IB Economics HL Paper 1 Question Bank

Check Out Our Results

OXFORD UNIVERSITY

(QS:3)

IMPERIAL COLLEGE

(QS:6)

CORNELL UNIVERSITY (QS:16)

45/45 (IBDP)

GEORGIA INSTITUTE

43/45 (IBDP)

KELLY SCHOOL

Our IB Economics HL Paper 1 Question Bank is an incredible resource for students preparing for the IB Economics exam. The Question Bank is full of high-quality, properly formatted questions that cover all aspects of the IB Economics syllabus. The questions are clearly laid out and easy to understand, and the answer key provides detailed explanations for each question. This is an essential tool for any student who wants to do well on the IB Economics exam.

Economics Higher Level Paper 1

1 hour and 15 minutes

Instructions to candidates

- Do not turn over this examination paper until instructed to do so.

- You are not permitted access to a calculator for this paper.

- Answer one question.

- Use fully labelled diagrams where appropriate.

- The maximum mark for this examination paper is [25 marks].

1.)

a) Define the term “Monopoly”. (10 marks)

A monopoly is a market structure in which a single seller or producer has complete control over the supply of a particular good or service, and no close substitutes are available to consumers. This gives the monopolist significant market power, allowing it to set prices at levels that maximize its profits, often at the expense of consumers.

The key characteristic of a monopoly is the absence of competition. Because there are no close substitutes available, consumers are forced to pay the price set by the monopolist if they want to purchase the good or service. This lack of competition can result in higher prices and reduced consumer surplus, as well as lower output and decreased social welfare.

There are two types of monopolies: natural monopolies and artificial monopolies. A natural monopoly arises when there are significant barriers to entry that prevent new firms from entering the market and competing with the existing monopolist. For example, the electric power industry is often considered a natural monopoly, as it requires significant upfront investments in infrastructure and equipment that make it difficult for new entrants to compete.

An artificial monopoly, on the other hand, is created when the monopolist uses tactics such as exclusive contracts, price discrimination, or other anti-competitive practices to prevent competitors from entering the market. These types of monopolies are often the target of antitrust laws and government regulation.

One example of a natural monopoly is the water supply industry. Because it requires significant infrastructure, such as treatment plants and distribution networks, it is often more cost-effective for a single supplier to serve an entire region or city. This gives the supplier significant market power, which can lead to higher prices for consumers.

An example of an artificial monopoly is Microsoft’s control over the operating system market in the late 1990s. By bundling its Internet Explorer browser with its Windows operating system and limiting access to its Application Programming Interfaces (APIs), Microsoft effectively prevented competitors from developing competing software that could run on its platform. This allowed Microsoft to charge higher prices for its products and limit consumer choice, leading to a lawsuit by the U.S. Department of Justice for anti-competitive behavior.

