IB Economics SL Paper 2 Question Bank

Check Out Our Results

OXFORD UNIVERSITY

(QS:3)

IMPERIAL COLLEGE

(QS:6)

CORNELL UNIVERSITY (QS:16)

45/45 (IBDP)

GEORGIA INSTITUTE

43/45 (IBDP)

KELLY SCHOOL

Our IB Economics SL Paper 2 Question Bank is an incredible resource for students preparing for the IB Economics exam. The Question Bank is full of high-quality, properly formatted questions that cover all aspects of the IB Economics syllabus. The questions are clearly laid out and easy to understand, and the answer key provides detailed explanations for each question. This is an essential tool for any student who wants to do well on the IB Economics exam.

Economics Standard Level Paper 2

1 hour and 45 minutes

Instructions to candidates

- Do not open this paper until instructed to do so.

- You are permitted access to a calculator for this paper.

- Unless otherwise stated in the question, all numerical answers must be given exactly or correct to two decimal places.

- You must show all your working.

- Answer one question.

- Use fully labelled diagrams and references to the text/data where appropriate.

- The maximum mark for this examination paper is [40 marks].

1.) Read the extracts and answer the questions that follow.

Text A: Exploring the Growth of India’s GDP

One example of a developing country with an interesting GDP case study is India. India is the world’s sixth-largest economy by nominal GDP and the third-largest by purchasing power parity. Despite its recent growth, the country still faces significant economic challenges.

In the early 1990s, India’s GDP growth rate was below 4% per year, and the country was suffering from high levels of inflation and a balance of payments crisis. The Indian government responded by implementing a series of economic reforms, including reducing tariffs and other trade barriers, deregulating industries, and allowing more foreign investment. These reforms were collectively known as the “liberalization” of the Indian economy.

Since then, India’s GDP growth rate has steadily increased. From 2003 to 2008, the country’s annual GDP growth rate averaged over 8%. However, the global financial crisis of 2008-2009 had a significant impact on the Indian economy. GDP growth slowed to 6.7% in 2008-2009 and 6.3% in 2009-2010.

Despite this setback, India’s economy has continued to grow in the years since the financial crisis. From 2014 to 2019, the country’s annual GDP growth rate averaged over 7%. However, there are still challenges that India must overcome to sustain this growth.

One of the biggest challenges is income inequality. Although India’s economy has grown rapidly in recent years, not all segments of the population have benefited equally. In particular, rural areas and low-income households have not seen the same level of economic growth as urban areas and high-income households. This has led to a growing wealth gap between the rich and poor in India.

Another challenge is the country’s high debt-to-GDP ratio. India’s debt-to-GDP ratio has risen in recent years, partly due to the government’s efforts to stimulate the economy. As of 2021, India’s debt-to-GDP ratio is over 80%, which is higher than many other developing countries.

In addition to these challenges, India’s economy has been impacted by the COVID-19 pandemic. The country experienced a sharp contraction in GDP in 2020 due to lockdowns and other measures to control the spread of the virus. However, the government has implemented various economic stimulus measures to support the economy during this difficult time.

Text B: India’s Economic Reforms

The reforms in India were initiated in response to an economic crisis in 1991 that was characterized by a severe balance of payments crisis, high inflation, and a dwindling foreign exchange reserve.

The economic reforms undertaken in India since 1991 can be divided into two phases. The first phase (1991-2003) focused on stabilizing the economy, while the second phase (2003-present) aimed at accelerating economic growth and development.

In the first phase, India undertook a range of macroeconomic policy measures to stabilize the economy. These measures included fiscal consolidation, monetary tightening, and devaluation of the rupee. India also took steps to liberalize trade and investment policies, including reducing import tariffs, removing restrictions on foreign investment, and simplifying procedures for foreign investors.

In the second phase, India continued with its liberalization and reform agenda, with a focus on deregulation, privatization, and further opening up of the economy. The government initiated a range of measures to encourage foreign investment in key sectors such as infrastructure, telecommunications, and power. India also implemented measures to improve the business environment, such as simplifying procedures for setting up new businesses, and improving access to credit.

