IB Economics SL Paper 1 Question Bank

Our IB Economics SL Paper 1 Question Bank is an incredible resource for students preparing for the IB Economics exam. The Question Bank is full of high-quality, properly formatted questions that cover all aspects of the IB Economics syllabus. The questions are clearly laid out and easy to understand, and the answer key provides detailed explanations for each question. This is an essential tool for any student who wants to do well on the IB Economics exam.

Economics Standard Level Paper 1

1 hour and 15 minutes

Instructions to candidates

- Do not turn over this examination paper until instructed to do so.

- You are not permitted access to a calculator for this paper.

- Answer one question.

- Use fully labeled diagrams where appropriate.

- The maximum mark for this examination paper is [25 marks].

1.)

a) Explain the difference between a specific tax and an ad valorem tax. Give an example of each and discuss their impact on consumers and producers. (10 marks)

Taxes are an important tool used by governments to generate revenue for public spending, as well as to regulate economic activities. There are several types of taxes that governments may use, including specific taxes and ad valorem taxes.

A specific tax is a tax that is levied on a fixed amount per unit of a good or service, regardless of its price. For example, if the government imposes a specific tax of $1 per unit on cigarettes, the tax will be applied to every pack of cigarettes sold, regardless of the price of the pack. This means that the amount of tax paid will be the same regardless of the price of the product.

On the other hand, an ad valorem tax is a tax that is levied as a percentage of the value of a good or service. For example, if the government imposes an ad valorem tax of 10% on a luxury car that costs $50,000, the tax paid will be $5,000. The tax rate remains constant, but the amount of tax paid increases with the price of the good or service.

The impact of specific and ad valorem taxes on consumers and producers can vary. In the case of a specific tax, the burden of the tax is borne entirely by the consumers. This is because the tax is added to the price of the product, and the consumer is forced to pay the increased price. This leads to a decrease in demand for the product, as consumers will look for cheaper alternatives. Producers, on the other hand, may see a decrease in sales, but their profit margins remain the same, as the tax is added to the price of the product.

In contrast, the burden of an ad valorem tax is shared between consumers and producers. As the tax is a percentage of the price, the consumer pays a portion of the tax through the increased price of the product, while the producer pays the remainder. As the price of the product increases, demand decreases, and producers may see a decrease in sales and profit margins.

To illustrate the impact of specific and ad valorem taxes, consider the example of a tax on alcohol. If the government imposes a specific tax of $2 per liter on alcohol, the price of a $10 bottle of wine will increase to $12. This will decrease demand for the product, and producers may see a decrease in sales, but their profit margin remains the same.

In contrast, if the government imposes an ad valorem tax of 20% on alcohol, the tax on a $10 bottle of wine will be $2, and the price of the product will increase to $12. This increase in price will lead to a decrease in demand for the product, and producers may see a decrease in sales and profit margins.

In conclusion, specific and ad valorem taxes are two different types of taxes that can have different impacts on consumers and producers. A specific tax places the burden of the tax entirely on consumers, while an ad valorem tax is shared between consumers and producers. The choice of tax type depends on the government’s objectives, and policymakers must consider the potential impact on various stakeholders before implementing a tax.

b) Using diagrams, to what extent does an indirect tax minimise negative consumption externalities? [15 marks]

