growth and evolution Notes

Growth and evolution

- Maximum output that can be achieved with the available resources/ inputs by improving the efficiency of production is called the scale of operations.

- Scale of operations can be changed (increased or decreased) by employing more inputs or decreasing the level of inputs, respectively.

Common mistake

Many students confuse ‘producing more’ with ‘changing the scale of operations’. Producing more implies increasing the output from the available resources by increasing capacity utilization. On the other hand, changing the scale of operations means increasing or decreasing the level of resources to change the level of output produced.

ECONOMIES OF SCALE & DISECONOMIES OF SCALE

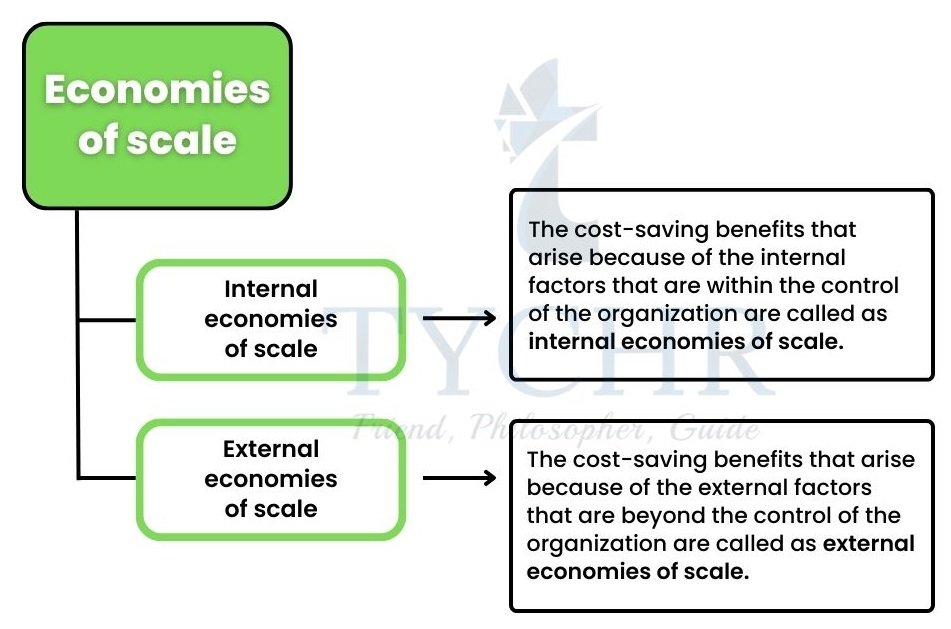

Economies of scale

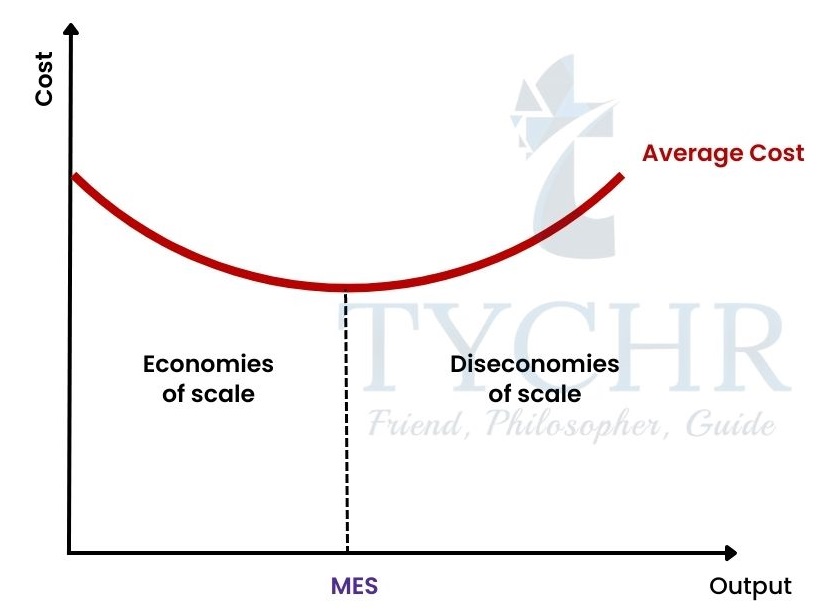

- The reductions in the average cost of production of a firm that results from the increase in the scale of operations is called as economies of scale. (AC = AFC + AVC and AC = TC/Q)

- The average fixed costs are reduced because the fixed costs are distributed among larger quantities of outputale

Internal economies of scale

The examples of different internal economies (cost-saving benefit) that result from various controllable internal factors are as follows:

- Technical economies- The use of sophisticated machinery for production can improve the efficiency of production. This will increase the output and provide cost reduction benefits to the firm.