These economic reforms have had a significant impact on India’s economy. India’s GDP growth rate has increased from an average of 5.5% in the 1980s to an average of over 7% in the 2000s. Poverty rates have also declined significantly, from around 60% in the 1980s to around 30% in the 2010s. India has also emerged as a major player in the global economy, with a large and growing middle class, and a vibrant and dynamic private sector.

Text C: India’s Trade Agreements

India has signed multiple trade agreements with countries across the globe, aiming to boost trade and investment and strengthen economic ties. One notable agreement is the Comprehensive Economic Cooperation Agreement (CECA) signed with Singapore in 2005.

Under the CECA, India and Singapore agreed to eliminate tariffs on a majority of goods traded between the two countries. Additionally, the agreement includes provisions for the liberalization of trade in services, investment, and intellectual property. The CECA has been successful in increasing trade and investment between India and Singapore, with bilateral trade increasing from US$6.7 billion in 2005 to US$17.7 billion in 2019.

India has also signed free trade agreements (FTAs) with several countries and regional blocs, including South Korea, Japan, and the Association of Southeast Asian Nations (ASEAN). The FTAs aim to reduce or eliminate tariffs on goods traded between the signatories and promote trade in services and investment.

Here is a table showing the trade data between India and some of its major trading partners under the respective trade agreements:

Table 1

Country/Region |

Trade Agreement |

Bilateral Trade (in billions of USD) |

|

Singapore |

CECA |

17.7 (2019) |

|

South Korea |

India-Korea Comprehensive Economic Partnership Agreement (CEPA) |

21.5 (2020) |

|

Japan |

India-Japan Comprehensive Economic Partnership Agreement (CEPA) |

17.6 (2019) |

|

ASEAN |

India-ASEAN Free Trade Agreement (FTA) |

97.4 (2020) |

a.)

i.) Define the term ‘income inequality’ (Text A). (2 marks)

Income inequality refers to the extent to which income is unevenly distributed among individuals or households in a particular society or country. It is typically measured using a Gini coefficient, which ranges from 0 (perfect equality, where everyone has the same income) to 1 (perfect inequality, where one person has all the income). High levels of income inequality can have significant social and economic consequences, including decreased social mobility, increased poverty rates, and reduced economic growth.

i.i) Define the term foreign investment (Text B). 2 marks

Foreign investment refers to an investment made by a company or individual in one country into a company or entity located in another country. It is a cross-border investment that involves the transfer of resources from one country to another. Foreign investment can take various forms, such as foreign direct investment (FDI), portfolio investment, or other forms of investment. FDI involves the direct ownership or control of a business entity in a foreign country, while portfolio investment involves the purchase of stocks, bonds, and other financial assets of a foreign company.

b)

i.) What economic reforms did the Indian government implement in the early 1990s to address the country’s economic challenges? (2 marks)

The Indian government implemented a series of economic reforms, collectively known as the “liberalization” of the Indian economy, which included reducing tariffs and other trade barriers, deregulating industries, and allowing more foreign investment.

ii.) Using information from Text A, what impact did the global financial crisis of 2008-2009 have on India’s GDP growth rate? (1 mark)

The global financial crisis of 2008-2009 had a significant impact on India’s GDP growth rate. GDP growth slowed to 6.7% in 2008-2009 and 6.3% in 2009-2010.

c) Discuss the impact of the Indian government’s economic reforms on the country’s GDP growth rate (Text B). (4 marks)

The Indian government’s economic reforms, collectively known as the “liberalization” of the Indian economy, had a positive impact on the country’s GDP growth rate. From 2003 to 2008, the country’s annual GDP growth rate averaged over 8%. However, the global financial crisis of 2008-2009 had a significant impact on the Indian economy. GDP growth slowed to 6.7% in 2008-2009 and 6.3% in 2009-2010. Despite this setback, India’s economy has continued to grow in the years since the financial crisis, with an annual GDP growth rate averaging over 7% from 2014 to 2019.

d) Analyze the role of foreign investment in the success of India’s economic reforms (Text B) (4 marks)

Foreign investment played a crucial role in the success of India’s economic reforms. The liberalization policies of the early 1990s, which involved reducing trade barriers, deregulating markets, and attracting foreign investment, led to an influx of foreign capital into the country. This foreign investment helped to stimulate economic growth, create jobs, and modernize industries.

