Table of Contents

1929

When you hear 1929, the first thing that comes to most people’s minds is the Great Depression. The Great Depression was the worst economic downturn in history, lasting from 1929 to 1939. It began after the stock market crash of October 1929, which sent Wall Street into a panic and wiped out millions of investors. A Depression is what one would define as a sustained, long-term downturn in economic activity– most IB kids would know.

There were two approaches to resolving this issue: the monetarist and the keynesian theory.

Monetarist theory

The monetarist theory is founded on the philosophies of Adam smith. Monetarist economists believe that consumers and firms make decisions in the free market economy in order to maximize their own self-interests. When fluctuations occur, the economy fixes itself due to the market forces, requiring no external intervention. The cornerstone of the classical theory is the belief in flexible wages and prices, this implies that workers’ wages increase with inflation.

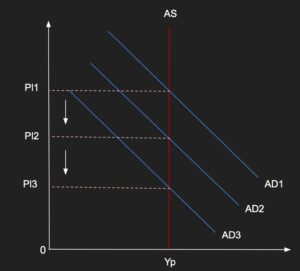

Here is a graph explaining the impact.

Over the next several years after the stock market crash, consumer spending and investment dropped, causing steep declines in output and employment as failing companies laid off workers. The leftward shift of AD1 to AD2, causing deflation.

Falling prices forced firms to cut wages for workers as they undergo loss, thus leading to unemployment.

This resulted in a further decrease in AD (AD2 to AD3), causing the price level to also reduce. Eventually, the economy faced a recession. The economy was in need of correction. According to monetarists, the market forces will adjust, thus bringing the economy back to its initial stage. As prices are low, consumers’ purchasing power parity is high, making goods and services more affordable. As consumption rises, AD starts to rise as well, resulting in higher price levels and thus inflation. These market forces are changing constantly, and according to this theory, it works all the time. However, that was not the case during the great depression.

Now is where the big man comes in.

Keynesian theory

Founded on the philosophies of John Maynard Keynes. Keynes believed that the monetarist theory is correct, but only to an extent. The natural market forces can lead the economy to spiral out of control, thus requiring government intervention. Wages and prices are sticky and do not fluctuate easily in reality.

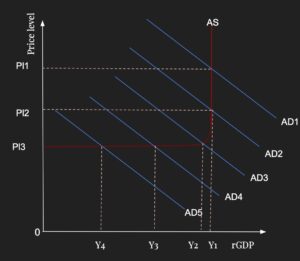

In the stock market crash, American consumerism plummeted and the unemployment rate skyrocketed from 3.2 per cent in 1929 to 8.9 per cent in 1930 (AD2 to AD3). As the firms closed down, real GDP reduced by 10% in 1930 and a recessionary gap occurred. President Hoover assured the American people that the economy would fix itself but as unemployment skyrocketed, the national income level was shrinking at a faster rate and even as flexible prices and wages continued to fall into the intermediary range; consumers didn’t have enough disposable income to stabilize the economy.

As aggregate demand continued to decrease, firms shut down and real GDP contracted by 50 per cent between 1929 and 1933 the US economy shrunk by 47 billion dollars and the unemployment rate reached 25 per cent the economy was in freefall. the solution to the country’s economic problems was more consumption and investment but by 1933 the economy had already entered the Keynesian range of aggregate supply and prices and wages were sticky.

In 1933, Franklin Roosevelt focused on Direct Relief which put income directly in the hands of consumers and work relief which provided jobs for workers to provide the nation with much-needed infrastructure.

By 1937, the United States real GDP doubled booming from 47 billion dollars the 92 billion dollars. As aggregate demand increased, consumers were gaining purchasing power allowing them to drive aggregate demand with consumer spending as government spending continued to generate jobs and income.

Eventually by 1940, the United States unemployment rate was cut to fourteen percent. All in all, the United States unemployment rate had decreased to 4.7 percent and the economy had moved back into the intermediary range. Prices and wages were more flexible and they increased as real GDP increased. By 1943, the United States economy was back to full capacity due in large part to the stimulation of aggregate demand by Franklin Roosevelt’s New Deal programs. Thus, the Keynesian theory passed its first test and soon became the most practiced economic theory around the world.

Frequently Asked Questions (FAQs)

Q1: What was the Great Depression?

A: The Great Depression was a severe worldwide economic depression that lasted from 1929 to the late 1930s. It began in the United States and quickly spread to other countries, resulting in widespread unemployment, poverty, and social upheaval.

Q2: What were the causes of the Great Depression?

A: There were multiple causes of the Great Depression, including overproduction and overspending in the 1920s, a stock market crash in 1929, and an unstable banking system. The Smoot-Hawley Tariff Act, which increased tariffs on imported goods, also contributed to the economic downturn by reducing international trade.

Q3: How did the Great Depression impact the United States?

A: The Great Depression had a significant impact on the United States, causing high unemployment rates, decreased consumer spending, and widespread poverty. Many families lost their homes and savings, and the government implemented programs such as the New Deal to help alleviate the economic crisis.

Q4: How did the Great Depression impact the rest of the world?

A: The Great Depression had a global impact, with many countries experiencing similar economic downturns and social unrest. It contributed to the rise of fascist governments in Europe and the beginning of World War II.

Q5: How did the Great Depression end?

A: The Great Depression officially ended in the late 1930s as a result of increased government spending on infrastructure and public works projects, as well as increased involvement in World War II, which boosted the economy. However, it took several more years for the economy to fully recover.