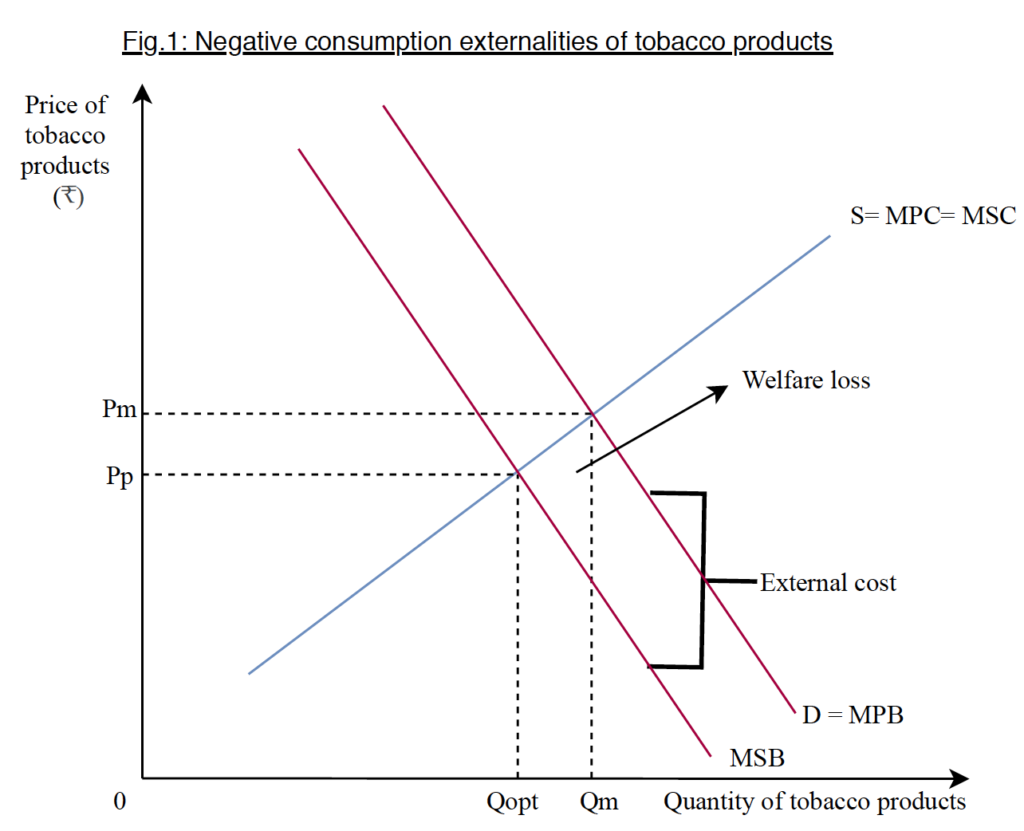

There is an urgent need for increasing the tax on the sale of tobacco products, such as bidis, which are considered demerit goods as they are harmful to society. They create negative consumption externalities – costs that are suffered by a third party. For instance, as a consequence of passive smoking, non-smokers bear costs such as an increased risk of lung cancer. The market overallocated resources for this demerit good, leading to market failure. Let’s use the example of cigarettes to illustrate the impact of the indirect tax.

In Fig.1, the additional benefit incurred by the Indian consumers from consuming an extra tobacco product, Marginal Private Benefit (MPB), is greater than the additional benefits to society, Marginal Social Benefit (MSB). The demand curve depicts the MSB accrued to society, and MPB, whereas the supply curve represents the Marginal Social Cost (MSC), which includes the existing tax.

For tobacco, the external cost to society is represented by the vertical distance between MSB and MPB. The social optimum quantity is determined by the intersection of the MSB and MSC curves. However, there is excessive production of tobacco products as seen at Qm. Hence, the consumption of tobacco is greater than the socially optimal quantity, leading to a welfare loss.

To minimize the production of such demerit goods to achieve the social optimum quantity (Qopt), economists recommend a hike in the indirect tax on tobacco products. Theoretically, this will lead to a decrease in tobacco supply as there is an increase in production costs. This is represented in Fig.2 by an upward shift of the supply curve from Marginal Private Cost (MPC) to S1. The quantity produced and consumed would drop from Qm to Qopt due to the intersection of curves S1 and MPB. As a result, the price would rise from Pm to Pc.

A high price may be a disincentive for consumers to purchase tobacco products or even initiate the usage of such, predominantly amongst the youth. Moreover, the Indian government would generate revenue. This revenue can not only be reinvested into crucial sectors of the economy such as healthcare and education.

However, there are several drawbacks to this policy since the addictive nature of tobacco products makes their demand inelastic, i.e. the market demand does not fall drastically when there is a price increase. Thus, the actual effect of this indirect tax likely does not completely shift the quantity of consumption close to Qopt (Fig 2). This is demonstrated in Fig 2 where the MPC curve does not fully overlap S1, but rather shifts to S2. It causes the price of tobacco products to rise from Pm to Pa, whereas quantity reduces from Qm to Qa (Fig 2). Shifting the quantity from Qm to Qopt will require a very high indirect tax which has regressive effects such as inefficiencies in correcting market failure as firms reduce production or may even close down in the long run. Although the recommendation of the tax amount is 75% of the retail price, the government may not have perfect information. While this level of taxation may be effective for lower socioeconomic classes, higher social classes may not be as affected. However, in the long run, millions of other lives would be affected as they depend on the trade of bidis for sustenance. Furthermore, there is a possibility of black markets emerging as individuals may not be willing to pay higher prices.