Foreign investment allowed Indian companies to access new technologies, management practices, and marketing strategies, which improved their competitiveness in global markets. The inflow of foreign investment also helped to boost the country’s foreign exchange reserves, which strengthened India’s ability to finance its imports and service its external debt.

Furthermore, foreign investment helped to create a favorable investment climate in India by signaling to other investors that the country was committed to economic liberalization and was open for business. This attracted even more foreign investment, creating a virtuous cycle of economic growth and investment.

e) With reference to Table 1, to what extent has the Comprehensive Economic Cooperation Agreement (CECA) with Singapore contributed to the increase in bilateral trade between India and Singapore (Text C)? (4 marks)

The Comprehensive Economic Cooperation Agreement (CECA) signed between India and Singapore in 2005 has been successful in increasing bilateral trade between the two countries. The agreement aimed to eliminate tariffs on a majority of goods traded between the two countries and promote liberalization of trade in services, investment, and intellectual property. The bilateral trade between India and Singapore increased from US$6.7 billion in 2005 to US$17.7 billion in 2019.

The elimination of tariffs on goods under the CECA has led to a significant increase in trade in several sectors, including electronics, pharmaceuticals, and chemicals. The agreement has also opened up opportunities for Singaporean firms to invest in India and vice versa. The liberalization of trade in services has also been a significant contributor to the increase in bilateral trade. The agreement has allowed Singaporean firms to operate in India’s service sectors, including banking, insurance, and telecommunications.

Furthermore, the CECA has created a favorable environment for trade and investment between India and Singapore. The agreement includes provisions for the protection of intellectual property rights, which have helped to create a more secure environment for investment. The agreement has also helped to reduce non-tariff barriers to trade, such as customs procedures, which have hindered trade in the past.

f) With reference to Table 1, analyze the impact of India’s free trade agreements (FTAs) with South Korea, Japan, and the Association of Southeast Asian Nations (ASEAN) on India’s trade with these countries and the region as a whole (Text C). (4 marks)

India has signed free trade agreements (FTAs) with several countries and regional blocs, including South Korea, Japan, and the Association of Southeast Asian Nations (ASEAN). These agreements aimed to reduce or eliminate tariffs on goods traded between the signatories and promote trade in services and investment.

The India-Korea Comprehensive Economic Partnership Agreement (CEPA) signed in 2009 aimed to reduce trade barriers and promote trade in goods, services, and investment. Since the agreement’s implementation, bilateral trade between India and South Korea has increased significantly from US$12 billion in 2009 to US$21.5 billion in 2020. The agreement has been successful in promoting trade in several sectors, including automobiles, chemicals, and textiles. The agreement has also helped to promote cooperation in areas such as science and technology, energy, and environment.

The India-Japan Comprehensive Economic Partnership Agreement (CEPA) signed in 2011 aimed to reduce or eliminate tariffs on goods traded between the two countries and promote trade in services and investment. Since the agreement’s implementation, bilateral trade between India and Japan has increased from US$13.6 billion in 2011 to US$17.6 billion in 2019. The agreement has been successful in promoting trade in several sectors, including automobiles, chemicals, and machinery. The agreement has also helped to promote cooperation in areas such as science and technology, energy, and environment.

The India-ASEAN Free Trade Agreement (FTA) signed in 2009 aimed to reduce or eliminate tariffs on goods traded between India and the ASEAN countries and promote trade in services and investment. Since the agreement’s implementation, bilateral trade between India and the ASEAN countries has increased from US$44 billion in 2009 to US$97.4 billion in 2020. The agreement has been successful in promoting trade in several sectors, including electronics, automobiles, and chemicals.

g) Using information from the texts/data and your knowledge of economics, discuss the potential long-term impact of income inequality on India’s economic growth. (15 marks)

Income inequality can have a significant impact on a country’s economic growth, and this is particularly true in the case of India. Despite India’s impressive economic growth in recent years, income inequality has been a persistent issue in the country. In fact, the World Inequality Database estimates that the top 10% of earners in India receive nearly 55% of the country’s total income, while the bottom 50% of earners receive just 14%.