- Financial economies- The firms that operate on a large scale can also enjoy the advantage of economies of scale by borrowing huge sums of money at a lower rate of interest unlike small firms that struggle to raise finances at a lower cost.

- Purchasing economies- Another way of reducing the costs of the firm is to purchase the raw materials/ goods in bulk. This benefit

can again be enjoyed by only large firms that can give orders for a huge quantity to the supplier. - Marketing economies- The large firms can reduce their marketing and selling costs by selling the goods & services in bulk. This helps in the reduction of various transaction and other selling and distribution expenses. For example: Due to its large scale of operations, multinational companies such as P&G (consumer goods corporation) and Pfizer (world’s premier biopharmaceutical company) are able to reduce their average marketing costs.

- Risk-bearing economies- The risk-bearing economies can be garnered by the large-scale conglomerates such as HUL (Hindustan Unilever) which produce a variety of products. The profits generated from the sale of one or more favorable products/products helps them to offset the risks associated with the other products.

- Managerial economies- Managerial economies arise when there are multiple managerial roles assigned to different specialist managers. This happens mostly in large-scale organizations such as partnership firms and limited companies.

- Specialization economies- Specialization economies are similar to managerial economies but here, the economies of scale are achieved from the division of labor rather than the managers. The skills and expertise of the specialist engineers, staff, marketers assist the firm to improve the production efficiency.

External economies of scale

The examples of different external economies that result from external factors which are beyond the control of the organization are:

- Technological advancement – Advancement in technologies benefit the firm by improving productivity and thus the level of output. This provides the cost reduction benefit.

- Improved transportation networks – The improved transportation network ensures the timely delivery of the raw materials in bulk for production. This leads to production of a larger level of output thus reducing the average cost of production.

- Regional specialization – When a particular region/ location has a trustworthy reputation for the production of a good/ service, it allows the organization to get access to the specialist workers at a reduced cost by carrying out its operations in that particular region/location. Moreover, the costs are also comparatively reduced because higher prices can be charged for the product because of the reputation of that region.

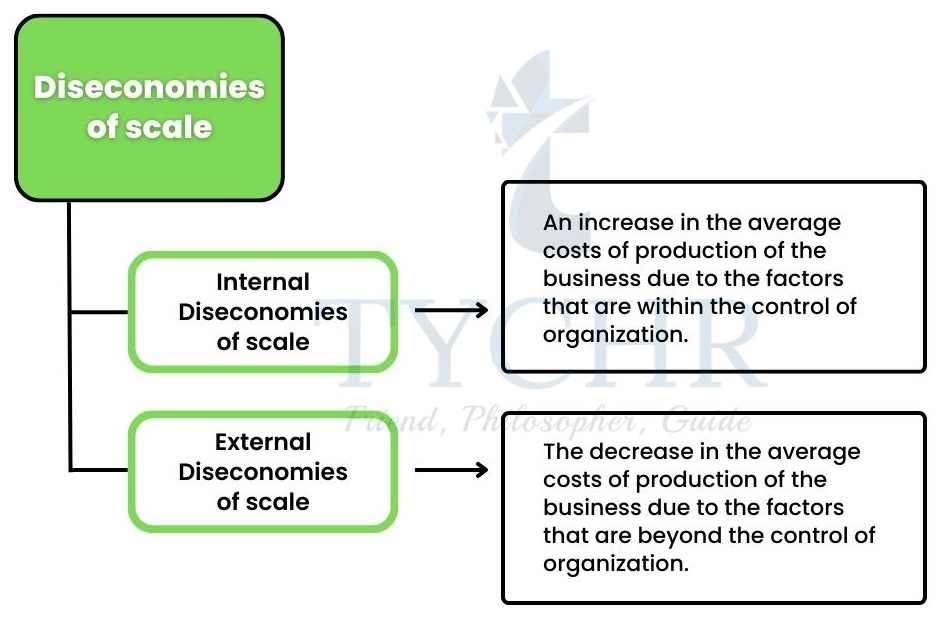

Diseconomies of scale

Diseconomies of scale refer to the increase in average costs of production as the business continues to increase its size and becomes inefficient.

Examples of internal diseconomies of scale:

- Lack of control and coordination – When the size of organization continues to increase, the span of control starts widening. The communication problems start occurring. Decision-making is slowed and thus, there is lack of coordination. This causes production to be inefficient and increase in average costs.

- Poor working relationships – With the increase in size of business, there is an increase in the number of levels of hierarchy. The senior level managers do not remain in contact with line workers. This brings down the motivation of the managers and the employees. The conflicts start arising with the increase in the number of people.

- Procrastination- When there is specialization and division of labor, the workers find the tasks monotonous and repetitive. They start procrastinating more and it leads to production inefficiency.

- Bureaucracy- As the business grows and expands, the administrative formalities and paperwork starts increasing. This not only delays decision-making but also increases the legal and administrative costs, which would otherwise be not incurred.

