IB Economics Paper 2 Question Bank

If you’re an IB Economics student, then you know that Paper 2 can be one of the most challenging parts of the course. Luckily, there’s a Question Bank available to help you prepare for this section of the exam. The IB Economics Question Bank includes multiple questions, divided into topic areas. Each question comes with a full solution, so you can see exactly how to approach each type of question on the exam. With so many questions at your fingertips, you’re sure to find Paper 2 a breeze!

Case study reference: https://www.azernews.az/business/155766.html

Sharp increase in subsidies in Azerbaijan to contribute to agriculture production growth

Incredible work has been done in Azerbaijan to improve the business environment and support entrepreneurship, Chairman of the Azerbaijan Pomegranate Manufacturers and Exporters Association Farhad Garashov told Trend. He made the remarks as part of the video project entitled “PREZIDENT. Musteqillik. Tehlukesizlik. Rifah”.

The geography of export of Azerbaijani non-oil products is expanding, and trading houses are opening in foreign countries, he said.As a result, the flow of currency into Azerbaijan increased, entrepreneurs made big profits, and thanks to the efforts of Azerbaijani President Ilham Aliyev, a favorable business environment has been created in the country, the state provides special benefits in this area, long-term loans are granted to farmers.

Garashov added that entrepreneurs shouldn’t depend only on state support.“We ourselves must be aware of our responsibility,” he said. “The Association supports the fulfillment of the requirements set by the president before state bodies in order to solve all problems of entrepreneurs, as well as steps taken to improve the business environment. Members of the Association present a single pavilion under the brand ‘Made in Azerbaijan’ at the biggest exhibitions of the world. Naturally, we set ourselves the goal of using all the conditions created for us.”

Garashov noted that the quality of products in Azerbaijan is growing from year to year. In his opinion, a sharp increase in the amount of subsidies for agriculture producers will contribute to the growth of agriculture production. “All this is related to the policy of President Ilham Aliyev,” he said. “Each of us expresses gratitude to the head of state for the conditions created for the entrepreneurs.”

a)

(i) Define the term ‘Subsidy’ [2 marks]

A subsidy is a government payment to producers attempting to lower the price of produce and increase quantity produced (encourage production). In the international trade context, the subsidy is given to domestic producers to increase their international competitiveness.

(ii) Define the term ‘ Trade Protection’ [2 marks]

Trade protectionism is a policy that protects domestic industries from unfair foreign competition. Trade protectionism involves various tools such as tariffs, subsidies, quotas, embargos and currency manipulation.

b) Explain the impact of this subsidy on the various stakeholders in the economy. [4 marks]

Foreign producers are negatively affected as they receive a lower revenue from reduced imports. In retaliation, the act of dumping may occur as countries start exporting their products at a price lower than their cost of production.

Moreover, the government incurs an opportunity cost as the money used to subsidize agricultural production could have been utilized to improve areas such as education, health care, infrastructure, perhaps even the tertiary sector. Noting that Azerbaijan is a developing country, an improvement in the tertiary sector would contribute further to economic growth and development in the form of an increase in the real Gross Domestic Production and the well-being of the citizens. Moreover, due to a reduction in the government’s budget, it may impose taxes to make future expenditures, therefore making taxpayers worse off.

Other stakeholders like the consumers do not face a loss in consumer surplus as the price remains constant. Furthermore, as there is less entry of imports, consumers do not have access to a wide range of goods or services and are dissatisfied.

c) Evaluate the effectiveness of trade protectionism [6 marks]

Trade protectionism is a policy that protects domestic industries from unfair foreign competition.

The advantages to trade protectionism include:

- Assisting emerging industries: According to the Infant Industry Argument, emerging industries need assistance in order to scale up in the face of established worldwide competition. Protectionists contend that altering the trade balance is required to promote innovation.

- Job creation: According to protectionists, restricting trade and favouring domestic producers lead to the creation of jobs at home and economic growth by providing domestic industries with the favourable conditions they require to thrive.