One potential long-term impact of income inequality on India’s economic growth is reduced consumer spending. When a large portion of a country’s population is struggling to make ends meet, they have less money to spend on goods and services. This can lead to a slowdown in economic growth, as businesses may struggle to sell their products and services.

Income inequality can also impact a country’s human capital development. When only a small segment of the population has access to quality education and training, the overall skill level of the workforce can suffer. This can limit the country’s ability to innovate and adapt to changing economic conditions, which can have long-term negative effects on economic growth.

Another potential impact of income inequality is social unrest. When large portions of the population feel that they are being left behind and are not benefitting from the country’s economic growth, it can lead to social and political unrest. This can have negative impacts on economic growth, as investors may become hesitant to invest in a country with political instability.

Furthermore, income inequality can also have negative effects on public health. When large portions of the population do not have access to basic necessities such as healthcare and clean drinking water, it can lead to higher rates of illness and disease. This can result in increased healthcare costs, reduced productivity, and lower economic growth.

To address the potential long-term impact of income inequality on India’s economic growth, the government needs to take measures to promote inclusive growth. This can include policies such as progressive taxation, investments in education and training, and targeted social welfare programs for low-income households.

In conclusion, income inequality can have a significant impact on India’s economic growth, and it is important for the government to take action to promote inclusive growth and address this issue. By doing so, India can ensure that all segments of the population benefit from the country’s economic growth and help to sustain long-term economic success.

Download our Successful College Application Guide

Our Guide is written by counselors from Cambridge University for colleges like MIT and other Ivy League colleges.

To join our college counseling program, call at +918825012255

2.) Read the extracts and answer the questions that follow.

Text D: Overview of Canada

Canada is a developed country with a mixed economy that is heavily reliant on its natural resources. Its economy is the 10th largest in the world, with a nominal GDP of around US$1.6 trillion in 2021. In this case study, we will provide an overview of Canada’s economy, including its major industries and economic indicators.

One of Canada’s largest industries is the service sector, which accounts for around 70% of the country’s GDP. The service sector includes industries such as finance, healthcare, education, and retail. The finance and insurance sector is particularly important, with Toronto being the second-largest financial center in North America after New York City.

Another major industry in Canada is natural resources. The country is rich in natural resources such as oil, gas, timber, and minerals. The energy sector is particularly important, with Canada being the world’s fourth-largest producer of oil and gas. Other important resource industries include mining and forestry.

Canada also has a significant manufacturing sector, which accounts for around 10% of its GDP. The country is known for its production of automobiles, aerospace products, and food and beverage products.

In terms of economic indicators, Canada has a relatively low unemployment rate of around 6.7% as of 2021. Its inflation rate is currently at 3.7%, which is higher than the target inflation rate of 2%, but is largely driven by supply chain disruptions caused by the COVID-19 pandemic.

Canada’s international trade is also a significant part of its economy. The country is heavily reliant on trade with the United States, which accounts for around three-quarters of its exports. However, Canada has also been diversifying its trade relationships in recent years, signing free trade agreements with countries such as the European Union, Japan, and South Korea.

Text E: Canada’s development plans

Canada has taken significant steps towards achieving sustainable development goals in recent years. The country is committed to meeting the targets outlined in the United Nations’ 2030 Agenda for Sustainable Development, which includes 17 sustainable development goals (SDGs) aimed at ending poverty, protecting the planet, and ensuring prosperity for all.

Canada’s approach to achieving sustainable development goals is outlined in its Federal Sustainable Development Strategy (FSDS), which was released in 2019. The FSDS sets out 20 aspirational goals and over 60 targets aimed at reducing Canada’s environmental footprint, promoting sustainable growth, and improving the well-being of Canadians.

