exchange rates and the balance of payments Notes

Understanding exchange rates and the balance of payments is a crucial part of the IB Economics syllabus. This topic provides insights into how currencies fluctuate, the factors influencing exchange rates, and how international transactions are recorded in a country’s balance of payments. Mastery of these concepts is essential for achieving top marks in Paper 2 and Paper 3, where real-world applications and data analysis are emphasized.

Freely floating exchange rates

INTERNATIONAL EXCHANGE RATES

- Constant flow of money in/out of countries because residents have transactions.

- Int’l transactions use different currencies (foreign exchange).

- Demand for foreign currencies generates supply of domestic currency (and vice versa).

- Exchange rates relate the value of one currency to another.

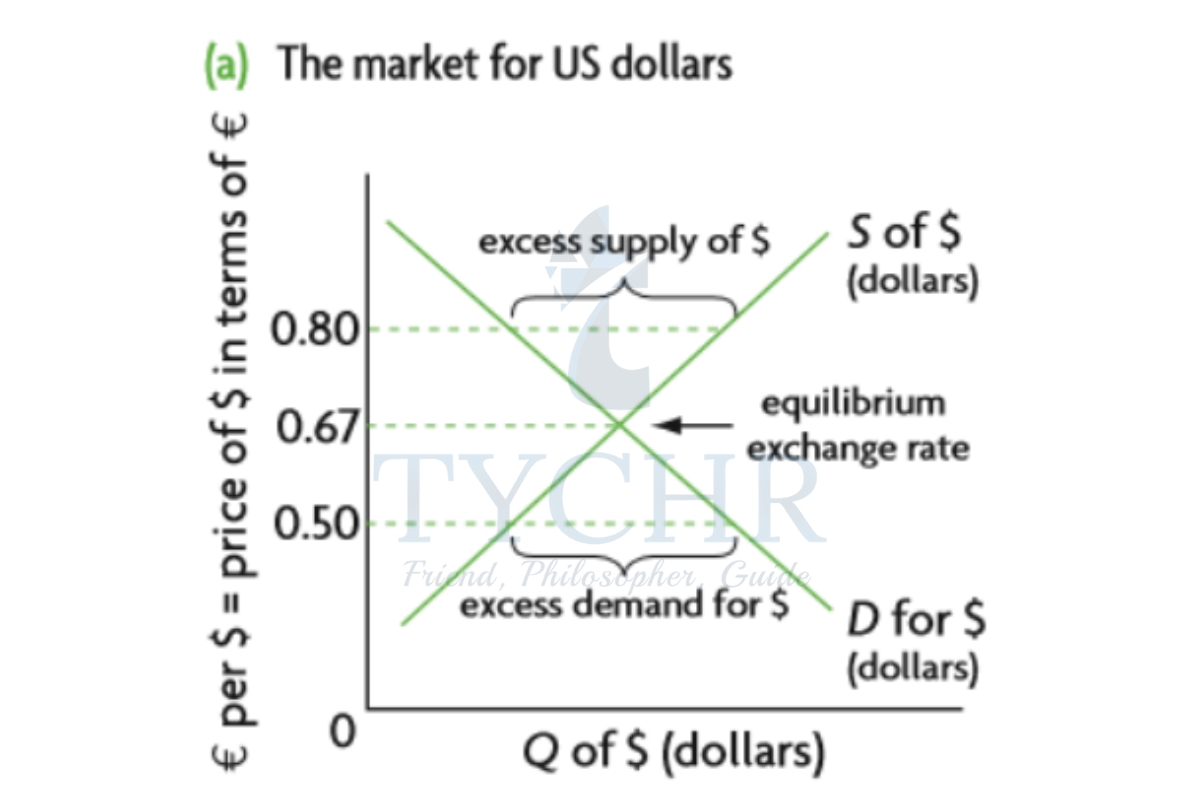

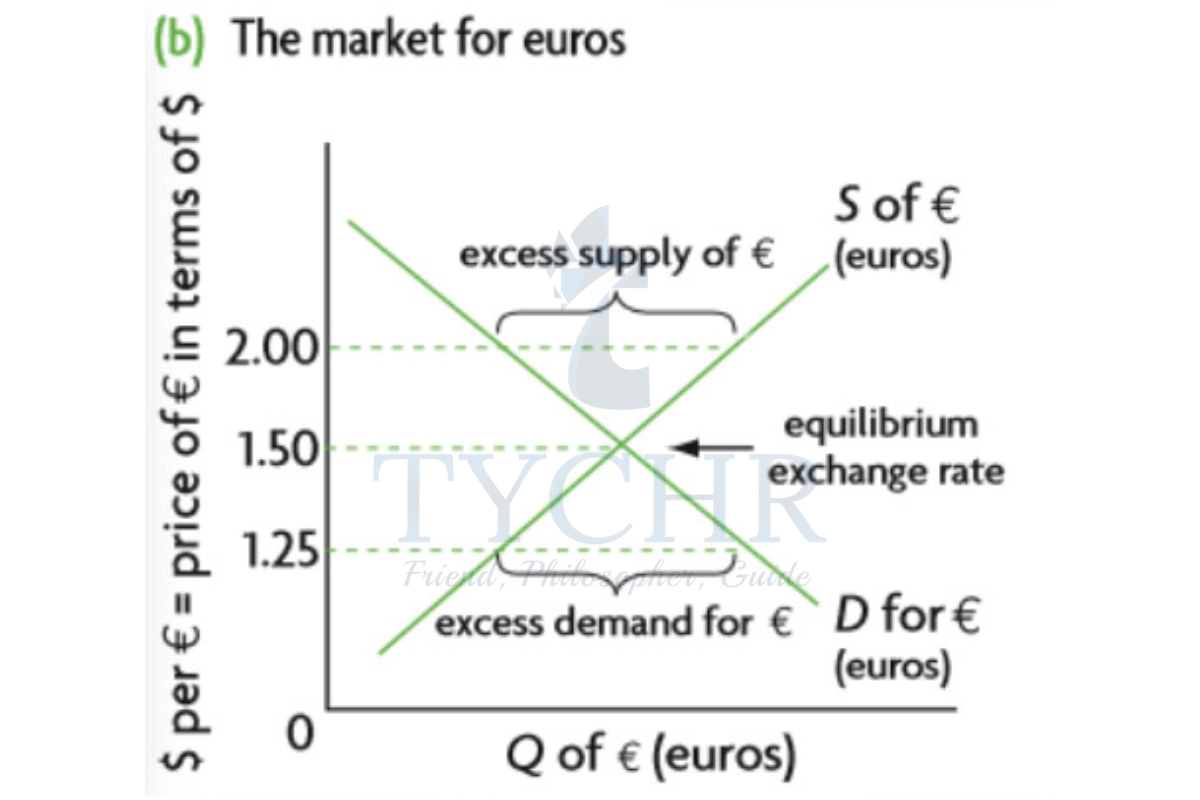

- In a freely floating exchange rate system (abbreviated in this guide as FFERS), the market determines the exchange rates. In a diagram, the price is expressed in terms of the other currency.

- The exchange rate settles at the point where the quantity of a currency demanded equals the quantity supplied in a system with a freely floating exchange rate. The exchange rate at equilibrium is this.

CHANGES IN EXCHANGE RATES

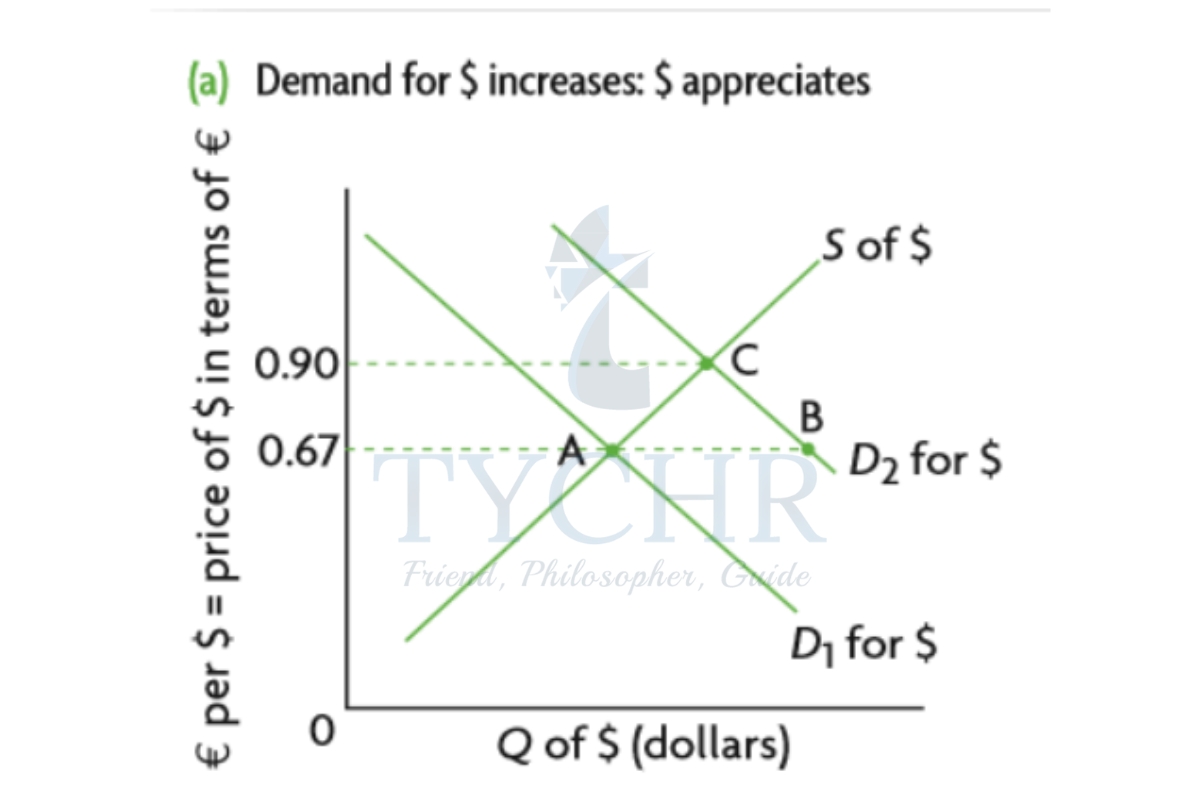

Appreciation – increase in the value of a currency in a FFERS.