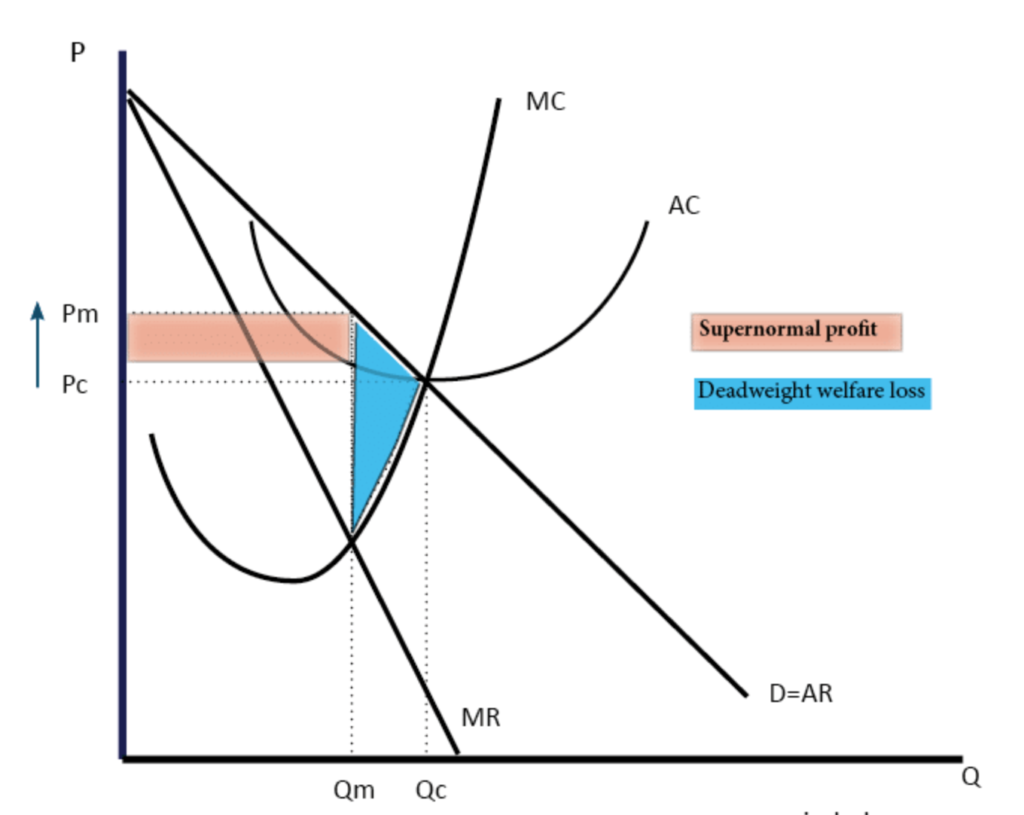

To illustrate the impact of a monopoly on consumers and producers, consider Figure 1.

Reference link: https://www.economicshelp.org/microessays/markets/monopoly-diagram/

In a competitive market, the equilibrium price and quantity are determined by the intersection of the supply and demand curves. However, in a monopoly market, the monopolist restricts output and raises prices to maximize its profits, resulting in a higher price (Pm) and lower quantity (Qm) than would exist in a competitive market.

This higher price reduces consumer surplus (the difference between the maximum price consumers are willing to pay and the price they actually pay) and producer surplus (the difference between the price received by producers and the minimum price they are willing to accept), while increasing the monopolist’s profits. The deadweight loss (the loss of social welfare resulting from the reduction in output and the increase in price) is represented by the shaded area in the diagram.

In conclusion, a monopoly is a market structure in which a single seller has complete control over the supply of a particular good or service. This gives the monopolist significant market power, allowing it to set prices at levels that maximize its profits. While natural monopolies can arise due to significant barriers to entry, artificial monopolies can be created through anti-competitive practices. Monopolies can result in higher prices, reduced output, and decreased consumer and producer surplus, as well as a loss of social welfare.

b) A monopoly firm faces no competition in the market, and can potentially earn abnormally high profits. Evaluate the view that a monopoly is always harmful to consumers and society as a whole, and discuss the possible benefits and drawbacks of government intervention to regulate or break up monopolies. (15 marks)

A monopoly is a market structure in which a single firm dominates the industry and faces no competition from any other firms. This can allow the monopoly firm to exercise significant market power and potentially earn abnormally high profits. However, the view that a monopoly is always harmful to consumers and society as a whole is not necessarily accurate, as there can be both benefits and drawbacks associated with this market structure.

One potential benefit of a monopoly is that it may be able to achieve economies of scale, which can result in lower costs and potentially lower prices for consumers. This is because a larger firm can spread its fixed costs over a larger output, reducing the average cost of production. For example, a monopoly in the water supply industry may be able to invest in expensive infrastructure to deliver water to consumers at a lower cost per unit than smaller firms would be able to achieve. This could result in lower water bills for consumers.

Another potential benefit of a monopoly is that it may be able to invest more in research and development, leading to innovation and technological advancements. This is because a monopoly does not face the same competitive pressures as firms in a more competitive market, allowing it to allocate more resources to R&D without worrying about losing market share to competitors. For example, a pharmaceutical monopoly may be able to invest heavily in research to develop new drugs that would not be financially feasible for smaller firms to pursue. This could lead to important medical advancements that benefit society as a whole.

However, there are also potential drawbacks associated with monopolies. One major concern is that a monopoly may be able to charge higher prices and earn abnormally high profits at the expense of consumers. This is because the monopoly faces no competition, and therefore has significant market power to raise prices without fear of losing market share. For example, a monopoly in the cable television industry may be able to charge higher prices for cable subscriptions, as consumers have no other options for accessing cable programming.

Another potential drawback of a monopoly is that it may lead to a lack of innovation and technological advancement. This is because a monopoly does not face the same competitive pressures as firms in a more competitive market, and may not have the same incentive to invest in research and development. This could result in a lack of innovation and stagnation in the industry, ultimately harming consumers and society as a whole.