One of Canada’s key goals is to reduce greenhouse gas (GHG) emissions and transition to a low-carbon economy. The country has committed to reducing GHG emissions by 30% below 2005 levels by 2030 and to achieving net-zero emissions by 2050. Canada has implemented a carbon pricing system to help achieve these goals, and it is investing heavily in renewable energy and clean technology.

Another important goal for Canada is to conserve and protect its natural environment. The country has committed to protecting at least 17% of its terrestrial and inland waters and 10% of its marine and coastal areas by 2020. Canada has also committed to protecting biodiversity, reducing plastic pollution, and promoting sustainable agriculture and forestry practices.

In addition to environmental goals, Canada is also focused on improving social and economic well-being for its citizens. The country has committed to reducing poverty, increasing access to affordable housing, and improving public health outcomes. Canada is also investing in education and training programs to ensure that its citizens have the skills they need to thrive in a changing economy.

Text F: Investment in Canada

Canada is an attractive destination for foreign investors due to its stable political climate, highly educated workforce, and abundant natural resources. The country has a diverse economy with strong sectors such as finance, energy, and technology, making it an appealing investment opportunity for both domestic and international investors.

One of the major drivers of foreign investment in Canada is its investment-friendly policies. The country has a well-developed legal system that protects foreign investors’ rights and interests. Canada has also established a range of tax incentives and investment programs to attract foreign investment. For instance, the Canadian government offers the Strategic Innovation Fund to support large-scale projects in strategic sectors such as aerospace, automotive, and clean technology. The program provides repayable contributions to companies looking to expand their operations in Canada.

Canada’s energy sector has also attracted significant foreign investment, particularly in the form of foreign direct investment (FDI). According to a report by the Organisation for Economic Co-operation and Development (OECD), Canada is among the top five countries in the world for attracting FDI in the energy sector. The country is a major producer and exporter of oil, natural gas, and hydroelectric power. Its energy resources have attracted significant investment from countries such as the United States, China, and the United Kingdom.

Another sector that has seen substantial investment in recent years is technology. Canada is home to several world-class technology hubs, including Toronto and Vancouver. These cities have a thriving startup culture and are known for their innovative companies in areas such as artificial intelligence, fintech, and cybersecurity. Canada’s tech sector has attracted significant investment from venture capital firms and strategic investors looking to capitalize on the country’s skilled workforce and supportive ecosystem.

The Canadian government has also taken steps to promote investment in rural and remote areas of the country. The Rural and Northern Immigration Pilot, for example, is a program that aims to attract skilled immigrants to work and live in rural communities. The government has also launched the Regional Economic Growth through Innovation program, which provides funding for businesses in rural and remote areas to help them grow and innovate.

a)

i.) Define the term ‘mixed economy’ (Text D). (2 marks)

A mixed economy is an economic system that combines elements of both the private and public sectors. In a mixed economy, private individuals and businesses own and operate the majority of the means of production and distribution of goods and services, while the government plays a significant role in regulating and guiding the economy. This means that there is a mix of free-market principles and government intervention in the economy. In a mixed economy, the government can take actions such as providing public goods, redistributing income, regulating markets, and intervening in the economy to achieve social or environmental goals. The exact balance between the public and private sectors can vary, and different countries may have different degrees of government intervention and regulation in their economies. Examples of mixed economies include countries such as Canada, the United States, and most Western European countries.

ii.) Define the term ‘sustainable development goals’ (Text E). (2 marks)

Sustainable Development Goals (SDGs) are a set of 17 interconnected global goals adopted by the United Nations General Assembly in 2015, with the aim of achieving a more sustainable future for all. The SDGs build on the successes of the previous Millennium Development Goals (MDGs) but expand their scope to include a more comprehensive and integrated approach to sustainable development. The SDGs cover a wide range of issues, including poverty reduction, health, education, gender equality, clean water and sanitation, affordable and clean energy, economic growth, industry and infrastructure, reduced inequalities, sustainable cities and communities, responsible consumption and production, climate action, life below water, life on land, peace, justice, and strong institutions.

b)

i.) Define the term ‘Foreign Investment’ (Text F). (2 marks)

Foreign investment refers to the act of investing capital, resources, or assets by individuals, businesses, or governments from one country into another country. It involves the acquisition or establishment of assets such as stocks, bonds, real estate, businesses, or production facilities in a foreign nation.