- From the diagram: increase in demand for $ or decrease in supply of $

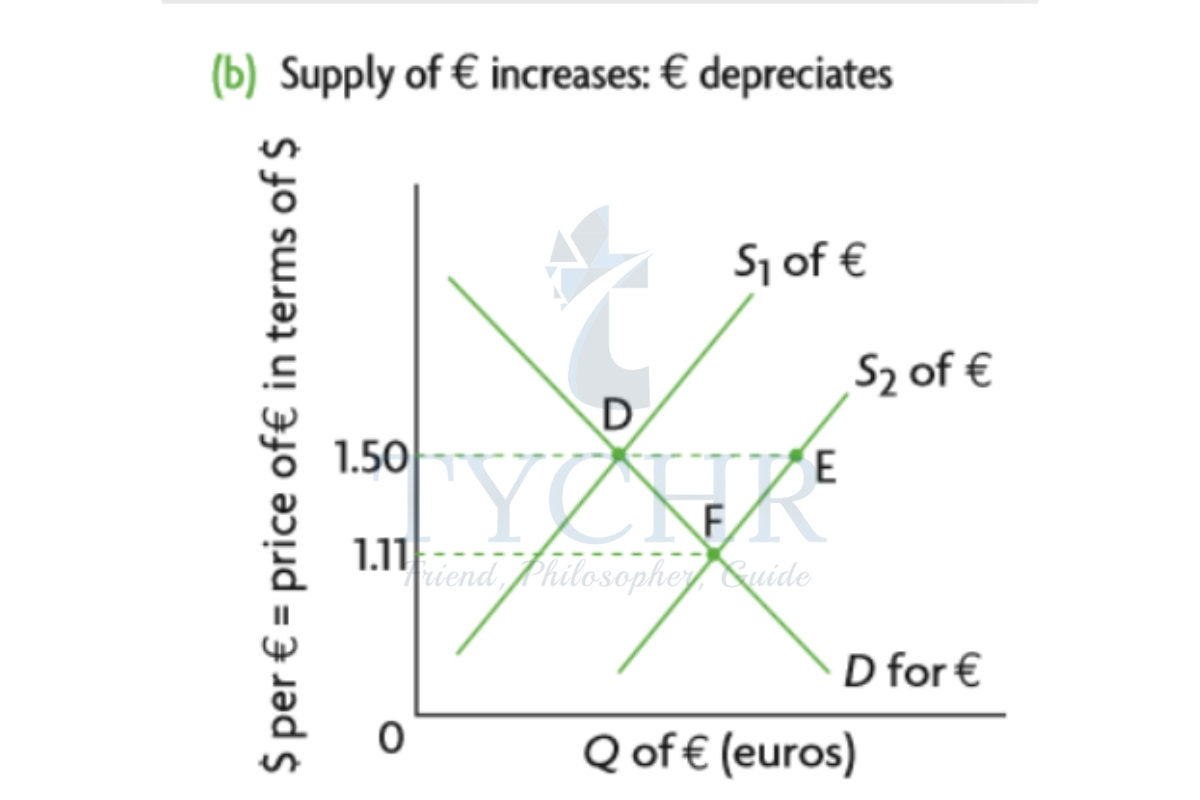

Depreciation – decrease in value of a currency in a FFERS.

- From the diagram: decrease in demand for € or increase in supply of €

- In a floating exchange rate system, appreciation (increase in value) and depreciation (decrease in value) of a currency occur as a result of changes in demand or supply for a currency.

CAUSES OF EXCHANGE RATE CHANGES

- Increase in demand for a country’s export: appreciation

- Increase in country’s demand for imports: depreciation

- A country’s interest rate and currency value changes in the same direction

- Inflation that is higher in a country than in other countries: depreciation

- Increase in foreign investment: appreciation

- A country’s relative income level and currency value change in opposite directions

- Widespread expectation of appreciation will contribute to appreciation

- Expectations of depreciation will contribute to depreciation

- If a foreign currency is purchased by the central bank: depreciation as a result of providing domestic currency In the event that the central bank sells a foreign currency: appreciation as a result of the need for foreign currency

EXCHANGE RATE EVALUATIONS

Inflation

- Cost-push: A depreciation makes imports more expensive. Production costs increase which can shift the LRAS leftwards. The more inelastic the demand of the input, the greater the inflation. Currency appreciation lowers inflationary pressures.

- Demand-pull: A depreciation makes exports cheaper, increasing net exports (X– M). Whether there is an inflation will depend on where the economy is in the business cycle.

Employment

- Depreciation can increase AD which can decrease cyclical unemployment and cause a temp. decrease in natural unemployment, but with inflationary pressures.

Appreciation will create a recessionary gap and cause cyclical unemployment or increase it.

