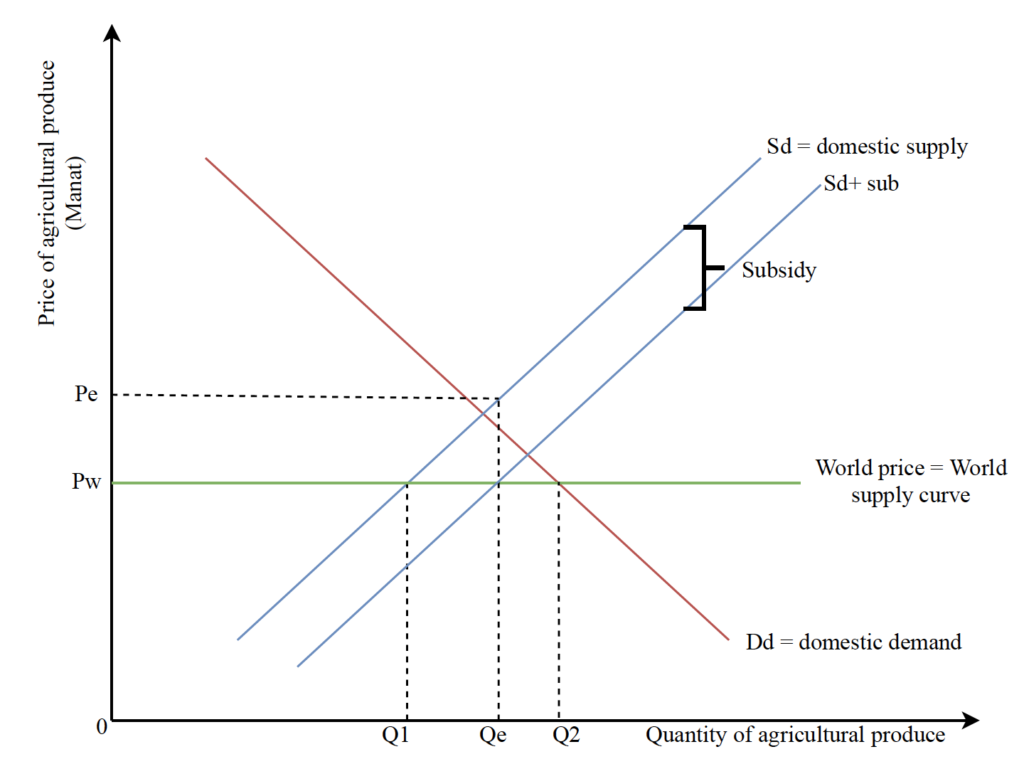

Prior to the introduction of subsidies to domestic agricultural producers, it is assumed that imports were initially high and that agricultural production took place at a slower rate. As seen in Fig.1, when trade takes place without protectionism, the equilibrium is at the intersection of the world price; a price for a good or service in all countries, with Sd at the quantity Q1 and price Pw. At this price, domestic supply is low (Q1) and the imports are high; Q2 minus Q1.

When the Azerbaijan government starts subsidizing its producers, they receive a higher effective price; Pe, providing them with the incentive to increase production from Q1 to Qe, even though the market price does not change. This results in a downward shift in the domestic supply curve by the size of the subsidy per unit, Sd+sub, indicating that there is higher domestic agricultural production as the cost of production is lowered. To meet the higher production process, demand for labour increases, leading to an overall rise in domestic employment and thus revenue. This revenue can be invested in capital to improve their agricultural production. However, these subsidies may also cause domestic producers to become lethargic, leading to inefficient agriculture production. This results in a global misallocation of resources, adversely affecting economies. In the long run, domestic employment may also negatively affect the economy as it causes a rise in inflation rates due to high costs of production from providing additional wages to labour. However, there are also long term benefits of diversification in agricultural production and exports in developing countries.

On the other hand, as the subsidy is not sufficient to change the Pw, Domestic demand (Dd) does not change either. Considering that Dd is constant and agricultural production is growing, there is a decrease in the entry of imports compared to the exports, from Q2 minus Q1 to Qe minus Q1. As there is less expenditure on imports, Azerbaijan’s current account improves. This also allows infant industries to grow in size and produce higher output and take advantage of economies of scale as it receives a lower average cost, hence enabling them to compete in the international market.