Instead, non-market-based policies, such as regulation, can be implemented to correct this market failure. For instance, the government could limit the amount of tobacco products produced or impose a ban on tobacco use in public places where consumption is high. They could impose severe penalties for consumers who violate the ban which further deters their consumption. Importantly, this policy is not affected by the price elasticity of demand, which is crucial in the case of tobacco products as they are highly inelastic. However, one major drawback with regulation is that it may disrupt equity between firms. If regulation policies are enforced upon firms who are not producers of tobacco products, but have a small percentage of tobacco in their products, the regulation may be unfair. Moreover, the government may incur significant costs to enforce this policy. Threats from black markets also remain an inevitable consequence under both policies. Overall, despite these drawbacks, regulation would be more effective than indirect taxes due to the inelastic nature of tobacco, lack of information and regressive effects.

2.)

a) Explain two factors which might cause economic growth. (10 marks)

Economic growth refers to an increase in the production of goods and services in an economy over a period of time. It is a key macroeconomic objective for governments as it is associated with rising living standards, increased employment opportunities, and higher tax revenues. There are various factors that can cause economic growth. In this essay, we will focus on two key factors – technological advancements and an increase in aggregate demand.

The first factor that can cause economic growth is technological advancements. Technological advancements refer to the creation and application of new and improved technologies, which can lead to an increase in productivity and efficiency. This, in turn, can lead to an increase in output and economic growth.

For example, in the 19th century, the invention of the steam engine led to the development of new industries such as textiles, transportation, and agriculture. This resulted in an increase in productivity and output, which led to economic growth. Similarly, in the 20th century, the invention of the computer and the internet has led to the development of new industries such as software, e-commerce, and telecommunications. This has resulted in an increase in productivity and output, which has contributed to economic growth.

Another factor that can cause economic growth is an increase in aggregate demand. Aggregate demand refers to the total amount of goods and services that households, firms, and governments are willing to buy at a given price level. An increase in aggregate demand can lead to an increase in output and economic growth.

One way to increase aggregate demand is through fiscal policy. Fiscal policy refers to the use of government spending and taxation to influence the level of aggregate demand in an economy. For example, the government can increase its spending on infrastructure projects such as roads, bridges, and airports. This will create jobs and increase the income of households, which will lead to an increase in consumer spending. This, in turn, will lead to an increase in output and economic growth.

Another way to increase aggregate demand is through monetary policy. Monetary policy refers to the use of interest rates and the money supply to influence the level of aggregate demand in an economy. For example, the central bank can lower interest rates, which will encourage households and firms to borrow and spend more. This will increase consumer spending and investment, which will lead to an increase in output and economic growth.

In conclusion, technological advancements and an increase in aggregate demand are two key factors that can cause economic growth. Technological advancements lead to an increase in productivity and efficiency, while an increase in aggregate demand leads to an increase in output and consumer spending. Governments can use a combination of fiscal and monetary policies to stimulate economic growth by promoting technological advancements and increasing aggregate demand.

b) Evaluate the effectiveness of the expansionary monetary policy. [15 marks]