Economic growth - Depreciation: Cause AD increase (short-term benefit) but with inflation. Can cause increases in potential output

Appreciation: Dampens GDP growth but may have indirect growth by making imports cheaper.

Current account balance

- Depreciation: Causes imports to fall and increases exports. Can cause the trade deficit to shrink.

- Appreciation: Increases trade deficit.

Foreign debt

- Depreciation: causes foreign currency debt value to increase

- A problem faced by developing countries because as their currency depreciates, they have a larger debt burden.

Government intervention

FIXED EXCHANGE RATE

Fixed exchange rate system – exchange rates are “fixed” by the central bank and do not respond to supply/demand changes. Gov’t intervention is used to maintain this fixed rate.

METHODS TO MAINTAIN FIXED RATES

Official reserves

- If there is an excess supply of a currency, the central bank can sell foreign reserves to buy the excess. If there is an excess demand, the central bank can buy foreign currency.

- If there is an excess supply and a downward pressure, the central bank will no longer be able to sell reserves.

When there is upward pressure, the central bank can just sell domestic currency. - Interest rates

By increasing interest rates, it will attract investments and increase the demand for the domestic currency. It may involve Contractionary policy, though. - Borrowing from abroad

Loans will be converted into the domestic currency which will increase the demand, but there are borrowing costs. - Efforts to limit imports

Limiting imports can reduce supply of domestic currency. This may cause retaliation. - Exchange controls

Exchange controls are government-imposed restrictions on the amount of foreign currency that can be purchased by domestic residents. restricts cash outflows. Allocation of resources

FIXED EXCHANGE RATE CHANGING

- Devaluation – when the government changes the fixed rate to a lower value because it is too high to be maintained through intervention.

- Revaluation – when the government fixes a currency at a higher value.

MANAGED EXCHANGE RATES

- Managed exchange rates (managed float) combine both floating and fixed exchange rate systems, though it leans towards the “float” side.

- Exchange rates usually float to their market levels, but central banks intervene to stabilize them from fluctuations.

- Some developing nations peg their currency to the US dollar to float with it. Pegged currencies float in relation to other currencies while remaining fixed in relation to a specific currency.

- This helps price stability for many developing nations.

- Under the managed float, exchange rates are mostly set by market forces, but central banks occasionally intervene to smooth out sudden changes. The majority of intervention consists of buying and selling official reserves. Some economies in transition and the developing world bind their currencies to the US dollar or the euro; Pegged currencies float in relation to all other currencies while remaining fixed in relation to the dollar or the euro.

CONSEQUENCES

- Overvalued currency – currency with value higher than equilibrium market value

- Imports become cheaper – often wanted to speed up industrialization

- Exports become more expensive – affects domestic exporters and worsens current account balance.

- Imports at lower prices must compete with domestic producers.

- Currency with a low value in relation to its free market value is an undervalued currency.

- Exports less expensive – used to expand exports

- Imports more expensive

- Undervalued currencies are considered “unfair” and are referred to as a “dirty float.”

Calculations using Exchange Rates

Calculating the value of a currency in terms of another:

A hypothetical exchange rate of 1.5 US dollars = 1 euro gives us the price of one euro in terms of dollars. If we want to find the price of one dollar in terms of euros, we divide the unit currency (euro) by the other currency (dollars).

Therefore:

1 dollar = 1/1.5 euro = 0.67 euro

The expressions 1.5 dollars = 1 euro, and 0.67 euro = 1 dollar are equivalent.

% Changes in the value of currency:

Amount of Euro appreciation = (New dollar value of euro – Old dollar value of euro) /

Old dollar value of euro

Ifthe value of the euro rises from $0.93 to $0.99 per euro, the amount of euro appreciation is computed as

(0.99 -0.93)/0.93 = 6.45%

Amount of dollar depreciation = (New euro value of dollar – old euro value of dollar) / Old euro value of dollar

The value of the dollar drops from 1/0.93 euros to 1/0.99.