In conclusion, trade protection such as subsidies can benefit Azerbaijan’s economy but only up to a moderate extent. This form of trade protection may be considered more effective in comparison to tariffs; which are taxes on imports, as it does not lead to possible loss of living standards or have negative effects on consumption. This indicates that as price does not increase, it does not make consumers switch to cheaper but fewer goods or services causing a deterioration in the standard of living. However, consumers may also be worse off as the government subsidizes producers rather than funding socially desirable aspects. Furthermore, the government would have to raise taxes to fund the subsidy.

Download our Successful College Application Guide

Our Guide is written by counselors from Cambridge University for colleges like MIT and other Ivy League colleges.

To join our college counseling program, call at +918825012255

2.) Read the extracts and answer the questions that follow.

Text D: Economic Reforms in China

China, one of the world’s most populous countries, has undergone significant economic reforms since the late 1970s, transforming it from a centrally planned economy to a market-oriented one. These reforms have been aimed at promoting economic growth, increasing efficiency, and improving living standards. This case study will explore the economic reforms that have taken place in China, their impacts, and the challenges the country still faces.

In the 1950s, China’s government embarked on a series of economic reforms aimed at creating a socialist economy. These reforms were based on the Soviet model of central planning and state ownership of the means of production. However, by the 1970s, China’s economy was struggling due to inefficiencies and a lack of incentives for workers and businesses.

In 1978, China’s leader, Deng Xiaoping, initiated a series of economic reforms aimed at introducing market mechanisms into the economy. These reforms included the establishment of special economic zones (SEZs), the liberalization of prices, the promotion of foreign investment, and the privatization of state-owned enterprises.

The establishment of SEZs was a crucial step in China’s economic development. These zones were initially established in 1980 in four cities, including Shenzhen and Zhuhai, to attract foreign investment and promote exports. They offered tax incentives, streamlined regulations, and other benefits to investors.

The success of the SEZs led to the expansion of the program to other parts of China. By 1992, there were 14 SEZs and more than 100 other special zones, including economic and technological development zones, export processing zones, and bonded zones. These zones have played a significant role in attracting foreign investment, promoting exports, and creating jobs.

Another key reform was the liberalization of prices. In the early years of reform, prices were set by the government, leading to inefficiencies and shortages. The liberalization of prices allowed market forces to determine prices, leading to more efficient allocation of resources and increased production.

The promotion of foreign investment was another important aspect of China’s economic reforms. In the early years of reform, foreign investment was limited to joint ventures with state-owned enterprises. However, in the 1990s, China began to open up to foreign investment, allowing foreign companies to set up wholly-owned enterprises.

Foreign investment has played a significant role in China’s economic development. It has provided capital, technology, and access to foreign markets. It has also helped to create jobs and promote exports.

Privatization of state-owned enterprises was another key reform. Prior to reform, state-owned enterprises dominated the economy. These enterprises were often inefficient and unprofitable. The privatization of these enterprises allowed for greater competition, increased efficiency, and improved productivity.

Text E: The US-China Trade War

The US-China trade war has been ongoing since 2018, with both countries imposing tariffs on each other’s goods in an attempt to protect their respective economies. The conflict has had a significant impact on the global economy, with the International Monetary Fund (IMF) warning that it could cause a global recession.

One of the main drivers of the trade war has been the US trade deficit with China, which reached a record high of $419 billion in 2018. The US has accused China of unfair trade practices, including intellectual property theft and forced technology transfer. In response, the US imposed tariffs on billions of dollars’ worth of Chinese imports, with China retaliating by imposing tariffs on US goods.

The impact of the trade war has been felt across a range of industries, with both countries experiencing economic losses. US farmers, for example, have been hit hard by the tariffs, with China being a major buyer of American agricultural products. In 2018, China accounted for over 60% of US soybean exports, but this figure dropped significantly as a result of the trade war.

In addition to the economic impact, the trade war has also had political implications. The US has accused China of trying to interfere in US domestic affairs, including in the 2018 midterm elections. The two countries have also clashed over issues such as human rights and the ongoing protests in Hong Kong.

The trade war has had wider implications for the global economy, with countries such as Japan and South Korea also being affected. The uncertainty caused by the conflict has led to a slowdown in global trade, with the World Trade Organization (WTO) predicting that growth in trade volumes will be just 1.2% in 2019, down from 3% in 2018.