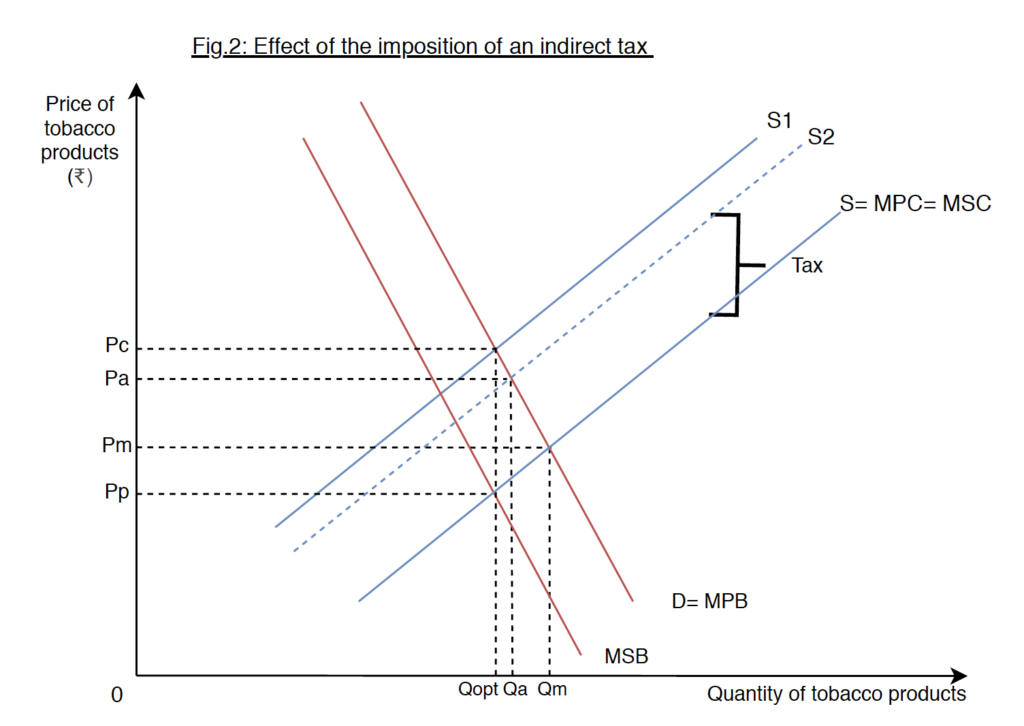

The Central Bank manipulates its interest rates in an attempt to bolster the economy from a recession. A recession is a period of a decline in economic activity, as a result of negative economic growth for two consecutive quarters. The Central Bank enforces an expansionary monetary policy – the reduction of interest rates – to increase the economy’s Aggregate Demand (AD). AD is the total demand for goods and services in an economy at different price levels.

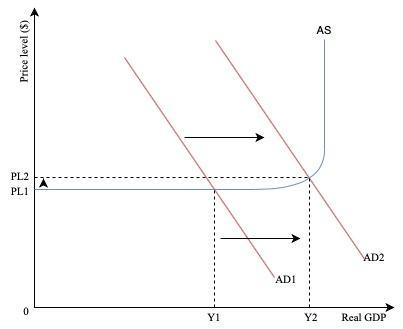

As seen in Fig.3, the reduction in interest rates from I1 to I2 does not occur on its own, but is a response from increasing the money supply from S1 to S2. As this supply rises, the demand for money (Dm) expands, reducing the cost of borrowing.

Reduced interest rates boost the components of AD such as consumption and investment as households and firms tend to spend more and save less, consequently increasing AD. This is represented by a rightward shift from AD1 to AD2 in Fig.4. To meet with higher demands, markets and businesses would expand production by increasing employment, which results in a hike in wages. This contributes to their cost of production, directly affecting price level as shown from PL1 to PL2.

Keynes, a British economist, argued that AD is the primary driving force in an economy for which prices and wages are inflexible. In the Keynesian model, an increase in AD leads to a higher real GDP. However, this only occurs while spare capacity is prevalent, as represented by the horizontal region of the Aggregate Supply (AS) curve. Once the spare capacity is exhausted, the firm is forced to produce at a higher price level. Hence it is efficient to produce at the full employment level of output (Y2), resulting in economic growth.

Firstly, the increase in AD will eventually lead to economic growth. It can then be inferred that economic growth will give rise to multiple benefits such as reduced poverty due to higher incomes and better education, improving society as a whole. Stakeholders such as consumers are able to borrow and spend with ease, hence resulting in higher living standards. Firms could benefit from the lower interest rates by increasing their investment in R&D, which could lead to increased efficiency and lower prices, making it prudent for the health of the economy in the long run.

However, there are a few drawbacks. Although consumption and investment may increase, it could take several months for a distinctive change to occur as interest rates are only a component of the various deciding factors. This policy also disfavors lower-income groups as it not only leads to inflation as firms set higher prices, but also reduces their ability to borrow loans as banks fear that the consumers will not pay them back. Lastly, the Federal Reserve may lose focus on pursuing other goals, such as exchange rate stability.