Hence the amount of dollar depreciation is computed as

(1/0.93 — 1/0.99) / (1/0.93) = 6.06%

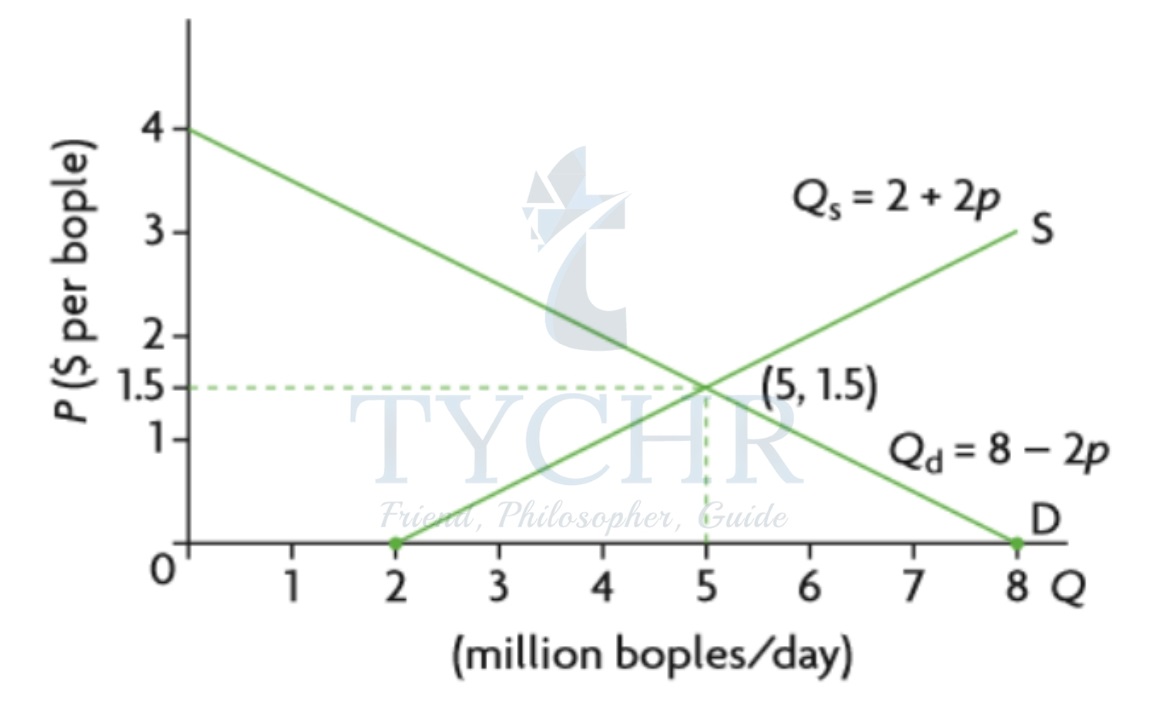

Exchange Rates from Linear Functions:

The exchange rate is the price of a currency.

If we are given demand and supply functions of the form Qd = a – bP and Qs = c + dP. In the equation, Qd = Qs, we will get the equilibrium price.

Graphical Representation of Linear Functions:

The balance of payments

BALANCE OF PAYMENTS

- The balance of payments is a record of all transactions between the residents of a country and the residents of other countries.

- Credits – payments for other countries; debits – payments to other countries; deficit – more debits than credits (negative balance); surplus – more credits than debits (positive balance)

- Credits create a foreign demand for a country’s currency, and debits create a supply of the currency.

- The IB follows a certain format for the balance of payments:

- The sum of everything is zero; the credits balance the debits.

- Current account + (capital account + financal account + errors/omissions) = 0

CURRENT ACCOUNT AND FINANCIAL ACCOUNT

- If imports > exports, there is a deficit in the trade balance, which makes it likely for there to be a current account deficit.

- If there is a current account deficit, there is a financial account surplus, which provides it with the exchange needed to pay for the excess imports.

- A current account surplus means a country consumes less; the country has more foreign exchange that is used to buy assets and other stuff which results in a financial account deficit.

IMBALANCE

- A balance of payments deficit/surplus means there is a deficit/surplus in the combined balance of payments excluding central bank intervention. In a deficit, the central bank can buy up excess currency to balance the payments.

The balance of payments and exchange rates

BALANCING DEFICITS WITH SURPLUSES (FREELY FLOATING)

- If there is a deficit/surplus in the current account, market forces create a/n downward/upward pressure on the exchange rate.A balance is established automatically by the exchange rates.

BALANCING DEFICITS WITH SURPLUSES (MANAGED FLOAT)

- To maintain a healthy balance of payments, a nation’s central bank purchases and sells currencies.

BALANCING DEFICITS WITH SURPLUSES (FIXED)

- Policies that fix the exchange rate maintain the balance of payments.