The ongoing nature of the trade war has led to concerns about the long-term impact on the global economy, with some experts warning that it could lead to a major recession. The IMF has warned that the conflict could shave 0.5% off global GDP by 2020, with the US and China being the hardest-hit countries.

In conclusion, the US-China trade war has had significant implications for the global economy, with both countries experiencing economic losses and the conflict having wider political implications. The impact has been felt across a range of industries, and there are concerns about the long-term impact on the global economy. It remains to be seen whether the two countries will be able to reach a resolution and put an end to the ongoing conflict.

Text F: GDP in the United States

The United States has a highly diversified economy with a wide range of industries, including services, manufacturing, agriculture, and mining. The country has a population of approximately 330 million people and is the third most populous country in the world after China and India.

The United States has a capitalist economy, characterized by private ownership of property and a market-based system of trade and exchange. The government plays a limited role in the economy, with most economic decisions being made by private individuals and businesses.

GDP Trends

The United States has experienced steady economic growth over the past several decades, with GDP increasing at an average annual rate of around 2.5% since 1980. The country has one of the highest GDPs in the world, with a total GDP of $21.44 trillion in 2019, according to the International Monetary Fund (IMF).

However, the United States has also experienced periods of economic decline, such as during the Great Recession of 2008-2009. During this time, the country’s GDP declined by 4.3% in 2009, marking the largest annual decline since 1946. The recession was triggered by a housing market crash and a financial crisis that led to widespread bank failures and a contraction in lending.

The United States has also experienced periods of rapid economic growth, such as during the late 1990s and early 2000s, when the country experienced a boom in the technology sector. During this time, GDP grew at an annual rate of around 4%, fueled by rapid advances in technology and a surge in investment in internet-based businesses.

a)

i.) Define the term ‘tariff’. (2 marks)

Tariffs are taxes imposed on imported goods by a country’s government. They increase the price of imported goods and make them less competitive compared to domestically produced goods. This can reduce the amount of imported goods and increase demand for domestic goods.

ii.) Define the term foreign investment (2 marks)

Foreign investment refers to the investment made by individuals, businesses or governments of one country in the assets or enterprises of another country. It includes investments in physical assets such as factories, machinery, and real estate, as well as investments in financial assets such as stocks and bonds. Foreign investment is an important source of capital for many countries, and can contribute to economic growth, job creation, and technology transfer.

b)

i.) Explain the significance of special economic zones (SEZs) in China’s economic development (Text D). (2 marks)

SEZs were established in China in 1980 to attract foreign investment and promote exports. These zones offered tax incentives, streamlined regulations, and other benefits to investors. The success of the SEZs led to the expansion of the program to other parts of China, which has played a significant role in attracting foreign investment, promoting exports, and creating jobs. Thus, SEZs were crucial in China’s economic development by facilitating economic growth and foreign investment.

ii.) Analyze the effects of the trade war on the Chinese economy. (3 marks)

The trade war has had negative effects on the Chinese economy, including a decline in exports, a slowdown in economic growth, and job losses in industries that are dependent on exports. The Chinese government has responded with measures to support the economy, including tax cuts and increased infrastructure spending. The trade war has also put pressure on the Chinese government to accelerate economic reforms and shift towards a more consumption-driven economy.

c) Discuss the challenges that China faces in privatizing state-owned enterprises (Text D). (4 marks)

The privatization of state-owned enterprises (SOEs) in China has faced several challenges. One of the main challenges is political resistance to privatization, as SOEs have been seen as a symbol of the state’s power and influence. Another challenge is the issue of worker displacement, which has led to social unrest and resistance to privatization. Additionally, there is a lack of expertise in managing private enterprises, and some SOEs are not attractive to potential buyers due to their inefficiencies and low profitability. Furthermore, privatization has been slow in some sectors due to national security concerns.

d) Discuss the economic reasons for the United States to impose tariffs on Chinese imports (Text E). (4 marks)

The United States imposed tariffs on Chinese imports as a way to address its trade deficit with China and to protect its domestic industries. The trade deficit with China was a significant concern for the US, as it meant that China was exporting more goods to the US than the US was exporting to China, leading to a significant outflow of money from the US. The tariffs were aimed at reducing the trade deficit by making Chinese goods more expensive in the US, thereby encouraging consumers to buy domestic products instead. Additionally, the US argued that China was engaging in unfair trade practices, such as intellectual property theft and forced technology transfer, which harmed US industries. The tariffs were therefore also aimed at protecting US industries from these practices and creating a more level playing field for trade.