Alternatively, market-based supply-side policies could be implemented as they increase the economy’s productive potential by improving the quality and quantity of inputs. As market and business investments are one of the main ways by which the economy could prevent itself from entering recessionary territory, the appropriate policy must focus on those aspects mainly. The government may provide an incentive to work as disposable income rises when lowering income taxes. Whereas for the firms, a reduction in corporate tax gives an incentive to raise productivity by increasing the quality and quantity of capital. Furthermore, the government can increase spending on long term assets such as education and infrastructure, thereby creating jobs directly. As education allows the development of skills, there will be a larger skilled labour force in the economy, whereas infrastructure reduces production and transportation costs, increasing productivity and leading to long-run economic growth. This helps achieve all macroeconomic objectives to a larger extent. However, as they are very expensive to do, it involves an opportunity cost.

To conclude, monetary policy benefits multiple stakeholders and promotes economic growth. Nevertheless, the policy could introduce harmful impacts on society due to time lags, unpredictability, and indirect effects. Hence, an alternative policy of increasing government expenditure is recommended to stimulate economic growth with greater efficiency.

Download our Successful College Application Guide

Our Guide is written by counselors from Cambridge University for colleges like MIT and other Ivy League colleges.

To join our college counseling program, call at +918825012255

3.)

a) Compare and contrast the concepts of absolute and comparative advantage in international trade.

International trade is a key driver of economic growth and development. One of the fundamental concepts that underpin international trade is the idea of comparative advantage and absolute advantage.

Absolute advantage refers to a situation where one country is able to produce a certain good or service more efficiently and effectively than another country. For example, Saudi Arabia has an absolute advantage in the production of oil due to its abundant natural resources, whereas Japan has an absolute advantage in the production of high-tech goods due to its advanced technology and skilled workforce.

Comparative advantage, on the other hand, refers to a situation where one country can produce a certain good or service at a lower opportunity cost than another country. This means that the country can produce a good or service at a lower cost than its trading partner, even if it is not more efficient than the trading partner in producing that good or service. For example, if the opportunity cost of producing wheat in the United States is lower than that of producing wheat in Canada, the United States has a comparative advantage in producing wheat, and Canada has a comparative advantage in producing a different good or service, such as timber.

Comparative advantage is a key principle of international trade, as it allows countries to specialize in the production of goods and services where they have a comparative advantage, and then trade with other countries for goods and services where they do not have a comparative advantage. This leads to increased efficiency, lower costs, and higher economic growth for all countries involved.

However, there are also potential limitations and criticisms of the theory of comparative advantage. One criticism is that it assumes that all countries have access to the same technology and resources, which may not be the case in reality. Another criticism is that it does not take into account the distributional effects of trade, which may lead to winners and losers within countries.

To further elaborate, it is important to understand that absolute advantage is a measure of productivity, while comparative advantage is a measure of opportunity cost. Absolute advantage is a straightforward concept as it focuses on the country that can produce a good or service with fewer resources or at a lower cost compared to another country.

Comparative advantage is a more nuanced concept as it involves an opportunity cost calculation. Opportunity cost is the cost of one alternative in terms of the next best alternative. The country that has the lowest opportunity cost of producing a good or service is said to have a comparative advantage in producing that good or service. This means that a country can produce a good or service at a lower cost than its trading partner, even if it is not more efficient than the trading partner in producing that good or service.

For example, consider a hypothetical scenario where the United States can produce 10 units of wheat or 4 units of steel per hour, while China can produce 6 units of wheat or 3 units of steel per hour. The United States has an absolute advantage in both wheat and steel production, as it can produce more units of both goods in an hour compared to China. However, if we consider the opportunity cost of producing one unit of wheat or steel, we can see that the United States has a comparative advantage in wheat production, while China has a comparative advantage in steel production. The opportunity cost of producing one unit of wheat in the United States is 2/5 units of steel, while the opportunity cost of producing one unit of wheat in China is 1/2 units of steel. This means that the United States gives up less steel for every unit of wheat produced compared to China, and hence has a comparative advantage in wheat production.