Examples of external diseconomies of scale:

- Increase in market rents – When there is regional specialization, many businesses operate in a particular region or location. The land resource becomes scarce and the cost of the land increases. This adds to the cost of production per unit of output.

- Higher financial incentives – The firm might have to offer higher financial rewards to attract them when there is less availability of skilled workers in a region. This hikes up the costs of production more than the increase in level of output.

- Traffic congestion – Traffic congestion on the roads might lead to delay in deliveries. This would increase transportation costs of business.

SMALL ORGANIZATIONS AND LARGE ORGANIZATIONS

The organizations with the small scale of operations and smaller size of workforce are called small organizations. The total sales turnover, revenue and the market share are smaller when compared to medium- sized or large-scale organizations. On the other hand, large organizations are the ones with the large scale of operations and huge sales turnover. These firms are able to produce a large amount of output which increases the total revenue and market share of the business.

Find the table below to get familiar with the advantages and disadvantages of small organizations:

Advantages of small organizations | Disadvantages of small organizations |

The financial risks of costs such as interest on borrowings, R&D costs, etc. is reduced in small organizations because of the small scale of operations. | Small organizations have limited sources of finance to raise the capital funds. |

Small businesses are at an advantage of seeking government subsidies and grants (financial support). | Small organizations are not able to reap cost- saving benefits of large-scale operations/ economies of scale. |

The small businesses are able to provide personalized services to the customers since they can closely understand their needs and requirements unlike the large organizations. | The workload, pressure and responsibilities are not divided and falls on the shoulders of owner alone. |

Advantages of large organizations | Disadvantages of large organizations |

Large organizations can enjoy the benefit of economies of scale. | There might be diseconomies of scale if these large firms continue to expand and grow. |

They can raise huge funds from various sources of finance such as share capital, long-term borrowings, etc. large organizations, this practically possible | When the business organization is large, the organizational structure has more levels of hierarchy and it often leads to delay in decision-making. |

Finance such as share capital, long-term borrowings, etc. | Organizational structure has more levels of hierarchy and it often leads to delay in decision-making. |

Large firms are able to build their brand image in the eyes of customers because of their large market share. They are able to provide a diversified range of products. | Large organizations have a greater number of employees and this increases the firms’ costs of salary and wages. |

The appropriate size or scale of operations for a business depends on the internal structure, aims and objectives, capital available, number of competitors, etc.

BUSINESS GROWTH- INTERNAL AND EXTERNAL GROWTH

Business growth refers to the stage where the business reaches the point of optimal utilization of resources and aims to expand further to increase profitability and market share.

Reasons why the firms seek for growth and expansion:

- To reap the cost-saving benefit of economies of scale that take place when the scale of operations is large.

- To diversify the products and minimize the risks of failure.

Internal growth

Internal growth takes place when the business organization grows organically, i.e. using its own resources and capabilities. The different ways in which a business can grow internally are as follows:

- Changing price- The businesses generally raise the total sales revenue by lowering the prices of the product because lower the price, higher is the demand.

- Effective promotion- Customers need to be informed and persuaded to buy the product. An effective (strong) can induce the customers to buy more of a product. This will increase the sales and the market share.

- Better quality products- The businesses which aim to grow and expand develop quality products at reasonable prices through strong market research and development.

- Increased capital investment- With the use of retained earnings and issue of share/ loan capital, the firms increase their financial capacity to invest in new production technologies, improve the efficiency of production and thereby increase the scale of operations.

- Improved training and development- Training and development of workers is necessary to improve their product knowledge so that they can provide quality service to the customers and keep them connected to the organization.

Advantages of internal growth | Disadvantages of internal growth |

|

|

Wide distribution network and availability – The products of the organization that have a wide distribution network are able to capture a larger share market. For example- The banking services of ICICI Bank Ltd. is available across the world which makes it a competitive player in the banking industry.