Foreign investment plays a significant role in the global economy, fostering economic growth, stimulating job creation, and facilitating the transfer of technology, knowledge, and expertise across borders. It enables investors to access new markets, resources, and business opportunities that may not be available domestically.

ii.) Analyze the impact of Canada’s reliance on natural resources on its economic growth and development (Text D). (4 marks)

Canada’s reliance on natural resources has had a significant impact on its economic growth and development. The country is rich in natural resources such as oil, natural gas, minerals, and forests, which have contributed to its economic growth. However, the dependence on these resources has also made Canada vulnerable to fluctuations in global commodity prices, which can affect the country’s economic stability.

Moreover, the extraction and use of natural resources have negative environmental impacts, including pollution, deforestation, and greenhouse gas emissions. This could potentially harm Canada’s reputation as a sustainable and responsible country, which could impact future economic growth.

c) Evaluate the effectiveness of Canada’s approach to achieving sustainable development goals outlined in the Federal Sustainable Development Strategy (Text D). (4 marks)

The Federal Sustainable Development Strategy outlines Canada’s approach to achieving sustainable development goals. The strategy focuses on reducing greenhouse gas emissions, protecting natural habitats, and promoting sustainable resource use. The effectiveness of Canada’s approach can be evaluated based on the progress made towards achieving these goals.

For example, Canada has made progress in reducing greenhouse gas emissions, with the introduction of a carbon tax and the implementation of regulations on the oil and gas sector. However, there are concerns that the reduction targets are not ambitious enough to effectively combat climate change.

In terms of protecting natural habitats, Canada has designated new protected areas and implemented policies to promote sustainable resource use. However, there is room for improvement in terms of enforcement and monitoring to ensure that these policies are being effectively implemented.

d) Discuss the economic implications of Canada’s commitment to reducing greenhouse gas emissions by 30% below 2005 levels by 2030 and achieving net-zero emissions by 2050 (Text E). (4 marks)

Canada’s commitment to reducing greenhouse gas emissions is likely to have significant economic implications. The reduction targets could result in increased costs for industries that are high emitters of greenhouse gases, such as the oil and gas sector. This could potentially impact employment and economic growth in these industries.

However, there are also potential economic benefits associated with reducing greenhouse gas emissions. For example, investing in renewable energy and green technologies could create new job opportunities and stimulate economic growth in these sectors. Furthermore, reducing greenhouse gas emissions can help Canada to position itself as a leader in sustainable development, which could attract investment and boost the country’s reputation.

Overall, the economic implications of Canada’s commitment to reducing greenhouse gas emissions are complex, and will likely involve both costs and benefits.

e) Evaluate the role of foreign investment in Canada’s economy, with a particular focus on its impact on economic growth and development (Text F). (4 marks)

Foreign investment has played a significant role in Canada’s economy, particularly in industries such as energy, mining, and technology. The influx of foreign investment has helped to finance large-scale projects and stimulate economic growth in these sectors.

However, there are concerns that foreign investment could also have negative impacts on Canada’s economy, such as the potential for foreign companies to take over Canadian firms, resulting in a loss of control over key industries. There are also concerns about the potential for foreign investment to exacerbate income inequality, particularly if the benefits of foreign investment are concentrated in certain regions or industries.

f) Analyze the effectiveness of the Canadian government’s investment-friendly policies, tax incentives, and investment programs in attracting foreign investment, with reference to examples such as the Strategic Innovation Fund (Text F). (4 marks)

The Canadian government has implemented a range of investment-friendly policies, tax incentives, and investment programs to attract foreign investment, with the aim of supporting economic growth and development. One example of such a program is the Strategic Innovation Fund (SIF), which was established to support research and development (R&D) and innovation in key sectors of the economy, including advanced manufacturing, clean technology, and digital industries.