In order to mitigate the potential harms of monopolies, governments may choose to intervene in the market to regulate or break up monopolies. One potential method of regulation is through price controls, which limit the prices that a monopoly can charge for its goods or services. For example, a government may set a cap on the prices that a monopoly utility company can charge for electricity, in order to prevent the company from overcharging consumers.

Another potential method of regulation is through antitrust laws, which prohibit monopolies from engaging in anti-competitive practices such as price fixing or exclusive dealing agreements. If a monopoly is found to be engaging in such practices, the government may seek to break up the monopoly or impose fines and other penalties.

While government intervention can help to mitigate some of the potential harms of monopolies, it is important to note that such intervention can also have drawbacks. For example, price controls may discourage investment in the industry, as firms may not be able to earn sufficient profits to justify the costs of investment. Similarly, breaking up a monopoly may lead to a more fragmented and less efficient market, potentially resulting in higher prices and lower quality goods and services.

In conclusion, while monopolies can have some benefits, they are generally harmful to consumers and society as a whole due to their ability to charge high prices, restrict output, and deter innovation. However, government intervention to regulate or break up monopolies must be carefully considered and balanced with potential drawbacks such as unintended consequences and reduced efficiency. Ultimately, the best approach may be to promote competition and prevent the formation of monopolies through antitrust laws and other regulatory measures.

2.)

a) Explain the two causes of cost-push inflation (10 marks)

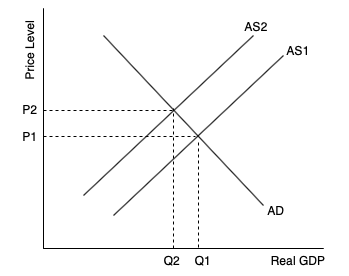

Cost-push inflation occurs when the cost of production of goods and services increases, leading to a decrease in aggregate supply and an increase in the general price level in the economy. Figure 2 below further explains how cost-push inflation occurs. As seen, when cost-push inflation occurs, aggregate supply shifts from AS1 to AS2, therefore increasing the price level from P1 to P2.

This phenomenon can be caused by two main factors: supply shocks and wage-push inflation.

Supply shocks refer to sudden and unexpected events that disrupt the production process, such as natural disasters, wars, and changes in government policies. For example, if an earthquake destroys a significant portion of a country’s infrastructure and production facilities, the cost of production will rise due to the increased cost of importing raw materials, replacing destroyed machinery, and rebuilding infrastructure. This results in a decrease in aggregate supply, leading to higher prices for goods and services. Similarly, if the government imposes new regulations or taxes on businesses, the cost of production increases, reducing the aggregate supply and leading to inflation.

Wage-push inflation occurs when wages rise at a faster rate than productivity growth, leading to higher production costs. This can occur due to various factors such as increased bargaining power of labor unions, minimum wage increases, and government policies that increase labor costs, such as taxes on employment or social security contributions. When workers demand higher wages, employers must increase the price of goods and services to cover the increased cost of production, leading to inflation.

Moreover, wage-push inflation can also occur when companies experience labor shortages. When demand for labor exceeds the supply, wages increase, leading to higher costs of production. This is common in industries with a high demand for skilled labor, such as technology and healthcare. As a result, companies must increase the prices of their products and services to cover the higher wages, leading to inflation.

In conclusion, cost-push inflation occurs due to an increase in production costs resulting from supply shocks or wage-push inflation. Supply shocks arise from sudden and unexpected events that disrupt the production process and increase the cost of production, while wage-push inflation occurs when wages rise at a faster rate than productivity growth, leading to higher production costs. Both factors can lead to a decrease in aggregate supply and an increase in the general price level in the economy, resulting in inflation.

b) Evaluate the effectiveness of interventionist supply-side policies in reducing cost-push inflation.

Cost-push inflation is a type of inflation that arises due to an increase in the costs of production. When the cost of inputs such as wages, raw materials, and energy increases, firms are forced to increase the prices of their goods and services to maintain their profit margins. This results in a general increase in the price level in the economy. To tackle cost-push inflation, governments can use interventionist supply-side policies. This article will evaluate the effectiveness of these policies in reducing cost-push inflation, with real-life examples.

Interventionist supply-side policies are government measures that aim to increase the supply of goods and services in the economy. These policies aim to lower production costs, increase productivity and efficiency, and promote economic growth. There are various interventionist supply-side policies, including investment in infrastructure, education and training, deregulation, tax incentives, and subsidies.