- Increasing competitiveness: In a free market, higher pay developed nations (such as the United States) cannot compete on price with lower wage emerging nations. This is another justification for protectionism (like China). In order to help the domestic industry compete, the government must tip the scales in its favour.

The disadvantages to trade protectionism include:

- Effectiveness of specialisation: Anti-protectionists contend that encouraging specialisation in a few important areas and forging beneficial trade agreements with other nations that have comparable specialisations is a more effective way to boost the economy than restricting international trade.

- High cost of job creation: While protectionism may help maintain or add to domestic employment, it may also hinder economic growth and cause price inflation as domestic goods become more expensive. Any jobs created will be expensive because inflation is a real possibility.

- Risk of retaliation: Protectionism’s detractors claim that, aside from trade wars, it has historically resulted in blatantly violent warfare, such as World War I.

d) To what extent does subsidising agricultural production impact trade? [8 marks]

The subsidies are a trade protection involving a government payment to domestic producers in Azerbaijan. They are intended to lower the price of produce and increase agricultural production. As the agricultural products are exported, this policy leads to an overall rise in Azerbaijan’s international competitiveness. This type of trade protection safeguards the Azerbaijan economy from foreign competition by minimizing imports. In addition, as developing countries depend on the primary sector, agricultural production is crucial to the health of the economy.

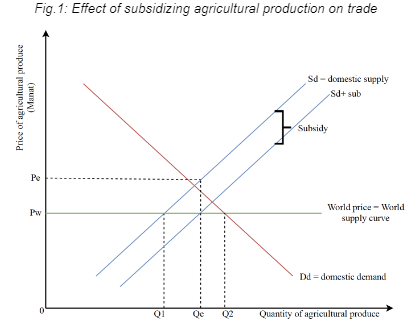

Prior to the introduction of subsidies to domestic agricultural producers, it is assumed that imports were initially high and that agricultural production took place at a slower rate. As seen in Fig.1, when trade takes place without protectionism, the equilibrium is at the intersection of the world price; a price for a good or service in all countries, with Sd at the quantity Q1 and price Pw. At this price, domestic supply is low (Q1) and the imports are high; Q2 minus Q1.

When the Azerbaijan government starts subsidizing its producers, they receive a higher effective price; Pe, providing them with the incentive to increase production from Q1 to Qe, even though the market price does not change. This results in a downward shift in the domestic supply curve by the size of the subsidy per unit, Sd+sub, indicating that there is higher domestic agricultural production as the cost of production is lowered. To meet with the higher production process, demand for labour increases, leading to an overall rise in domestic employment and thus revenue. This revenue can be invested in capital to improve their agricultural production. However, these subsidies may also cause domestic producers to become lethargic, leading to inefficient agriculture production. This results in a global misallocation of resources, adversely affecting economies. In the long run, domestic employment may also negatively affect the economy as it causes a rise in inflation rates due to high costs of production from providing additional wages to labour. However, there are also long term benefits of diversification in agricultural production and exports in developing countries.

On the other hand, as the subsidy is not sufficient to change the Pw, Domestic demand (Dd) does not change either. Considering that Dd is constant and agricultural production is growing, there is a decrease in the entry of imports compared to the exports, from Q2 minus Q1 to Qe minus Q1. As there is less expenditure on imports, Azerbaijan’s current account improves. This also allows infant industries to grow in size and produce higher output and take advantage of economies of scale as it receives a lower average cost, hence enabling them to compete in the international market.

In conclusion, trade protection such as subsidies can benefit Azerbaijan’s economy but only up to a moderate extent. This form of trade protection may be considered more effective in comparison to tariffs; which are taxes on imports, as it does not lead to possible loss of living standards or have negative effects on consumption. This indicates that as price does not increase, it does not make consumers switch to cheaper but fewer goods or services causing a deterioration in the standard of living. However, consumers may also be worse off as the government subsidizes producers rather than funding socially desirable aspects. Furthermore, the government would have to raise taxes to fund the subsidy.