Overall, the effectiveness of these investment-friendly policies, tax incentives, and investment programs in attracting foreign investment to Canada has been mixed. On one hand, Canada has seen a significant increase in foreign direct investment (FDI) in recent years, with FDI inflows totaling $51.3 billion in 2020, up from $33.5 billion in 2019 (Statistics Canada, 2021). This suggests that these policies have been successful in attracting foreign investment to Canada.

However, there are also several challenges that may limit the effectiveness of these policies. For example, Canada’s high corporate tax rates, as well as the complexity and variability of its tax system, may deter some foreign investors. In addition, some investors may be concerned about Canada’s relatively small domestic market, which could limit the potential returns on their investments.

Regarding the Strategic Innovation Fund specifically, it has been successful in supporting R&D and innovation in key sectors of the economy. For example, the SIF has provided funding for projects related to advanced manufacturing, such as the development of new materials and processes for aerospace and automotive manufacturing. It has also supported projects related to clean technology, such as the development of new technologies for carbon capture and storage.

g) Using information from the texts/data and your knowledge of economics, evaluate the impact of government intervention in promoting economic growth and economic development in Canada. (15 marks)

The Canadian government has implemented various policies and programs to promote economic growth and development in the country. Some of these policies include investing in infrastructure, providing tax incentives for businesses, and promoting research and development. In this essay, I will evaluate the impact of government intervention in promoting economic growth and development in Canada.

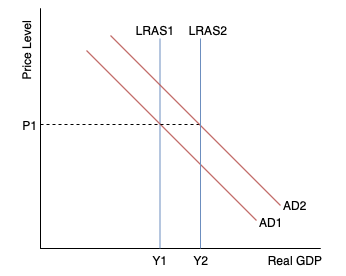

In Figure 1, as investment is one of the components of Aggregate Demand (AD), we can see the shift from AD1 to AD2. As investment increases, it leads to a higher level of AD, which can contribute to economic growth in the short run by increasing production and employment. However, it’s worth noting that sustained economic growth also requires improvements in productivity, technology, and the efficiency of the economy as a whole, which can be fostered through policies and other factors.

One of the primary ways that the government has intervened to promote economic growth is through infrastructure investments. According to Text A, the Canadian government has committed to investing over $180 billion in infrastructure over the next 12 years. These investments have the potential to create jobs, boost productivity, and stimulate economic growth. For example, the construction of new highways, bridges, and public transportation systems can improve the efficiency of the transportation sector, reducing travel time and lowering transportation costs. This can make Canadian businesses more competitive in global markets.

Another way that the government has intervened to promote economic growth is by providing tax incentives for businesses. According to Text B, the Canadian government has implemented various tax measures aimed at encouraging business investment, including the Accelerated Investment Incentive and the Canada Training Credit. These measures can increase business investment in research and development and capital expenditures, which can lead to increased productivity, job creation, and economic growth.

Moreover, the government has also promoted research and development through programs such as the Strategic Innovation Fund, as mentioned in Text F. This fund aims to support research and development in key sectors of the economy, such as aerospace, digital technology, and clean technology. These investments can lead to the development of new products and technologies, which can increase the competitiveness of Canadian businesses in global markets and drive economic growth.

However, there are also potential negative consequences associated with government intervention in the economy. For example, government investments in infrastructure projects may crowd out private investment, as private firms may be less likely to invest in projects that are already being financed by the government. Additionally, the effectiveness of tax incentives in stimulating business investment is uncertain, as businesses may simply use the savings from tax reductions to increase shareholder dividends rather than invest in new projects.

In conclusion, government intervention has the potential to promote economic growth and development in Canada by stimulating investment, promoting research and development, and improving infrastructure. However, the effectiveness of these policies is not guaranteed and may have unintended consequences. Overall, it is important for the government to carefully evaluate the potential costs and benefits of its interventions and ensure that they are targeted towards achieving long-term economic growth and development goals.