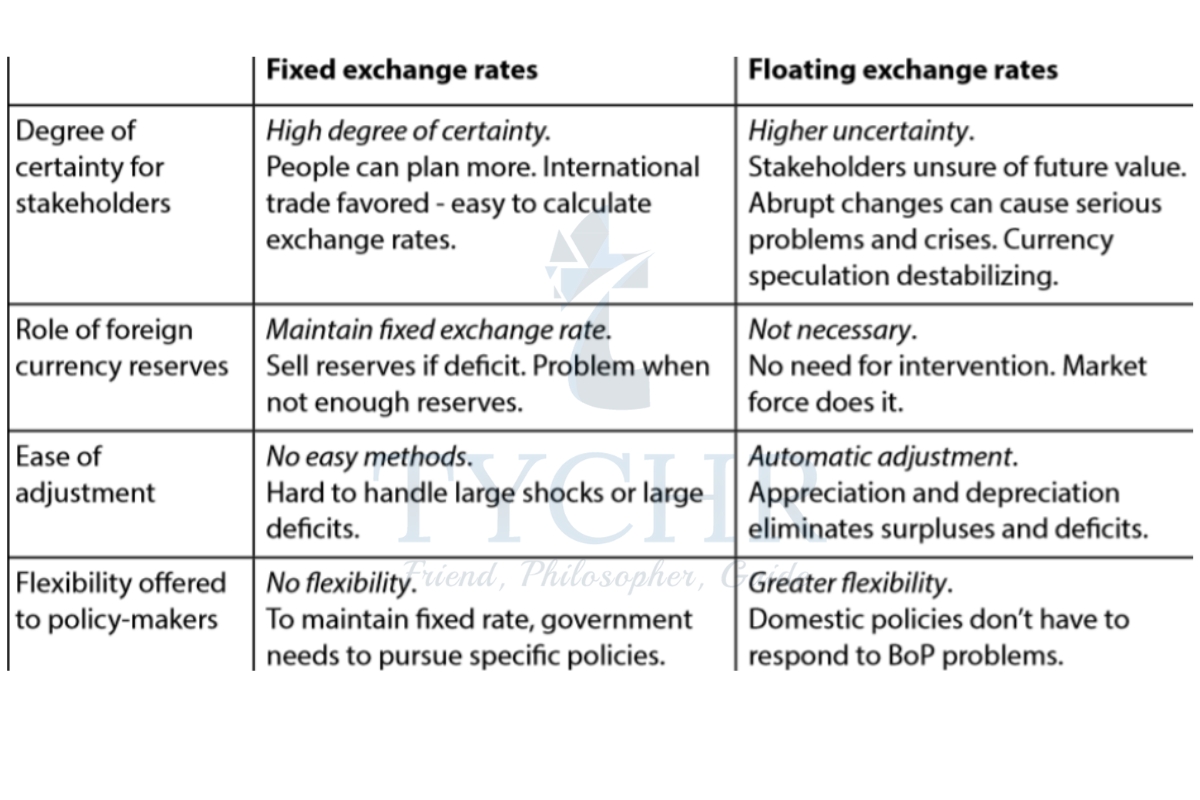

COMPARING AND CONTRASTING EXCHANGE RATE SYSTEMS

EVALUATION: MANAGED FLOAT

- Supporters: Offers flexibility to pursue policies that the economy needs. Also allows the government to prevent large fluctuations.

- Critics: Not good enough to deal with large fluctuations; not successful in eliminating trade imbalances; allows dirty floats

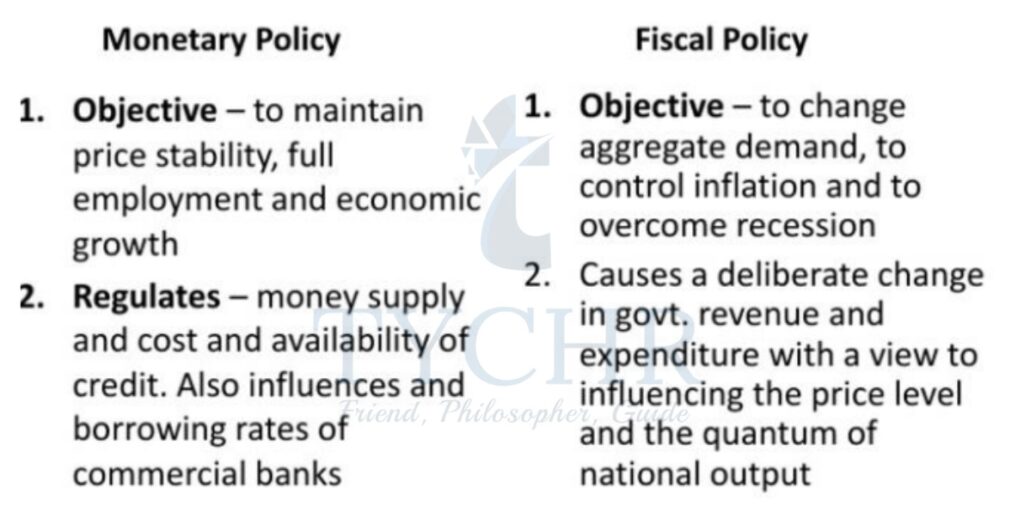

FISCAL AND MONETARY POLICY

Expansionary and Contractionary Monetary policy and Trade balance:

EXPANSIONARY | CONTRACTIONARY |

Increases aggregate demand | Decreases aggregate demand |

Decreases Interest Rates | Increases Interest Rates |

Depreciates the currency | Appreciates the currency |

Increases net exports | Decreases net exports |

It improves trade deficit and worsens trade surplus | It improves trade surplus and worsens trade deficit |

- The problem of cost pushing inflation due to increased import prices can be corrected by higher interest rates which appreciate the currency and lower import prices.

Topics on exchange rates and the balance of payments

- Current Account Deficit (Excess of Imports over exports)

These deficits when financed by loans leads to (borrowing from abroad and through sale of domestic assets) following problems:- Higher Interest rates leads to recession.

- Borrowings lead to high indebtedness.

- Exchange rate depreciates.

- Leads to poor International credit ratings.

- Payment of interest on loans uses up the national income of the country.

- Interest payment on loan uses up foreign exchange earnings which could have been used for import of capital goods.

- Leads to lower economic growth and low standard of living.

- Methods to Current Account Deficit

- Revaluation of exchange rate (make exports cheaper, imports more expensive).

- Reduce domestic consumption and sending on imports through trade barriers (e.g. tight fiscal policy/ higher taxes).