e) Discuss the role of private ownership of property in the United States economy (Text F). (4 marks)

Private ownership of property is a key feature of the United States economy. It allows individuals and businesses to own and control assets such as land, buildings, and machinery, giving them the incentive to invest in and improve those assets. This creates a market-based system of trade and exchange, in which goods and services are produced and sold based on supply and demand. The government plays a limited role in the economy, allowing individuals and businesses to make most economic decisions. This has led to an emphasis on innovation, competition, and efficiency, which has helped to drive economic growth in the country.

f) Discuss the factors that have contributed to the steady economic growth of the United States since 1980 (Text F). (4 marks)

The steady economic growth of the United States since 1980 can be attributed to several factors. First, the country has a highly diversified economy, with a wide range of industries, including services, manufacturing, agriculture, and mining. This diversity has helped to insulate the economy from shocks in any one sector. Second, the country has a capitalist economy that emphasizes private ownership of property and a market-based system of trade and exchange, which has encouraged innovation and competition. Third, the country has a large and growing population, which has fueled demand for goods and services. Finally, the country has invested heavily in research and development, leading to advances in technology and increased productivity.

g) Evaluate the effectiveness of tariffs as a tool to reduce trade imbalances. (15 marks)

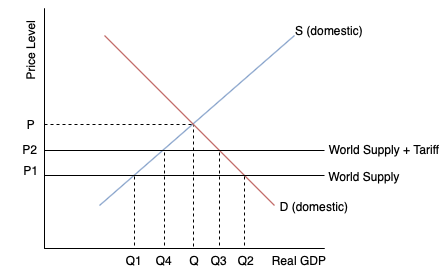

Tariffs are taxes imposed on imported goods by the government of the importing country. The primary purpose of tariffs is to increase the price of imported goods, making them less attractive to consumers and giving domestic producers a price advantage. Tariffs can be used as a tool to reduce trade imbalances, which occur when a country imports more than it exports, leading to a negative balance of trade. As seen below in figure 2, the imposition of a tariff raises the price of the imported good from P1 to P2, making it relatively more expensive compared to domestically produced goods. This can encourage consumers to purchase domestically produced goods instead of imports, which can help to reduce the trade deficit or imbalance.

One potential benefit of tariffs is that they can help to protect domestic industries from foreign competition, which can stimulate growth and create jobs. By making foreign goods more expensive, tariffs can encourage consumers to purchase domestic products, increasing demand for domestic goods and services. This can lead to increased investment in domestic industries, creating jobs and driving economic growth. Tariffs can also be used to protect key industries, such as agriculture or steel production, that are vital to a country’s national security or economic stability.

However, tariffs can also have negative consequences, particularly for consumers. By increasing the cost of imported goods, tariffs can lead to higher prices for consumers, reducing their purchasing power and potentially lowering their standard of living. Tariffs can also lead to retaliation from trading partners, who may impose their own tariffs in response, leading to a cycle of protectionism that can harm both countries involved. Additionally, tariffs can lead to reduced competition, which can lead to decreased innovation, lower quality products, and reduced efficiency.

The effectiveness of tariffs as a tool to reduce trade imbalances is highly debated among economists. Some argue that tariffs can help to protect domestic industries and reduce imports, leading to a reduction in trade deficits. Others argue that tariffs can lead to retaliation from trading partners, reducing exports and ultimately harming the domestic economy. Additionally, some argue that tariffs are not an effective tool for reducing trade imbalances, as they do not address the underlying issues that lead to imbalances, such as differences in productivity or exchange rates.

Overall, the effectiveness of tariffs as a tool to reduce trade imbalances depends on a variety of factors, including the specific circumstances of the country involved and the impact of the tariffs on both domestic and international markets. While tariffs can be effective in protecting domestic industries and reducing imports, they can also have negative consequences for consumers and lead to retaliation from trading partners. Therefore, it is important for policymakers to carefully consider the potential costs and benefits of tariffs before implementing them as a tool to reduce trade imbalances. Other measures, such as increasing productivity or addressing exchange rate differentials, may be more effective in reducing trade imbalances in the long term.