Investment in infrastructure is a popular interventionist supply-side policy. Governments can invest in new roads, bridges, airports, and other public facilities to improve the transportation and communication network in the economy. This can reduce the cost of transporting goods and services, which can lower production costs and increase the supply of goods and services. For example, in the 1950s and 1960s, Japan invested heavily in infrastructure, building highways, railways, ports, and airports. This investment contributed to the rapid growth of the Japanese economy, reducing the cost of production and increasing the competitiveness of Japanese goods and services in the global market.

Education and training are other interventionist supply-side policies that can increase the supply of skilled labor, which can improve productivity and efficiency in the economy. Governments can invest in education and training programs to improve the skills of workers, which can reduce production costs and increase the competitiveness of firms. For example, in the 1990s, Singapore implemented a comprehensive education and training program, including vocational training, lifelong learning, and university education. This investment in human capital increased the productivity and efficiency of workers, leading to a reduction in production costs and an increase in the supply of goods and services.

Deregulation is an interventionist supply-side policy that aims to reduce the regulatory burden on firms. Governments can remove regulations that impede competition, innovation, and efficiency in the economy. Deregulation can lower production costs and increase the supply of goods and services. For example, in the 1980s, the United States deregulated the airline industry, removing price controls and entry barriers. This led to increased competition, lower prices, and improved efficiency in the industry, reducing production costs and increasing the supply of air travel services.

Tax incentives are another interventionist supply-side policy that aims to reduce the tax burden on firms. Governments can offer tax incentives to encourage firms to invest in capital, research and development, and innovation. This can reduce production costs and increase the supply of goods and services. For example, in the 2000s, Ireland offered tax incentives to foreign firms to set up operations in the country. This policy led to a significant increase in foreign direct investment, which increased productivity, reduced production costs, and increased the supply of goods and services.

Subsidies are interventionist supply-side policy that aims to reduce production costs and increase the supply of goods and services. Governments can offer subsidies to firms to invest in capital, research and development, and innovation. Subsidies can also be used to support industries that are struggling due to higher input costs. For example, in the 2010s, the Australian government offered subsidies to the automobile industry to offset the higher costs of production due to the high Australian dollar. This policy helped to support the struggling industry.

However, it is important to note that interventionist supply-side policies may not be effective in reducing cost-push inflation in all circumstances. For example, if the inflation is caused by a supply shock, such as a natural disaster or a sudden increase in oil prices, interventionist supply-side policies may not be effective in reducing inflation. In such cases, other policies, such as monetary policy, may be more effective in reducing inflation.

In conclusion, interventionist supply-side policies can be effective in reducing cost-push inflation, but their effectiveness depends on the specific circumstances of the economy. Policies such as reducing taxes, investing in infrastructure, and investing in education and training programs can increase the productivity of the economy and reduce the cost of production, leading to lower prices and lower inflation. However, it is important to consider the potential drawbacks of these policies, such as their impact on government finances and the potential for unintended consequences. Ultimately, a combination of different policies may be necessary to effectively address cost-push inflation and promote long-term economic growth.

Download our Successful College Application Guide

Our Guide is written by counselors from Cambridge University for colleges like MIT and other Ivy League colleges.

To join our college counseling program, call at +918825012255

3.)

a) Explain the factors that contribute to economic growth and development and assess the role of government policies in promoting sustained economic growth.

Economic growth and development are key indicators of a country’s economic performance and wellbeing. Economic growth refers to the increase in the production of goods and services in an economy over time, while economic development refers to the improvement in the standard of living and quality of life of a country’s citizens. A country’s economic growth and development depend on various factors, including natural resources, human capital, technology, and institutional factors.

Natural resources, such as oil, gas, minerals, and agricultural products, are essential for economic growth and development. Countries rich in natural resources can use them to boost their economies through exports and the creation of industries. For example, countries like Saudi Arabia, Russia, and Australia have vast oil and gas reserves, which they export to other countries, generating significant revenues for their economies.

Human capital is another critical factor in economic growth and development. It refers to the knowledge, skills, and abilities of people in an economy. Countries with well-educated and skilled populations tend to have higher economic growth rates and better development outcomes. For instance, South Korea and Singapore have invested heavily in education and training, leading to highly skilled workforces, which have contributed to their remarkable economic success in recent decades.

Technology is also a significant contributor to economic growth and development. Advances in technology increase productivity and efficiency, enabling countries to produce more goods and services with fewer resources. Countries that invest in research and development, innovation, and technology transfer tend to have higher economic growth rates and better development outcomes. For example, countries like the United States, Japan, and Germany are known for their advanced technology sectors, which have contributed significantly to their economic success.