- Supply side policies to improve the competitiveness of domestic industry and exports.

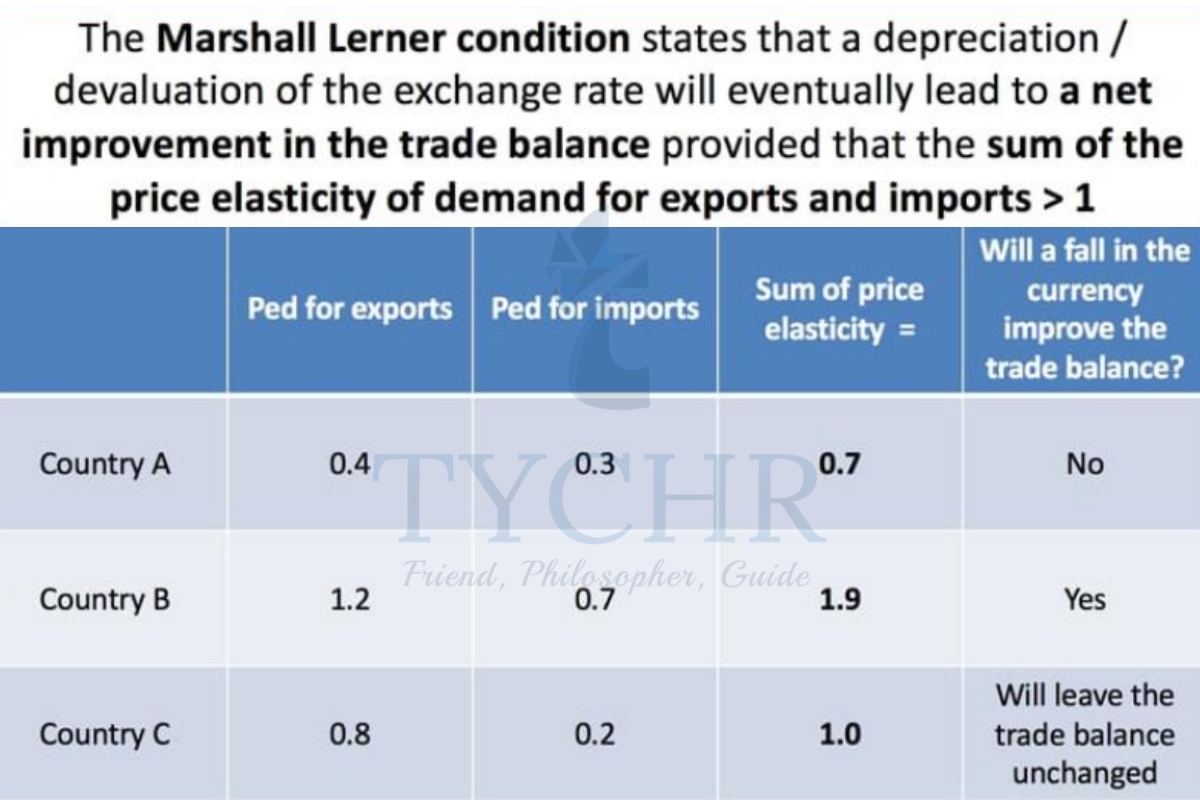

- Marshall Lerner condition

The Marshall–Lerner condition states the following:- Devaluation or depreciation will improve the trade balance (reduce the trade deficit) if the PEDs for imports and exports are greater than 1, or PEDm + PEDx > 1.

- Devaluation or depreciation will worsen the trade balance (will increase the trade deficit) if the sum of the two PEDs is less than 1.

- The trade balance will not change as a result of devaluation or depreciation if the sum of the two PEDs is 1.

NOTE: PEDM = PED for imports, PEDX = PED for exports.