Overall, comparative advantage is a more flexible and dynamic concept compared to absolute advantage, as it takes into account the opportunity cost of production, which can change over time as a result of changes in technology, resources, and trade policies. Comparative advantage allows countries to specialize in the production of goods and services where they have a comparative advantage, leading to increased efficiency, lower costs, and higher economic growth for all countries involved. However, it is important to acknowledge the potential limitations and criticisms of the theory of comparative advantage, such as the assumption of equal access to technology and resources, and the potential distributional effects of trade.

b) To what extent does the theory of comparative advantage explain patterns of international trade and economic development?

The theory of comparative advantage is a fundamental concept in international trade that explains the benefits of trade between countries. According to the theory, countries should specialize in producing goods and services in which they have a comparative advantage, meaning that they can produce at a lower opportunity cost than other countries. By doing so, countries can trade with each other and benefit from increased efficiency, lower costs, and higher economic growth.

To what extent does the theory of comparative advantage explain patterns of international trade and economic development? This is an important question as it addresses the relevance and limitations of the theory in the real world. In this essay, we will explore the extent to which the theory of comparative advantage explains patterns of international trade and economic development, using real-world examples to support our analysis.

Firstly, the theory of comparative advantage explains the patterns of international trade in terms of specialization and gains from trade. For example, consider the case of Mexico and the United States. Mexico has a comparative advantage in producing goods such as fruits, vegetables, and textiles, while the United States has a comparative advantage in producing high-tech goods such as electronics and aerospace products. By specializing in their respective areas of comparative advantage, Mexico and the United States can trade with each other and benefit from increased efficiency, lower costs, and higher economic growth.

Mexico can export its fruits, vegetables, and textiles to the United States, while the United States can export its high-tech goods to Mexico. This trade allows both countries to benefit from the lower costs of production and the higher quality of goods. The theory of comparative advantage explains this pattern of trade, as each country specializes in the production of goods in which they have a comparative advantage.

Secondly, the theory of comparative advantage also explains patterns of economic development. Countries that specialize in producing goods and services in which they have a comparative advantage can benefit from increased efficiency and higher economic growth. For example, consider the case of South Korea and Japan. Both countries have a comparative advantage in producing high-tech goods, such as semiconductors and electronics. By specializing in the production of these goods, both countries have experienced rapid economic growth and development.

South Korea has become a global leader in the production of semiconductors, while Japan has become a leader in the production of electronics. This specialization has allowed both countries to benefit from increased efficiency, lower costs, and higher economic growth. The theory of comparative advantage explains this pattern of economic development, as both countries have specialized in the production of goods in which they have a comparative advantage.

However, it is important to note that the theory of comparative advantage has some limitations and criticisms. Firstly, the theory assumes that there are no barriers to trade, such as tariffs and quotas, which can limit the benefits of trade. In reality, many countries impose trade barriers that can distort patterns of international trade and economic development.

For example, the United States has imposed tariffs on steel imports from China, which has limited China’s ability to export its steel to the United States. This has distorted patterns of international trade and economic development, as China has been forced to look for other markets to export its steel, which may not be as profitable as the United States market.

Secondly, the theory of comparative advantage assumes that all factors of production, such as capital and labor, are mobile between industries and countries. In reality, this may not always be the case, as some factors of production may be immobile due to cultural or legal barriers.

For example, the United States has a comparative advantage in producing high-tech goods, such as software and artificial intelligence. However, these industries require highly skilled workers, which may not be readily available in other countries. This can limit the ability of other countries to specialize in these industries and benefit from increased efficiency and economic growth.

In conclusion, the theory of comparative advantage explains patterns of international trade and economic development to a large extent. The theory is based on the idea that countries should specialize in producing goods and services in which they have a comparative advantage, meaning that they can produce at a lower opportunity cost than other countries. This specialization allows countries to trade with each other and benefit from increased efficiency, lower costs, and higher economic growth.

Real-world examples such as Mexico and the United States, and South Korea and Japan, demonstrate the benefits of specialization and trade. However, the theory of comparative advantage has some limitations and criticisms, including the assumption of no trade barriers and the assumption of mobile factors of production.

Trade barriers and immobile factors of production can limit the benefits of trade and distort patterns of international trade and economic development. Nonetheless, the theory of comparative advantage remains a fundamental concept in international trade, and its relevance and limitations should be considered in analyzing patterns of international trade and economic development.