External growth

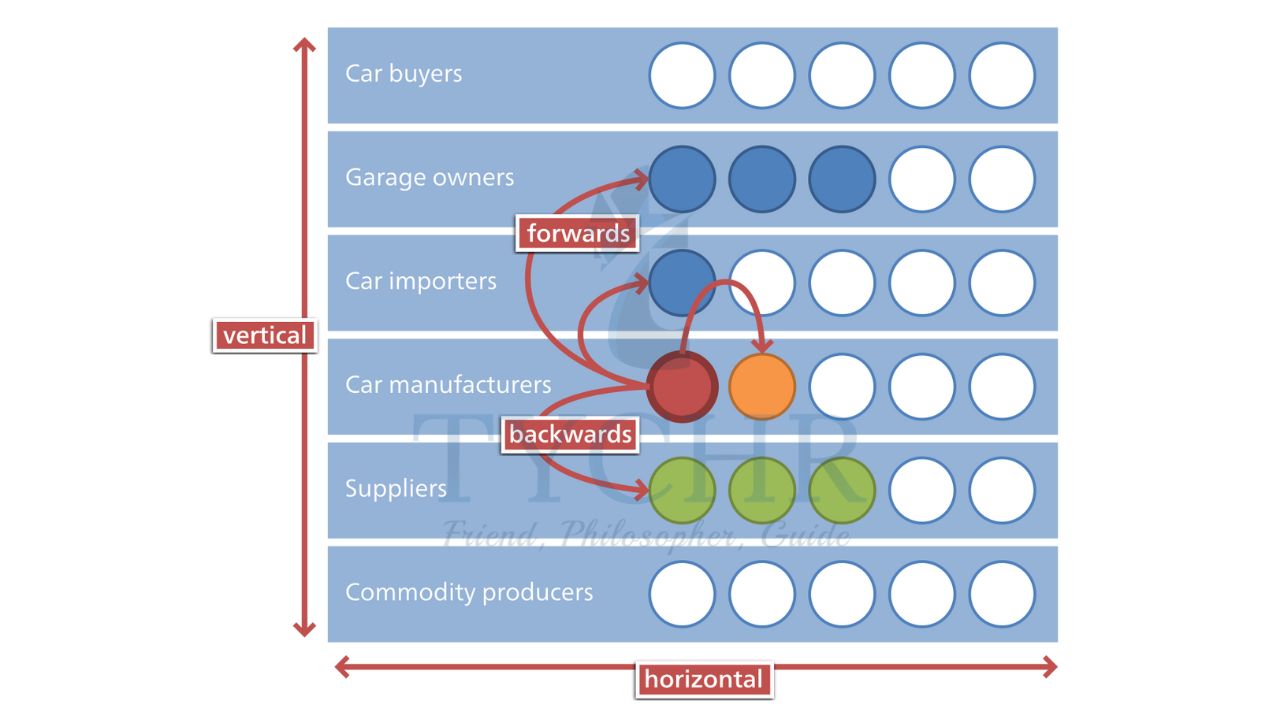

External growth takes place when the expansion and growth happen inorganically by a way of integration with any outside organization. The common forms/ types of integration are:

1) Horizontal integration – Integration with the firm in the same industry and is at the same stage of production. Example- In 2012, Facebook acquired Instagram for about $1 billion. Both are social networking companies.

2) Vertical integration – Integration happens between the firms of the same industry which are at different stages of production. Example- Walt Disney, the mass media and entertainment conglomerate integrated with the animations company, Pixar in 2006.

Forward vertical integration- Amalgamation with the customer of the firm.

Backward vertical integration- Amalgamation with the supplier of the firm.

3) Conglomerate integration- Integration with an organization from a completely different business industry. Example- Merger of Walt Disney and American broadcasting company.

Type of integration | Advantages | Disadvantages | Impact on the stakeholders |

Horizontal integration |

|

|

|

Vertical integration |

|

|

|

Conglomerate integration |

|

|

|

Methods of external growth:

1) Mergers and acquisitions- Merger is the mutual integration of two firms where the shareholders and managers of both the companies agree to consolidate the two firms into one entityOn the other hand, a takeover (acquisition) occurs when a larger company acquires a smaller company by holding a controlling stake with a majority stake as a shareholder. A takeover can be hostile when the acquiring company takes over the target company without the consent of the BODs of the target company.

Benefits of mergers and acquisitions | Drawbacks of mergers and acquisitions |

|

|

2) Joint ventures- Joint venture is a method of external growth when two or more businesses join hands to work on a particular project for a specified duration and split the costs, risks, and rewards of that project. The merging entities no longer operate as separate companies.

3) Strategic alliances- Strategic alliance is formed when two business organizations agree to pool their resources to work on an agreed set of objectives. In strategic alliance, the entities continue to operate as independent firms and work together to increase the performance of both the entities. The four key stages to the formation of strategic alliance are:

- Feasibility study- The objectives are set, and the study/ analysis is carried out to understand whether the SA will be feasible or not.

- Partnership assessment- The potential of the partners to SA is analyzed to understand how much resource each partner can offer.

- Contract negotiation- Contract is framed after negotiation of the share of contribution and rewards/ risks.

- Implementation- Operations are initiated once the contract is signed by both the parties.

4) Franchising- It is one of the methods of external growth where the business arrangement involves two parties- franchisee and the franchisor. The franchisor grants franchisees the right to use its trade name, logo and business systems and processes to produce/ sell a particular product as per the specifications. The franchisee has to pay a royalty fee based on its sales revenue to the franchisor. Some of the renowned franchise businesses are fast-food companies such as KFC, Dominos, McDonalds, etc.

Benefits of franchising to the franchisor | Drawbacks of franchising to the franchisor |

|

|