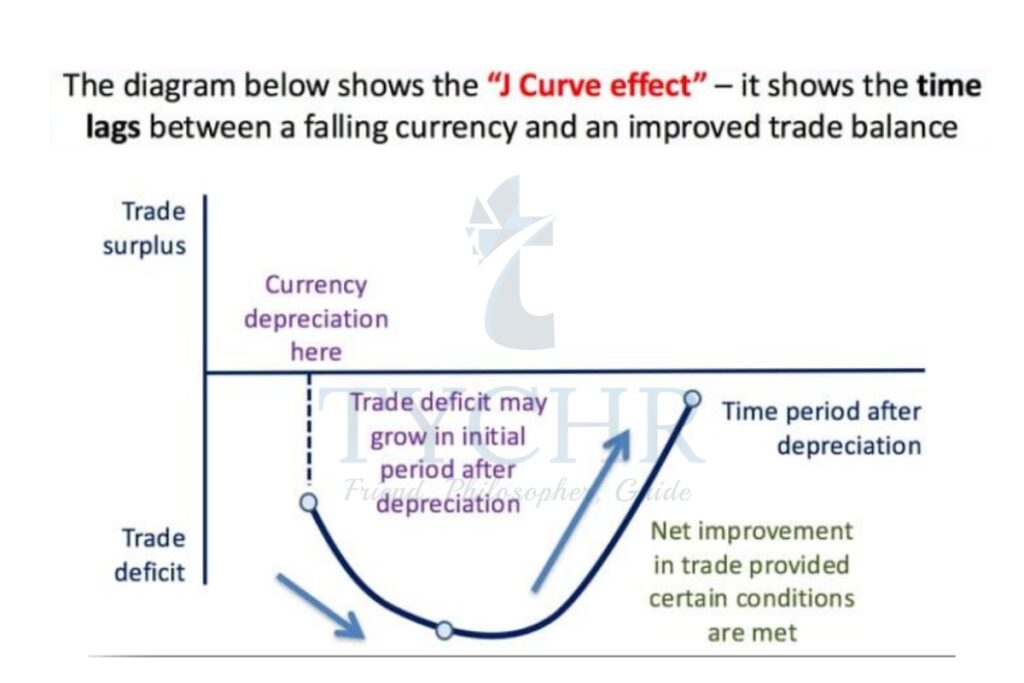

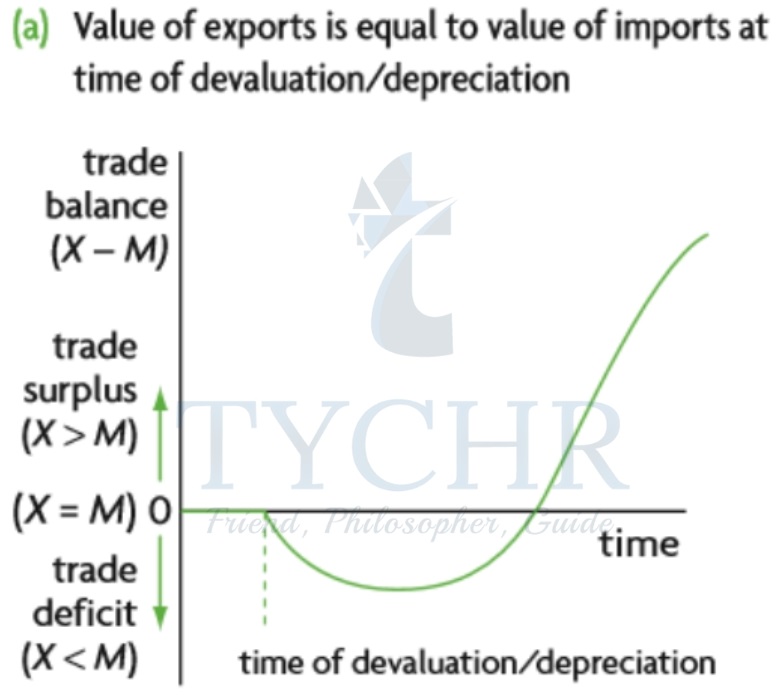

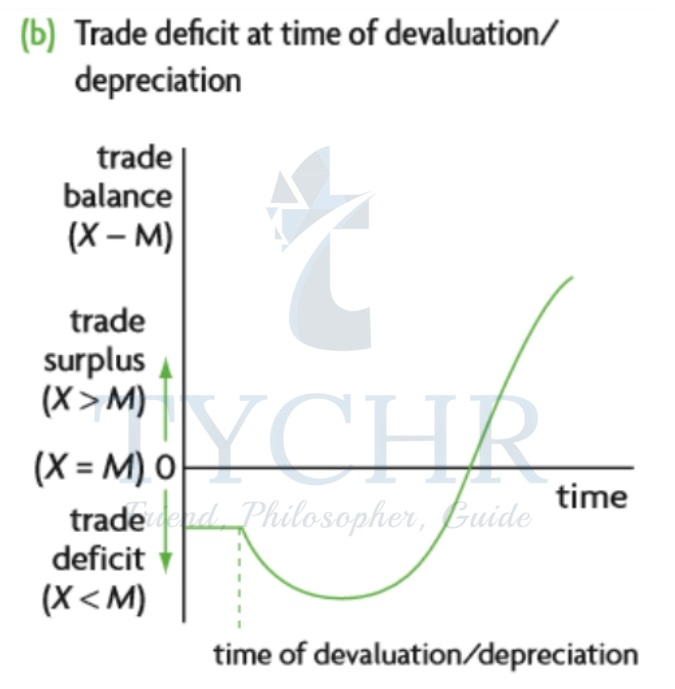

J-Curve

The effect of currency depreciation on the trade deficit depends on price elasticity of demand for exports and imports. The J-curve effect says a trade deficit can worsen after depreciation but improve in the medium term if the Marshall-Lerner condition holds. It is called J-curve because of its shape.

Consequences of Current Account Surpluses

- Low domestic consumption and low standard of living.

- Insufficient domestic investment.

- Appreciation of the domestic currency.

- Reduced export competitiveness i.e. exports become expensive

Suppose you’re looking for expert guidance to excel in IB Economics. In that case, Tychr offers access to highly experienced IB Economics SL & HL tutors who specialize in breaking down complex topics like exchange rates and the balance of payments. Our personalized tutoring sessions help you gain clarity, enhance your problem-solving skills, and confidently tackle exam questions. Unlock your academic potential with Tychr’s best-in-class tutoring.