Institutional factors, such as the rule of law, property rights, and governance, are critical for economic growth and development. Countries with effective institutions tend to have more stable and predictable economic environments, leading to higher levels of investment, trade, and economic growth. For example, countries like Norway, Switzerland, and New Zealand are known for their strong institutions, which have contributed to their high levels of economic development.

Government policies can play a crucial role in promoting sustained economic growth and development. Policies such as investment in education and infrastructure, the promotion of research and development, the provision of incentives for businesses, and the implementation of sound macroeconomic policies can all contribute to sustained economic growth. For example, Singapore’s government has implemented policies that promote education, innovation, and entrepreneurship, leading to sustained economic growth and development.

However, government policies can also have negative effects on economic growth and development. Policies that promote rent-seeking, corruption, and cronyism can distort markets, leading to inefficiencies and reduced economic growth. For example, many African countries have suffered from rent-seeking and corruption, which have led to weak institutions and reduced economic growth.

In conclusion, economic growth and development depend on various factors, including natural resources, human capital, technology, and institutional factors. Government policies can play a crucial role in promoting sustained economic growth, but they can also have negative effects on economic growth and development. It is crucial for policymakers to consider these factors carefully and implement policies that promote sustainable economic growth and development, ensuring the wellbeing of their citizens in the long run.

b) Discuss the different types of barriers to economic growth and development, and evaluate the effectiveness of policies aimed at overcoming these barriers. (15 marks)

Economic growth and development are key indicators of a country’s progress, but achieving sustained economic growth and development is not always easy. There are various barriers that can hinder economic growth and development, including institutional, financial, technological, and environmental barriers. In this essay, I will discuss each of these barriers and evaluate the effectiveness of policies aimed at overcoming them.

Institutional barriers refer to factors such as corruption, weak rule of law, and political instability. These factors can discourage investment, both domestic and foreign, and reduce economic activity. For example, many African countries have suffered from institutional barriers that have hindered their economic growth and development. Policies aimed at overcoming institutional barriers often involve strengthening institutions, improving governance, and promoting transparency. For instance, in 2011, the Nigerian government established the Economic and Financial Crimes Commission (EFCC) to tackle corruption, which has been a significant institutional barrier to economic development in the country.

Financial barriers refer to constraints on access to finance, such as limited access to credit and lack of financial infrastructure. These barriers can limit investment, entrepreneurship, and economic growth. Policies aimed at overcoming financial barriers often involve promoting financial inclusion, improving access to credit, and strengthening financial institutions. For example, in Kenya, the government implemented the M-Pesa mobile money platform, which enabled people without access to traditional financial services to access mobile banking services, promoting financial inclusion and entrepreneurship.

Technological barriers refer to constraints on access to technology and knowledge, which can reduce productivity and innovation. Countries that lack access to technology and knowledge may be unable to compete in the global market, leading to reduced economic growth and development. Policies aimed at overcoming technological barriers often involve promoting research and development, improving access to technology and knowledge, and investing in infrastructure. For example, South Korea has been successful in promoting economic growth and development through investment in technology and innovation, leading to the development of a highly skilled workforce and advanced technology sectors.

Environmental barriers refer to constraints on natural resources and environmental degradation, which can limit economic activity and reduce the quality of life for citizens. Policies aimed at overcoming environmental barriers often involve promoting sustainable development, improving resource management, and investing in renewable energy. For example, Costa Rica has been successful in promoting sustainable economic growth and development through policies aimed at protecting its natural resources, such as its forests and wildlife, which have become a major tourist attraction.

Overall, policies aimed at overcoming barriers to economic growth and development can be effective, but their success depends on various factors, including the nature of the barriers, the level of investment, and the political will of policymakers. In some cases, policies aimed at overcoming barriers may also create unintended consequences or exacerbate other problems. For example, policies aimed at promoting financial inclusion may lead to increased debt levels, while policies aimed at promoting sustainable development may lead to job losses in certain industries.

In conclusion, barriers to economic growth and development are numerous and complex, and overcoming them requires a multifaceted approach. Institutional, financial, technological, and environmental barriers can all limit economic activity and reduce the quality of life for citizens. Policies aimed at overcoming these barriers require investment, political will, and careful consideration of unintended consequences. By addressing these barriers, countries can promote sustained economic growth and development, leading to a better quality of life for their citizens.